Travelers 2005 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

180

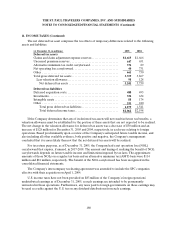

11. INCOME TAXES (Continued)

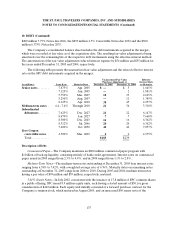

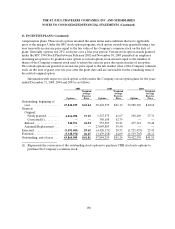

The net deferred tax asset comprises the tax effects of temporary differences related to the following

assets and liabilities:

(at December 31, in millions) 2005 2004

Deferred tax assets

Claims and claim adjustment expense reserves ................... $1,615

$1,666

Unearned premium reserves.................................. 647 651

Alternative minimum tax credit carryforward.................... 376 89

Net operating loss carryforward. ............................... 40

731

Other...................................................... 661 730

Total gross deferred tax assets ................................. 3,339 3,867

Less valuation allowance. ................................... 98

128

Net deferred tax assets ................................... 3,241 3,739

Deferred tax liabilities

Deferred acquisition costs. .................................... 488 493

Investments................................................. 352 634

Intangible assets ............................................. 88

174

Other...................................................... 251 240

Total gross deferred tax liabilities .......................... 1,179 1,541

Total deferred income taxes............................... $2,062

$2,198

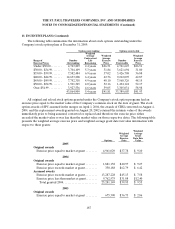

If the Company determines that any of its deferred tax assets will not result in future tax benefits, a

valuation allowance must be established for the portion of these assets that are not expected to be realized.

The net change in the valuation allowance for deferred tax assets was a decrease of $30 million and an

increase of $128 million for December 31, 2005 and 2004, respectively, in each year relating to foreign

operations. Based predominantly upon a review of the Company’s anticipated future taxable income, and

also including all other available evidence, both positiveand negative, the Company’s management

concluded that it is more likely than not that the net deferred tax assets will be realized.

For tax return purposes, as of December 31, 2005, the Company had a net operation loss (NOL)

carryforward that expires, if unused, in 2017-2018. The amount and timing of realizing the benefit of NOL

carryforwards depends on future taxable income and limitations imposed by tax laws. The approximate

amounts of those NOLs on a regular tax basis and an alternative minimum tax (AMT) basis were $114

million and $81 million, respectively. The benefit of the NOL carryforward has been recognized in the

consolidated financial statements.

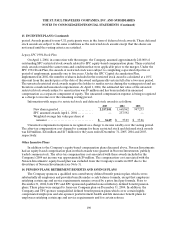

The Company’s intercompany tax sharing agreement was amended to include the SPC companies

effective with their acquisition on April 1, 2004.

U.S. income taxes have not been provided on $83 million of the Company’s foreign operations’

undistributed earnings as of December 31, 2005, as such earnings are intended to be permanently

reinvested in those operations. Furthermore, any taxes paid to foreigngovernments on these earnings may

be used as credits against the U.S. tax on any dividend distributions from such earnings.