Travelers 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

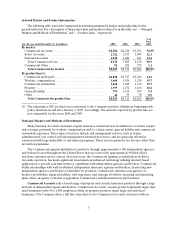

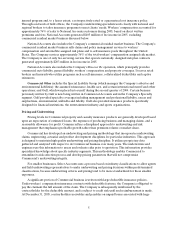

Selected Market and Product Information

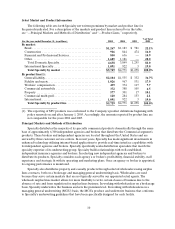

The followingtable sets forth Commercial net writtenpremiums by market and product line for the

periods indicated. For a description of the product lines and markets referred to in the table,see “—Principal

Markets and Methods ofDistribution” and “—Product Lines,” respectively.

(for the year ended December 31, in millions) 2005 2004 2003

% of

Total

2005

By market:

Commercial Accounts .................................... $4,386 $4,210 $3,251

52.0%

Select Accounts .......................................... 2,722 2,555 2,047

32.3

National Accounts ....................................... 1,230 1,040 831

14.6

Total Commercial Core................................. 8,338 7,805 6,129

98.9

Commercial Other....................................... 91 506 733

1.1

Total Commercialby market............................ $8,429 $8,311 $6,862

100.0%

By product line(1):

Commercial multi-peril ................................... $2,890 $2,517 $2,246

34.3

Workers’ compensation................................... 1,660 1,530 1,234

19.7

Commercial automobile .................................. 1,660 1,609 1,313

19.7

Property ................................................ 1,399 1,472 1,166

16.6

General liability. ......................................... 774 1,130 833

9.2

Other. .................................................. 46 53 70

0.5

Total Commercial by product line........................ $8,429 $8,311 $6,862

100.0%

(1) The reporting of SPC products was conformed to the Company’s product definitions beginning with

policy renewals on and after January 1, 2005. Accordingly, the amounts reported by product line are

not comparable for the years 2004 and 2005.

Principal Markets and Methodsof Distribution

Many National Accounts customers require insurance-related services in addition to or in lieu of pure

risk coverage, primarily for workers’ compensation and, to a lesser extent, general liability and commercial

automobile exposures. These types of services include risk management services, such as claims

administration, loss control and risk management information services, and are generally offered in

connection with large deductible or self-insured programs. These services generate fee income rather than

net written premiums.

The Commercial segment distributes its products through approximately 6,300 independent agencies

and brokers located throughout the United States that are serviced by approximately 90 field offices

and three customer service centers. In recent years, the Commercial segment, particularly in its Select

Accounts operation, has made significant investments in enhanced technology utilizing internet-based

applications to provide real-time interface capabilities with independent agencies and brokers. Commercial

builds relationships with well-established, independent insurance agencies and brokers. In selecting new

independent agencies and brokers to distribute its products, Commercial considers each agency’s or

broker’s profitability, financial stability, staff experience and strategic fit with its operating and marketing

plans. Once an agency or broker is appointed, Commercial carefully monitors its performance.

Commercial Accounts sells a broad range of property and casualty insurance products through a large

network of independent agents and brokers. Commercial Accounts’ casualty products primarily target mid-

sized businesses with 50 to 1,000 employees, while its property products target large and mid-sized

businesses. The Company offers a full lineof products to its Commercial Accounts customers with an