Travelers 2005 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2005 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC.AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

196

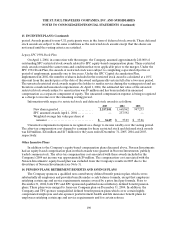

14. PENSION PLANS,RETIREMENT BENEFITS AND SAVINGS PLANS (Continued)

Legacy TPC 401(k) Savings Plan

Prior to the September 2005 plan merger, the Company had a 401(k) savings plan under which

substantially all legacy TPC employees and Company employees hired after April 1, 2004, were eligible to

participate. In 2004, the Company matched employee contributions up to 5% of eligible pay but not more

than $2,500 annually. Prior to 2004, the Company matched employee contributions up to 3% of eligible

pay but not more than $1,500 annually. The expense related to this plan was $34 million and $20 million

for the years ended December 31, 2004 and 2003, respectively.

Legacy SPC 401(k) Savings Plus and Stock Ownership Plans

Prior to the September 2005 plan merger and in connection with the merger with SPC, the Company

assumed The St. Paul Companies, Inc. Savings PlusPlan (SPP), a 401(k) savings plan and The St. Paul

Companies, Inc. Stock Ownership Plan (SOP). Substantially all employees who were hired by legacy SPC

before April 1, 2004 were eligible to participate in these plans. In 2004 under the SPP, the Company

matched 100% of employees’ contributions up to a maximum of 6% of their salary. The match was in the

form of preferred shares, to the extent available in the SOP, or in the Company’scommon shares. Also

allocated to participants were preferred shares equal to the value of dividends on previously allocated

shares.

To finance the preferred stock purchase for future allocation to qualified employees, the SOP

borrowed $150 million at 9.4% from a primary U.S. underwriting subsidiary. As the principal and interest

of the trust’s loan was paid, a pro rata amountof preferred stock was released for allocation to

participating employees. Each share of preferred stock pays a dividend of $11.72 annually and is currently

convertible into eight shares of the Company’s common stock. Preferred stock dividends on all shares held

by the trust were used to pay a portion of the SOP obligation. In addition to dividends paid to the trust,

additional cash contributions were made to the SOP as necessary in order to meet the SOP’s debt

obligation. The SOP’s debt obligation was paid off in January 2005 with a final payment of $5 million;

consequently, all preferred stock dividends are now paid to preferred stockholders. The SOP allocated the

final 71,346 preferred shares in 2004. The SOP has no preferred shares available for future allocations.

All common shares and the common stock equivalent of all preferred shares held by the SOP are

considered outstanding for diluted EPS computationsand dividends paid on all shares are charged to

retained earnings.

The Company follows the provisions of Statement of Position 76-3, “Accounting Practices for Certain

Employee Stock Ownership Plans,” and related interpretations in accounting for this plan. The Company

recorded an expense of $5 million in 2004.

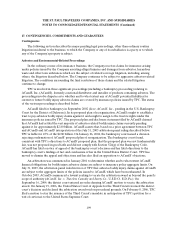

15. LEASES

Rent expense was $219 million, $207 million and $115 million in 2005, 2004 and 2003, respectively.

Future minimum annual rental payments under noncancellable operating leases are $173 million,

$157 million, $124 million, $87 million, $52 million and $164million for 2006, 2007, 2008, 2009, 2010 and

2011 and thereafter, respectively. Future sublease rental income aggregating approximately $55 million will

partially offset these commitments.