Travelers 2005 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

156

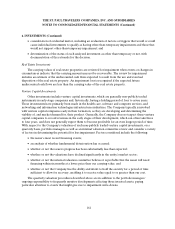

6. INVESTMENTS (Continued)

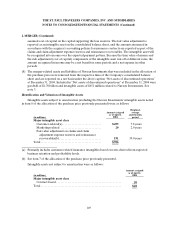

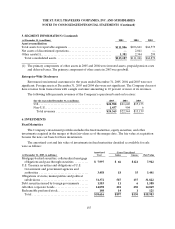

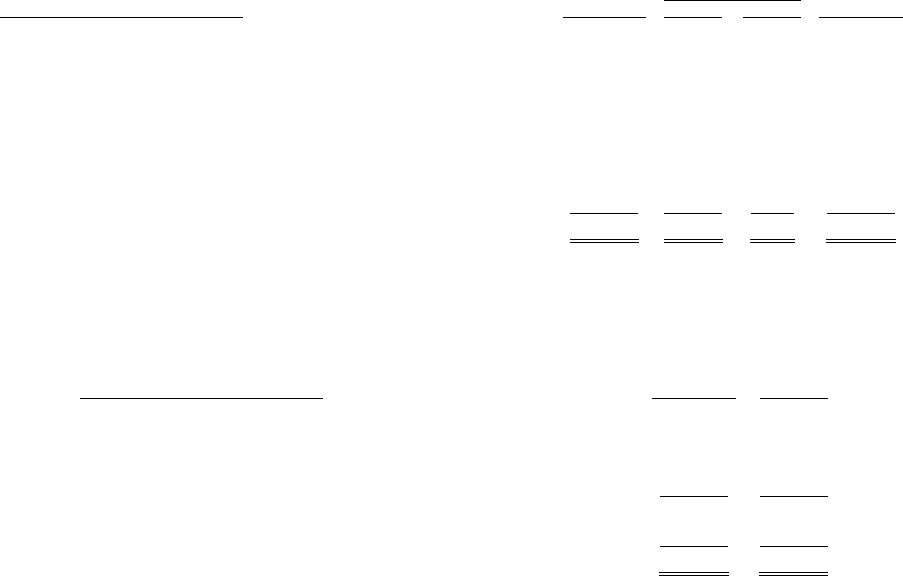

AmortizedGross Unrealized

(at December 31, 2004, in millions) Cost Gains Losses Fair Value

Mortgage-backed securities, collateralized mortgage obligations

and pass-through securities.............................. $8,543 $169 $ 34 $ 8,678

U.S. Treasury securities and obligations of U.S. Government

and government agencies and authorities.................. 3,015 40 22 3,033

Obligations of states, municipalities and political subdivisions.. 26,034 857 50 26,841

Debt securities issued by foreign governments ............... 1,846194 1,861

All other corporate bonds ................................. 13,383 36199 13,645

Redeemable preferredstock ............................... 196161 211

Total................................................. $ 53,017 $ 1,462$ 2 10 $ 54,269

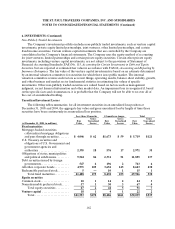

The amortized cost and fair value of fixed maturities by contractual maturity follow. Actual maturities

will differ from contractual maturities because borrowers may have the right to call or prepay obligations

with or without call or prepayment penalties.

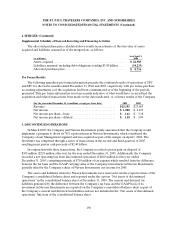

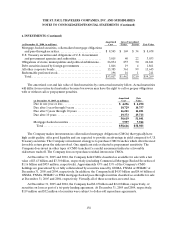

(at December 31, 2005, in millions)

Amortized

Cost

Fair

Value

Due inone year or less................................... $ 4,296 $ 4,290

Due after 1 year through5 years ........................... 10,729 10,757

Due after 5 years through 10 years ......................... 16,221 16,281

Due after 10 years ....................................... 19,373 19,713

50,619 51,041

Mortgage-backed securities ............................... 7,997 7,942

Total................................................. $ 58,616 $ 58,983

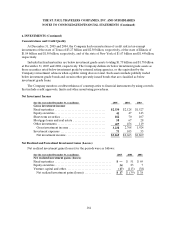

The Company makes investments in collateralized mortgage obligations (CMOs) that typically have

high credit quality, offer good liquidity and are expected to provide an advantage in yield compared to U.S.

Treasury securities. The Company’s investment strategy is to purchase CMO tranches which offer the most

favorable return given the risks involved. One significant risk evaluated is prepayment sensitivity. The

Company does invest in other types of CMO tranches if a careful assessment indicates a favorable

risk/return tradeoff. The Company does not purchase residual interests in CMOs.

At December 31, 2005 and 2004, the Company held CMOs classified as available for sale with a fair

value of $3.43 billion and $3.30 billion, respectively (excluding Commercial Mortgage-Backed Securities of

$1.16 billion and $953 million, respectively). Approximately 43% and 53% of the Company’s CMO

holdings are guaranteed by or fully collateralized by securities issued by GNMA, FNMA or FHLMC at

December 31, 2005 and 2004, respectively. In addition, the Company held $4.83 billion and $4.66 billion of

GNMA, FNMA, FHLMC or FHA mortgage-backed pass-through securities classified as available for sale

at December 31, 2005 and 2004, respectively. Virtually all of these securities are rated Aaa.

At December 31, 2005 and 2004, the Company had $2.67 billion and $2.60 billion, respectively, of

securities on loan as part of a tri-party lending agreement. At December 31, 2005 and 2004, respectively,

$119 million and $32 million of securities were subject to dollar-roll repurchase agreements.