Travelers 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22005 Annual Report

making us a “go-to” market in our agents’ and bro-

kers’ offices. While our relationships are deep in many

individual product lines, they do not always reflect

the breadth of insurance products and services that

we offer. Therefore, one of our best opportunities for

growth lies in our ability to increase distributor access

to our range of products, which is among the broadest

in the industry. We are pursuing strategies designed

to make it easier for distributors to tap into our many

products and services. These strategies are based upon

the foundation of offering quality products and services,

delivered at competitive prices. The strategies include:

• Being Local. We are committed to delivering the bene-

fits of our national franchise through a local operating

structure. This structure enables us to respond to our

agents like a smaller company, but offer the benefits

and resources of a national leader. We are creating a

strong culture of front-line relationship managers in

the field, whose priority it is to deliver our complete

franchise value to our agents and brokers. Our scale

and national reach are competitive advantages, and

we will continue to focus on providing the breadth of

our product suite in a way that makes us the market

of choice for all of the products and services we offer.

• Business and Marketing Collaborations. We have the

expertise to meet the needs of a wide range of clients –

from individual homeowners to small businesses to

complex multinational companies. We continue to

share that expertise across our businesses to support

marketing, underwriting and service initiatives. For

example, our Global Underwriting business unit has

successfully broadened its reach by partnering with

National Accounts. Our collaborative efforts also are

eliminating gaps in coverage for policyholders, such as

through Boiler & Machinery now offering Equipment

Breakdown coverage on all property policies under-

written by Commercial and Specialty.

• Technological Advantages. Agents continually report

that their primary consideration in choosing to work

with an insurer is the ease of doing business. Our use of

technology allows us to better meet this need. For exam-

ple, our new Quantum AutoSM product uses state-of-the-

art technology to enable us to respond to a broader

segment of the automobile insurance market than pre-

viously was available to us, which in turn has enabled

agents to place more business with Travelers personal

lines. This technology also enables us to deliver our

quotes to agents in a desktop application that is simple

and straightforward. The results have been encouraging.

Late in 2005, we successfully rolled out an updated plat-

form for issuing small commercial policies that has

broadened the types and classifications of business

that agents now can quote directly. Again, early signs

are encouraging.

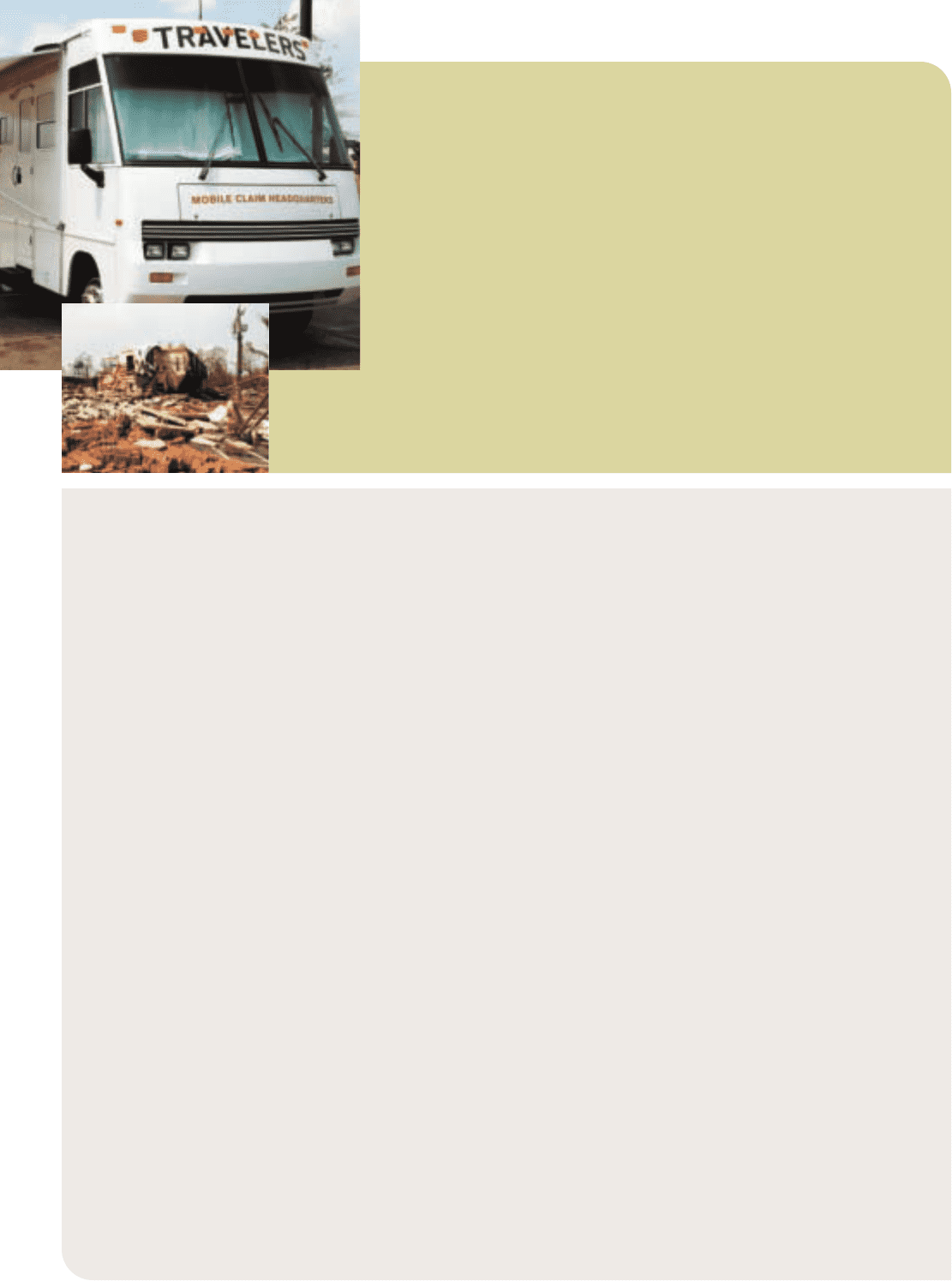

Mobile Claim Headquarters

Respond to Customers

The company’s seven Mobile Claim

Headquarters – custom-built RVs designed

as mobile insurance claim offices that can

provide claim services immediately following

a disaster – were stationed in the hardest-hit

areas surrounding New Orleans, La., Mobile, Ala.,

and Jackson, Miss., following Hurricane Katrina

in August. They also were deployed following

Hurricanes Rita and Wilma and following the

November tornados in Evansville, Ind., and

Henderson, Ky.

The Mobile Claim Headquarters, the first of their

type in the industry, are staffed by catastrophe

response team members equipped with wireless

technology and other equipment required to

process claims in the midst of a disaster area.

Each of the vehicles has its own generator, so

it can operate in areas without electricity and

can process claims through wireless or satellite

connectivity if land lines are not available.

The vehicles allow claims to be resolved more

quickly and checks to be issued to policyholders

on the spot.