Travelers 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

collateral, including trust agreements, escrow funds and letters of credit, under certain reinsurance

agreements. The Company monitors thefinancial condition of reinsurers on an ongoing basis and reviews

its reinsurance arrangements periodically. Reinsurers are selected based on their financial condition,

business practices and the price of their product offerings. For additional information concerning

reinsurance, see note 8 of notes to the Company’s consolidated financial statements.

The Company utilizes a variety of reinsurance agreements to manage its exposure to large property

and casualty losses, including:

•facultative reinsurance, in which reinsurance is provided for all or a portion of the insurance

provided by a single policy and each policy reinsured is separately negotiated;

•treaty reinsurance, in which reinsurance is provided for a specified type or category of risks; and

•catastrophe reinsurance, in which the Company is indemnified for an amount of loss in excess of a

specified retention with respect to losses resulting from a catastrophic event.

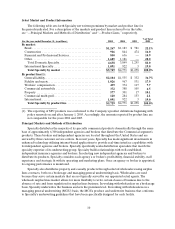

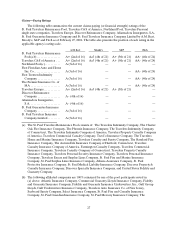

The following presents the Company’s top fivereinsurer groups, by reinsurance recoverables at

December 31, 2005 (in millions):

Reinsurer Group

Reinsurance

Recoverables

A.M. Best Ratingof Group’s

Predominant Reinsurer

Munich Re Group. ............................. $1,304 Athir d highest of 16ratings

Swiss Re Group................................ 912A+secondhighest of16 ratings

GE Insurance Services Group.................... 778A thirdhighest of 16 ratings

Berkshire Hathaway Group...................... 764A++ highestof16 ratings

American International Group................... 754A+secondhighest of16 ratings

In November 2005, the Swiss Re Group announced that it had agreed to acquire GE Insurance

Solutions, the fifth largest reinsurer worldwide, from General Electric Company. Upon expected

consummation of this transaction in mid-2006, the Swiss Re Group would become the Company’s largest

reinsurer group with recoverables of $1.69 billion as of December 31, 2005. Consequently, the XL Capital

Group is expected to become the Company’s fifth largest reinsurer group with recoverables of $651 million

as of December 31, 2005.

At December 31, 2005, the Company had $19.57 billion in reinsurance recoverables. Of this amount,

$2.21 billionwas for mandatory pools and associations that relate primarily to workers’ compensation

service business and have the obligation of the participating insurance companies on a joint and several

basis supporting these cessions. An additional $3.99 billion was attributable to structured settlements

relating primarily to personal injury claims, for which the Company has purchased annuities and remains

contingently liable in the event of a default by the companies issuing the annuities. Of the remaining

$13.37 billion of reinsurance recoverables at December 31, 2005, $1.20 billion was attributable to asbestos

and environmental claims, and the remainder principally reflected reinsurance in support of ongoing and

runoff business. At December 31, 2005, $2.40 billion of reinsurance recoverables were collateralized by

letters of credit, trust agreements and escrow funds. Also at December 31, 2005, the Company had an

allowance for estimated uncollectible reinsurance recoverables of $804 million.

For a description of reinsurance-related litigation, see Item 3, “Legal Proceedings.”

Current Net Retention Policy

The descriptions below relate to the Company’s reinsurance arrangements in effect at January 1, 2006.

Most property and casualty reinsurance agreements have terrorism sublimits or exclusions. For third party

liability, Commercial limits the net retention to a maximum of $8 million per insured, per occurrence after