Travelers 2005 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

142

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Cont inued)

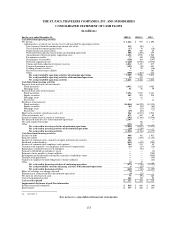

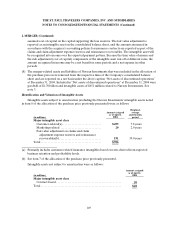

The following table illustrates the effect on net income and earnings per share for each period

indicated as if the Company had applied the fair value recognition provisions of FAS 123 to all outstanding

and unvested stock-based employee awards.

(for the year ended December 31, in millions, except per share data) 2005 2004 2003

Net income as reported ............................................... $1,622

$955 $1,696

Add: Stock-based employee compensation expense included in reported net

income, net of related tax effects(1).................................. 64

49 18

Deduct: Stock-based employee compensation expense determined under fair

value based method, net of related tax effects(2) ....................... (76 )(75 ) (73)

Net income pro forma................................................. $1,610

$929 $1,641

Earnings per share

Basic—as reported ................................................. $2.39

$1.56 $3.91

Basic—pro forma.................................................. 2.37

1.52 3.79

Diluted—as reported ............................................... 2.33

1.53 3.80

Diluted—pro forma ................................................ 2.31

1.49 3.76

(1) Represents compensation expense on all restricted stock and stock option awards granted after

January 1, 2003.

(2) Includes the compensation expense added back in (1).

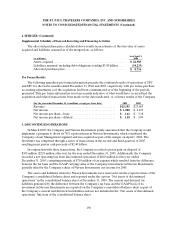

Derivative Financial Instruments

The Company may use derivative financial instruments,including interest rate swaps, equity swaps,

credit derivatives, options, forward contracts and financial futures, as a means of hedging exposure to

interest rate, equity price change and foreign currency risk. The Company’s insurance subsidiaries do not

hold or issue derivative instruments for trading purposes. The Company recognizes all derivatives,

including certain derivative instruments embedded in other contracts, as either assets or liabilities in the

consolidated balance sheet and measures those instruments at fair value. Where applicable, hedge

accounting is used to account for derivatives. To qualify for hedge accounting, the changes in value of the

derivative must be expected to substantially offset the changes in value of the hedged item. Hedges are

monitored to ensure that there is a high correlation between the change in the value of the derivative

instruments and the change in value of the hedged investment. Derivatives that do not qualify for hedge

accounting are carried at fair value with the changes in fair value reflected in the consolidated statement of

income in net realized investment gains (losses).

Interest rate swaps, equity swaps, credit derivatives, options and forward contracts were not significant

at December 31, 2005 and 2004.

Nature of Operations

The Company is organized into three reportable business segments: Commercial, Specialty and

Personal. These segments reflect the manner by which the Company manages its property and casualty

insurance products and insurance-related services and represent an aggregation of these products and