IBM 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

Management Discussion

International Business Machines Corporation and Subsidiary Companies

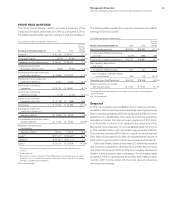

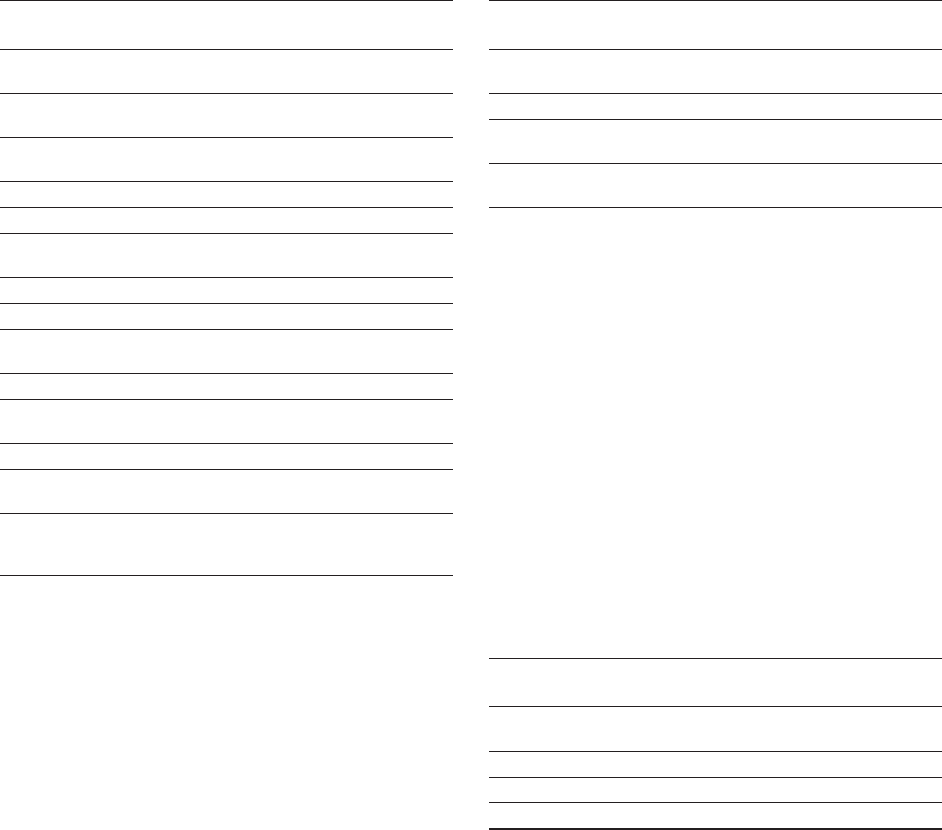

Selling, General and Administrative

($ inmillions)

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent

Change

Selling, general and

administrative expense

Selling, general and

administrative—other $18,532 $19,178 (3.4)%

Advertising and promotional

expense 1,307 1,294 1.1

Workforce rebalancing charges 1,472 1,031 42.7

Retirement-related costs 811 986 (17.8)

Amortization of acquired

intangible assets 374 370 1.2

Stock-based compensation 350 435 (19.4)

Bad debt expense 334 156 113.8

Total consolidated selling, general

and administrative expense $23,180 $23,451 (1.2)%

Non-operating adjustments

Amortization of acquired

intangible assets (374) (370) 1.2

Acquisition-related charges (11) (25) (54.1)

Non-operating retirement-related

(costs)/income (257) (376) (31.7)

Operating (non-GAAP)

selling, general and

administrative expense $22,537 $22,680 (0.6)%

Total selling, general and administrative expense decreased

1.2percent in 2014 versus 2013 primarily driven by the following

factors:

• The effects of currency (2points); and

• Lower base expense (1 point); partially offset by

• Acquisition-related spending (2 points).

Operating (non-GAAP) SG&A expense decreased 0.6percent

primarily driven by:

• The effects of currency (2 points); partially offset by

• Acquisition-related spending (1 point).

Workforce rebalancing charges in 2014 were $1,472million, an

increase of $440million year to year, which resulted in a 2point

year-to-year impact in operating (non-GAAP) SG&A base

expense. Bad debt expense increased $178million year to year

driven by higher specific provision additions, primarily in China and

Latin America. The receivables provision coverage was 2.2per-

cent at December31, 2014, an increase of 60basis points from

year-end 2013.

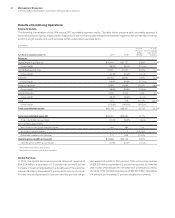

Research, Development and Engineering

($ inmillions)

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent

Change

Total consolidated research,

development and engineering $5,437 $5,743 (5.3)%

Non-operating adjustment

Non-operating retirement-related

(costs)/income 77 (57) NM

Operating (non-GAAP) research,

development and engineering $5,514 $5,686 (3.0)%

NM—Not meaningful

Research, development and engineering expense was 5.9percent

of revenue in 2014 and 5.8percent of revenue in 2013.

RD&E expense decreased 5.3percent in 2014 year to year

primarily driven by:

• Lower base expense (7points); and

• The effects of currency (1point); partially offset by

• Higher expense due to acquisitions (2points).

Operating (non-GAAP) RD&E expense decreased 3.0percent in

2014 compared to the prior year, primarily driven by:

• Lower base expense (4points); and

• The effects of currency (1point); partially offset by

• Higher expense due to acquisitions (2points).

Intellectual Property and Custom Development Income

($ inmillions)

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent

Change

Sales and other transfers of

intellectual property $283 $352 (19.7)%

Licensing/royalty-based fees 129 150 (13.9)

Custom development income 330 320 3.1

Total $742 $822 (9.8)%

The timing and amount of Sales and other transfers of IP may vary

significantly from period to period depending upon the timing of

divestitures, economic conditions, industry consolidation and the

timing of new patents and know-how development. There were no

significant individual IP transactions in 2014 or 2013.