Travelers 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OFOPERATIONS

The following is a discussion and analysis of the financial condition and results of operations of The

St. Paul Travelers Companies, Inc. (together with its subsidiaries, the Company). On April 1, 2004,

Travelers Property Casualty Corp. (TPC) merged with a subsidiary of The St. Paul Companies, Inc. (SPC),

as a result of which TPC became a wholly-owned subsidiary of SPC, and SPC changed its name to The St.

Paul Travelers, Inc. In connection with the merger, each issued and outstanding share of TPC class A

(including the associated Companies preferred stock purchase rights) and class B par value $0.01 common

stock was exchanged for 0.4334 of a share of the Company’s common stock without designated par value.

Share and per share amounts for all periods presented havebeen restated to reflect the second quarter

exchange of TPC common stock for the Company’s common stock in the merger. For accounting purposes,

this transaction was accounted for as a reverse acquisition with TPC treated as the accounting acquirer.

Accordingly, this transaction was accounted for as a purchase business combination, using TPC historical

financial information and applying fair value estimates to the acquired assets, liabilities, and commitments

of SPC as of April 1, 2004. Beginning onApril 1, 2004, the results of operations and financial condition of

SPC were consolidated with TPC’s. Accordingly, all financial information presented herein for the twelve

months ended December 31, 2005 reflects the consolidated accounts of SPC and TPC. The financial

information presented herein for the twelve months ended December 31, 2004 reflects only the accounts of

TPC for the three months ended March 31, 2004 and the consolidated accounts of SPC and TPC for the

nine months ended December 31, 2004. The financial information presented herein for 2003 reflects the

accounts of TPC.

For more information regarding the completion of the merger, including the calculation and

allocation of the purchase price, refer to note 2 of notes to the Company’s consolidated financial

statements included in this report.

The Company completed the divestiture of its 78% equity interest in Nuveen Investments in2005,

which is described in more detail later in this discussion. The Company’s share of Nuveen Investments’

operating results in 2005 prior to divestiture was classified as discontinued operations, and the Company’s

prior year results were reclassified to conform to the 2005 presentation.

EXECUTIVE SUMMARY

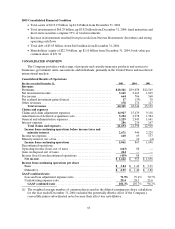

2005 Consolidated Results of Operations

•Income from continuing operations of $2.06 billion, or $3.04 per share basic and $2.95 diluted

•Net income of $1.62 billion, or $2.39 per share basic and $2.33 diluted, including loss from

discontinued operationsof $439 million, or $0.65 per share basic and $0.62 diluted

•Net proceeds of $2.40 billion from the divestiture of Nuveen Investments; loss from discontinued

operations resulted from significant tax provision related to sale

•Total cost of catastrophes of $2.19 billion pretax (net of reinsurance) and $1.47 billionafter-tax,

primarily relating to Hurricanes Katrina, Rita and Wilma

•Net unfavorable prior year reserve development of $325 million pretax and $216 million after-tax,

primarily due to a pretax charge of $830 million ($548 million after-tax) to increase asbestos

reserves

•Gross written premiums of $23.74 billion; net written premiums of $20.39 billion; net written

premiums reduced by $121 million of reinstatement premiums related to catastrophes

•GAAP combined ratio of 101.3, including 10.7 points from catastrophe losses

•Pretax net investment income of $3.17 billion ($2.44 billion after-tax)