Travelers 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

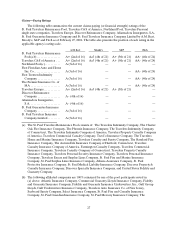

Insurance Regulation Concerning Dividends

The Company’s principal insurance subsidiaries are domiciled in the states of Connecticut and

Minnesota. The insurance holding company laws of both states applicable to the Company’s subsidiaries

require notice to, and approval by, the state insurance commissioner for the declaration or payment of any

dividend, that together with other distributions made within the preceding twelve months, exceeds the

greater of 10% of the insurer’s capital and surplus as of the preceding December 31, or the insurer’s net

income for the twelve-month period ending the preceding December 31, in each case determined in

accordance with statutory accounting practices and by state regulation. This declaration or payment is

further limited by adjusted unassigned surplus, as determined in accordance with statutory accounting

practices.

The insurance holding company laws of other states in which the Company’s insurance subsidiaries

are domiciled generally contain similar, although in some instances somewhat more restrictive, limitations

on the payment of dividends.

Assessments for GuarantyFunds and Second-Injury Funds and Other Mandatory Pooling Arrangements

Virtually all states require insurers licensed to do business in their state to bear a portion of the loss

suffered by some insureds as a result of the insolvency of other insurers. Depending upon state law,

insurers can be assessed an amount that is generally equal to between 1% and 2%of premiums written for

the relevant lines of insurance in that state each year to pay the claims of an insolvent insurer. Part of these

payments is recoverable through future premium rates, premium tax credits or policy surcharges.

Significant increases in assessments could limit the ability of the Company’s insurance subsidiaries to

recover such assessments through tax credits or other means. In addition, there have been some legislative

efforts to limit or repeal the tax offset provisions, which efforts, to date, havebeen generally unsuccessful.

These assessments leveled off in 2005 and in certain states began to decrease. These assessments may

increase in the future if additional insolvencies occur.

Many states have laws that established second-injury funds to provide compensation toinjured

employees for aggravation of a prior condition or injury. Insurers writing workers’ compensation in those

states having second-injury funds are subject to the laws creating the funds, including the various funding

mechanisms that those states have adopted to fund the second-injury funds. Several of thestates having

larger second-injury funds utilize a premium surcharge that effectively passes the cost of the fundto

policyholders. Other states assess the insurer based on paid losses and allow the insurer to recoup the

assessment through future premium rates.

The Company’s insurance subsidiaries are also required to participate in various involuntary assigned

risk pools, principally involving workers’ compensation and automobile insurance, which provide various

insurance coverages to individuals or other entities that otherwise are unable to purchase that coverage in

the voluntary market. Participation in these pools in most states is generally in proportion to voluntary

writings of related lines of business in that state. In the event that a member of that pool becomes

insolvent, the remaining members assume an additional pro rata share of the liabilities of the pool. The

underwriting results of these pools traditionally have beenunprofitable. Combined earned premiums

related to such pools and assigned risks for the Company were $174 million, $168 million and $160 million

in 2005, 2004 and 2003, respectively. The related combined underwriting losses for the Company were $112

million, $71 million and $111 million in 2005, 2004 and 2003, respectively.

Proposed legislation and regulatory changes have been introduced in the states from time to time that

would modify some of the laws and regulations affecting the financial services industry, including the use of

information. The potential impact of that legislation on the Company’s businesses cannot be predicted at

this time.