IBM 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

Management Discussion

International Business Machines Corporation and Subsidiary Companies

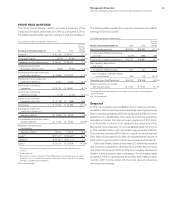

Systems Hardware

($ inmillions)

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Systems Hardware external revenue $9,996 $12,988 (23.0)% (16.8)%*

zSystems (23.3)% (22.6)%

Power Systems (18.9) (18.2)

Storage (12.0) (11.0)

Systemx (35.1) (34.9)

* Adjusted for divestitures and currency.

Systems Hardware revenue of $9,996 million decreased 23.0

percent as reported in 2014, 17percent adjusted for the divesti-

ture of the Systemx business (5points) and currency (1point). In

2013, the Systems Hardware business reported a profit decline

of $1,653 million compared to 2012. During 2014, the company

worked to reposition this business and to stabilize profit. It divested

the Systemx business and announced the divestiture of the

Microelectronics business. Performance in 2014 reflected year-

to-year declines related to the zSystems product cycle as well

as declines in Power Systems and Storage. Systems Hardware

grew profit in the fourth quarter, and was profitable for the year.

Profit performance year to year was impacted by the divestiture

and currency, in addition to the revenue impacts.

The fourth quarter of 2014 marked the 10th quarter of the

current zSystems product cycle. In January 2015, the company

announced the z13, the new generation mainframe. The z13

system culminates a $1billion investment and five years of devel-

opment, leverages the innovation of more than 500 new patents

and represents a collaboration with more than 60clients. The

result of this effort is a mainframe that has the world’s fastest pro-

cessor that can execute two-and-a-half billion transactions a day.

Although Power Systems revenue was down year to year, there

was sequential improvement in the year-to-year revenue growth

rate at constant currency in the last two quarters of 2014. The com-

pany has repositioned Power which is not only a systems business,

but also an open chip processor and an IP income opportunity

through the OpenPOWER foundation. In June 2014, scale-out

systems based on POWER8 were introduced and high-end POW-

ER8-based enterprise systems were announced in October 2014.

These systems are highly scalable and can handle the most data

intensive, mission critical applications in the industry. In addition,

the company saw continued expansion of the OpenPOWER con-

sortium, with over 80 members, 14 of which are in greater China.

Since the establishment of the consortium in 2013, several offer-

ings have been introduced by consortium members based on

the POWER architecture. In addition, the company has initiated

a strategic partnership with Suzhou PowerCore, which intends to

use POWER architecture to develop and market processors for

servers in China.

Storage revenue decreased year to year in 2014. However,

at constant currency, it delivered sequential improvement in the

year-to-year growth rate over the last three quarters of 2014. Full-

year performance included strong contribution from FlashSystem

and the Storwize portfolio. However, this was more than offset by

weakness in high-end disk and the continued wind down of the

legacy storage-related OEM business.

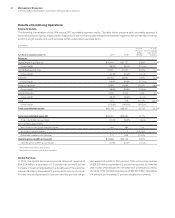

($ inmillions)

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent/

Margin

Change

Systems Hardware

External gross profi t $3,945 $5,299 (25.6)%

External gross profi t margin 39.5% 40.8% (1.3) pts.

Pre-tax income $ 34 $ 213 (84.1)%

Pre-tax margin 0.3% 1.6% (1.3) pts.

Systems Hardware gross profit margin of 39.5percent decreased

1.3points year to year. The decrease was driven by lower margins

in Power Systems (1.3points) and Storage (0.9points), partially

offset by an increase due to mix (0.7points), driven by the divesti-

ture of the Systemx business.

In 2014, the company took significant actions to reposition its

Systems Hardware business for higher value, and reinforced its

commitment to driving innovation in high-end systems and storage.

It repositioned Power through the development of the POWER8

systems which are built for cloud and big data, and it made

available the POWER8 architecture through the OpenPOWER

consortium to build an open ecosystem and an IP opportunity.

further enable its analytics portfolio in a cloud environment and

announced IBM Verse, a cloud-based email and collaboration

offering that integrates Watson capabilities. This type of continued

innovation in offerings, together with expanding services on the

Bluemix Platform-as-a-Service, will better allow customers to

move to a hybrid environment.