Travelers 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

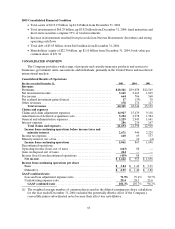

2005 ConsolidatedFinancial Condition

•Total assets of $113.19 billion, up $1.94 billion from December 31, 2004

•Total investments of $68.29 billion, up $3.92 billion from December 31, 2004; fixed maturities and

short-term securities comprise 93% of total investments

•Increase in investments resulted from proceeds from Nuveen Investments’ divestiture and strong

operating cash flows

•Total debt of $5.85 billion, down $463 million from December 31, 2004

•Shareholders’ equity of $22.30 billion, up $1.10 billion from December 31, 2004; book value per

common share of $31.94

CONSOLIDATED OVERVIEW

The Company provides a wide range of property and casualty insurance products and services to

businesses, government units, associations and individuals, primarily in the United States and in selected

international markets.

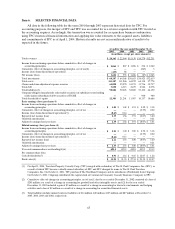

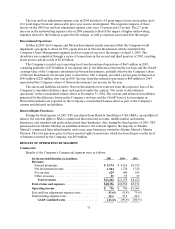

Consolidated Results of Operations

For the year ended December 31,2005 2004 2003

Revenues

Premiums ...................................................... $ 2 0,341 $ 1 9,038 $ 12,545

Net investment income. .......................................... 3,165 2,663 1,869

Fee income..................................................... 664 706 560

Net realized investment gains (losses).............................. 17 (39 ) 38

Other revenues ................................................. 178 176 127

Total revenues.............................................. 24,365 22,544 15,139

Claims and expenses

Claims and claim adjustment expenses ............................. 14,927 15,439 9,118

Amortization of deferred acquisition costs. ......................... 3,252 2,978 1,984

General and administrative expenses .............................. 3,229 2,945 1,641

Interest expense. ................................................ 286 236 167

Total claims and expenses.................................... 21,694 21,598 12,910

Incomefrom continuing operations before income taxes and

minority interest............................................ 2,671 946 2,229

Income tax expense.............................................. 610 69 537

Minority interest, net of tax....................................... — 10 (4)

Incomefrom continuing operations ............................. 2,061 867 1,696

Discontinued operations:

Operating income (loss),net of taxes .............................. (663 ) 88 —

Gain on disposal, net of taxes ..................................... 224 — —

Income (loss) from discontinued operations ........................ (439 ) 88 —

Net income................................................... $1,622 $ 955 $1,696

Income from continuing operations per share

Basic........................................................ $3.04 $1.42 $3.91

Diluted(1). ................................................... $2.95 $1.40 $3.80

GAAP combined ratio

Loss and lossadjustment expense ratio. .......................... 71.9 % 79.4 % 70.7%

Underwriting expense ratio. .................................... 29.4 28.3 25.6

GAAP combined ratio ....................................... 101.3 % 107.7 % 96.3%

(1) The weighted average number of common shares used in the diluted earnings per share calculation

for the year ended December 31, 2004 excluded the potentially dilutive effect of the Company’s

convertible junior subordinated notes because their effect was anti-dilutive.