IBM 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

97

For the “Other Acquisitions,” the overall weighted-average life of

the identified amortizable intangible assets acquired is 6.6years.

These identified intangible assets will be amortized on a straight-

line basis over their useful lives. Goodwill of $961million was

assigned to the Software ($948million) and Systems Hardware

($13million) segments. At the acquisition dates, it was expected

that approximately 2percent of the goodwill would be deductible

for tax purposes.

Divestitures

Microelectronics—On October20, 2014, IBM and GLOBAL-

FOUNDRIES announced a definitive agreement in which

GLOBALFOUNDRIES would acquire the company’s Microelec-

tronics business, including existing semiconductor manufacturing

assets and operations in East Fishkill, NY and Essex Junction,

VT. The commercial OEM business to be acquired by GLOBAL-

FOUNDRIES included custom logic and specialty foundry,

manufacturing and related operations. The transaction closed on

July1, 2015.

The transaction included a 10-year exclusive manufacturing

sourcing agreement in which GLOBALFOUNDRIES will provide

server processor semiconductor technology for use in IBM Sys-

tems. The agreement provides the company with capacity and

market-based pricing for current semiconductor nodes in produc-

tion and progression to nodes in the future for both development

and production needs. As part of the transaction, the company

provides GLOBALFOUNDRIES with certain transition services,

including IT, supply chain, packaging and test services and lab

services. The initial term for these transition services is one to three

years, with GLOBALFOUNDRIES having the ability to renew.

In the third quarter of 2014, the company recorded a pre-tax

charge of $4.7billion related to the sale of the Microelectronics dis-

posal group, which was part of the Systems Hardware reportable

segment. The pre-tax charge reflected the fair value less the esti-

mated cost of selling the disposal group including an impairment

to the semiconductor long-lived assets of $2.4billion, $1.5billion

representing the cash consideration expected to be transferred

to GLOBALFOUNDRIES and $0.8billion of other related costs.

Additional pre-tax charges of $116million were recorded during

2015 related to the disposal. The cumulative pre-tax charge was

$4.8billion as of December31, 2015. Additional charges may be

recorded in future periods.

All assets and liabilities of the business, which were held for

sale at June30, 2015, were transferred at closing. The company

transferred $515million of net cash to GLOBALFOUNDRIES in the

third quarter of 2015. This amount included $750million of cash

consideration, adjusted by the amount of working capital due from

GLOBALFOUNDRIES and other miscellaneous items. The remain-

ing cash consideration will be transferred over two years.

Reporting the related assets and liabilities initially as held for

sale at September30, 2014 was based on meeting all of the criteria

for such reporting in the applicable accounting guidance. While

the company met certain criteria for held for sale reporting in prior

periods, it did not meet all of the criteria until September30, 2014.

In addition, at September30, 2014, the company concluded that

the Microelectronics business met the criteria for discontinued

operations reporting. The disposal group constitutes a compo-

nent under accounting guidance. The continuing cash inflows and

outflows with the discontinued component are related to the man-

ufacturing sourcing arrangement and the transition, packaging

and test services. These cash flows are not direct cash flows as

they are not significant and the company will have no significant

continuing involvement.

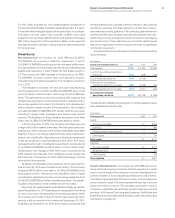

Summarized financial information for discontinued operations

is shown below.

($ inmillions)

For the year ended December 31: 2015 2014 2013

Total revenu e $ 720 $ 1,335 $1,384

Loss from discontinued operations,

before tax (175) (619) (720)

Loss on disposal, before tax (116) (4,726) —

Total loss from discontinued

operations, before income taxes (291) (5,346) (720)

Provision/(benefi t) for income taxes (117) (1,617) (322)

Loss from discontinued

operations, net of tax $(174) $(3,729 ) $ (398 )

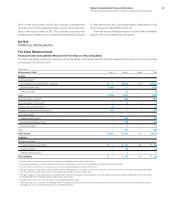

The assets and liabilities at December31, 2014 presented below

were classified as held for sale.

($ inmillions)

At December 31: 2015 2014

Assets:

Accounts receivable $— $245

Inventory —380

Property, plant & equipment, net ——

Other assets —92

Total assets $— $717

Liabilities:

Accounts payable $— $177

Deferred income —87

Other liabilities —163

Total liabilities $— $427

Industry Standard Server—On January23, 2014, IBM and Lenovo

Group Limited (Lenovo) announced a definitive agreement in which

Lenovo would acquire the company’s industry standard server

portfolio (Systemx) for an adjusted purchase price of $2.1billion,

consisting of approximately $1.8billion in cash, with the balance in

Lenovo common stock. The stock represented less than 5percent

equity ownership in Lenovo. The company would sell to Lenovo

its Systemx, BladeCenter and Flex System blade servers and

switches, x86-based Flex integrated systems, NeXtScale and

iDataPlex servers and associated software, blade networking and

maintenance operations.