IBM 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

122

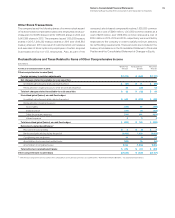

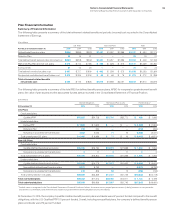

Deferred Tax Liabilities

($ inmillions)

At December 31: 2015 2014

Depreciation $ 919 $ 487

Retirement benefi ts 252 205

Goodwill and intangible assets 1,407 1,263

Leases 916 912

Software development costs 554 421

Deferred transition costs 395 374

Other 1,177 1,111

Gross deferred tax liabilities $5,620 $4,773

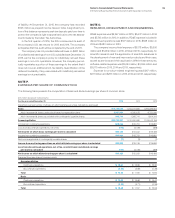

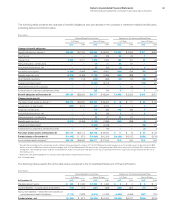

For income tax return purposes, the company has foreign and

domestic loss carryforwards, the tax effect of which is $742million,

as well as domestic and foreign credit carryforwards of $1,149mil-

lion. Substantially all of these carryforwards are available for at

least two years or are available for 10years or more.

The valuation allowances as of December31, 2015, 2014 and

2013 were $740million, $646million and $734million, respectively.

The amounts principally apply to certain foreign, state and local

loss carryforwards and credits that, in the opinion of management,

are more likely than not to expire unutilized. However, to the extent

that tax benefits related to these carryforwards are realized in the

future, the reduction in the valuation allowance will reduce income

tax expense.

The amount of unrecognized tax benefits at December31, 2015

decreased by $530million in 2015 to $4,574 million. A reconciliation

of the beginning and ending amount of unrecognized tax benefits

is as follows:

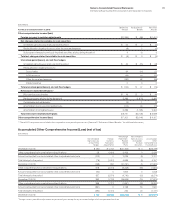

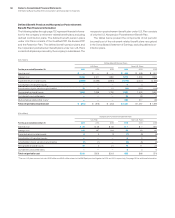

($ inmillions)

2015 2014 2013

Balance at January1 $ 5,104 $4,458 $ 5,672

Additions based on tax positions

related to the current year 464 697 829

Additions for tax positions

of prior years 569 586 417

Reductions for tax positions

of prior years (including impacts

due to a lapse in statute) (1,348) (579) (2,201)

Settlements (215) (58) (259)

Balance at December 31 $ 4,574 $5,104 $ 4,458

The additions to unrecognized tax benefits related to the current

and prior years are primarily attributable to non-U.S. issues, certain

tax incentives and credits and state issues. The settlements and

reductions to unrecognized tax benefits for tax positions of prior

years are primarily attributable to the completion of the IRS exam-

ination for 2011 and 2012, currency, non-U.S. audits and impacts

due to lapses in statutes of limitation.

In April 2010, the company appealed the determination of the

Japan Tax Authorities with respect to certain foreign tax losses.

The unrecognized tax benefit of these losses totals $997million

as of December31, 2015. In April 2011, the company received noti-

fication that the appeal was denied, and in June 2011, the company

filed a lawsuit challenging this decision. In May 2014, the Tokyo

District Court ruled in favor of the company. The Japanese govern-

ment appealed the ruling to the Tokyo High Court. In March 2015,

the Tokyo High Court ruled in favor of the company and, in April

2015, the Japanese government appealed the ruling to the Japan

Supreme Court. See Note U, “Subsequent Event,” for an update

on this matter.

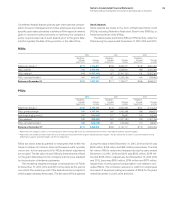

The liability at December31, 2015 of $4,574 million can be

reduced by $850million of offsetting tax benefits associated with

the correlative effects of potential transfer pricing adjustments, U.S.

tax credits, state income taxes and timing adjustments. The net

amount of $3,724 million, if recognized, would favorably affect the

company’s effective tax rate. The net amounts at December31,

2014 and 2013 were $4,229 million and $3,902 million, respectively.

Interest and penalties related to income tax liabilities are

included in income tax expense. During the year ended Decem-

ber31, 2015, the company recognized $141million in interest

expense and penalties; in 2014, the company recognized $216mil-

lion in interest expense and penalties; and, in 2013, the company

recognized a benefit of $93million in interest expense and pen-

alties. The company has $613million for the payment of interest

and penalties accrued at December31, 2015, and had $593million

accrued at December31, 2014.

Within the next 12 months, the company believes it is reason-

ably possible that the total amount of unrecognized tax benefits

associated with certain positions may be reduced as certain

foreign issues may be concluded. The company estimates that

the unrecognized tax benefits at December31, 2015 could be

reduced by approximately $413million excluding the Japan matter

discussed above.

The company is subject to taxation in the U.S. and various

state and foreign jurisdictions. With respect to major U.S. state

and foreign taxing jurisdictions, the company is generally no

longer subject to tax examinations for years prior to 2011. With

limited exception, the company is no longer subject to income tax

examination of its U.S. federal tax return for years prior to 2013.

The open years contain matters that could be subject to differing

interpretations of applicable tax laws and regulations related to

the amount and/or timing of income, deductions and tax credits.

Although the outcome of tax audits is always uncertain, the com-

pany believes that adequate amounts of tax and interest have been

provided for any significant adjustments that are expected to result

for these years.

In the fourth quarter of 2013, the company received a draft tax

assessment notice for approximately $866million (approximately

$810million at 2015 year-end currency rates) from the Indian

Tax Authorities for 2009. The company believes it will prevail on

these matters and that this amount is not a meaningful indicator