Travelers 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

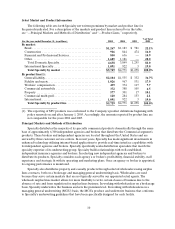

Geographic Distribution

The following table shows the distribution of Personal’s direct written premiums for the states that

accounted for the majority of premium volume for the year ended December 31, 2005:

State

% of

Total

New York........................................................... 16.3%

Texas. .............................................................. 9.2

Pennsylvania ........................................................ 7.1

Massachusetts ....................................................... 7.0

New Jersey.......................................................... 6.3

Florida ............................................................. 6.0

Virginia............................................................. 4.7

Georgia............................................................. 4.5

Connecticut......................................................... 4.3

California ........................................................... 3.9

Maryland ........................................................... 3.0

All Others (1)....................................................... 27.7

Total............................................................. 100.0%

(1) No other single state accounted for 3.0% or more of the total direct written premiums written in2005

by the Company.

CLAIMS MANAGEMENT

The Company’s claims management strategies, together with its focus on optimizing claim outcomes,

cost efficiency and service are critical to the Company’s ability to grow profitably and reflect these core

tenets:

•fair, efficient, fact-based claims management controls losses for the Company and its customers;

•use of advanced technology provides front-lineclaim professionals with necessary information and

facilitates prompt claim resolution;

•specialization of claim professionals and segmentation of claims by complexity, as indicated by

severity, coverage and causation, allow the Company to focus its resources effectively;

•effective collaboration, using meaningful management information, across all divisions within the

Company facilitates product analysis and enhances risk selection and risk pricing; and

•excellent customer service enhances customer retention.

The Company’s claims function is managed through its Claim Services operations. With nearly 13,000

employees, Claim Services employs a diverse group of professionals, including claim adjusters, appraisers,

attorneys, investigators, engineers, accountants, system specialists and training, management and support

personnel. Approved external service providers, such as independent adjusters and appraisers,

investigators and attorneys, are available for use as appropriate.

Field claim management teams located in 32 claim centers and 89 satellite and specialty-only offices in

49 states are organized to maintain focus on the specific claim characteristics unique to the businesses

within the Commercial, Specialty and Personal segments. Claim teams with specialized skills, resources,

and workflows are matched to the unique exposures of those businesses with local claim management

dedicated to achieving optimal results within each segment. The Company’s home office operations

provide additional support in the form of workflow design, quality management, information technology,