Travelers 2005 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

158

6. INVESTMENTS (Continued)

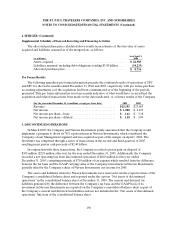

Proceeds from the sale of real estate investments totaled $37 million in2005. Gross gains of $15

million and no gross losses were realized on those sales in 2005. The Company did not sell any real estate

investments in 2004 or 2003.

Future minimum rental income expected on operating leases relating to the Company’s real estate

properties is $93 million, $84 million, $70 million, $52 million, $37 million, and$40 million for 2006, 2007,

2008, 2009, 2010 and 2011 and thereafter, respectively.

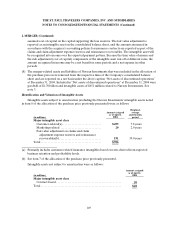

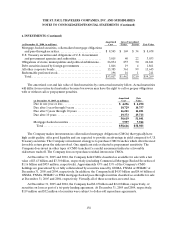

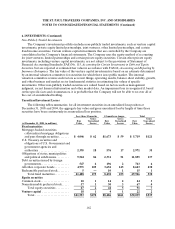

Venture Capital

The cost and fair value of investments in venture capital, which are reported as part of other

investments in the Company’s consolidated balance sheet, were as follows:

Gross Unrealized Fair

(at December 31, 2005, in millions) Cost Gains Losses Value

Venture capital.................................... $ 406 $ 91 $ 2$ 4 95

Gross Unrealized Fair

(at December 31, 2004, in millions) Cost Gains Losses Value

Venturecapital.................................... $480 $ 29 $ 1 8$491

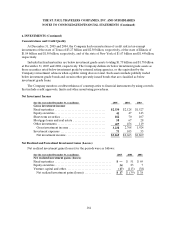

Variable Interest Entities

The following entities are consolidated:

•Municipal Trusts—The Company ownsinterests invarious municipal trusts that were formed for

the purpose of allowingmore flexibility to generate investment income in a manner consistentwith

the Company’s investmentobjectives and tax position. As of both December 31, 2005 and 2004,

there were 36such trusts, which held a combined total of $441 million and $450 million,

respectively, in municipal securities, of which $84 million and $84 million, respectively, were owned

by outside investors. The net carrying value of the trusts owned by the Company at December 31,

2005 and 2004 was $357 million and $366 million, respectively.

•Venture Capital Entities and Tax CreditFunds—The Company has investments in venture capital

entities which are held for the purposes of generating long-term investment returns. The Company

also has investments in certain tax credit funds which generate tax benefits. The Company

consolidates certain venture capital investments and tax credit funds under the provisions of the

FASB Revised Interpretation No. 46, Consolidation of Variable Interest Entities. The combined

carrying values of these investments were not significant at December 31, 2005 and 2004.

The Company has significant interests in VIEs which are not consolidated because the Company is

not considered to be the primary beneficiary. These entities are as follows:

•The Company has a significant variable interest in one real estate entity. This investment has total

assets of approximately $143 million and $117 million as of December 31, 2005 and 2004,

respectively. The carrying value of the Company’s share of this investment was approximately $31

million and $38 million at December 31, 2005 and 2004, respectively, which also represented its

maximum exposure to loss. The purpose of the Company’s involvement in this entity is to generate

investment returns.