IBM 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

Management Discussion

International Business Machines Corporation and Subsidiary Companies

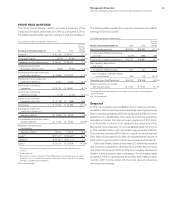

EMEA fourth quarter revenue of $7,320 million decreased

8.5percent as reported, but grew 1percent adjusted for cur-

rency on a year-to-year basis. Germany decreased 0.3percent

as reported, but had growth of 13percent adjusted for currency.

The UK decreased 1.4percent year to year as reported, but grew

3percent adjusted for currency. France declined 10.6percent as

reported, but grew 2percent adjusted for currency. The Middle

East and Africa region grew 2.6percent as reported and 8percent

adjusted for currency. However, there was a decline in the central

and eastern European region.

Asia Pacific fourth quarter revenue of $4,417 million decreased

9.8percent as reported and 3percent adjusted for currency com-

pared to the prior year. Japan decreased 2.6percent as reported,

but had growth of 3percent adjusted for currency, led by services.

On an adjusted basis, this was the 13th consecutive quarter of

revenue growth in Japan. Australia decreased 5.2percent year

to year, but returned to strong growth of 11percent in the fourth

quarter adjusted for currency. India also had strong growth com-

pared to the prior year. However, this growth was more than offset

by declines in China and other countries in the region.

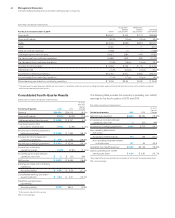

Total Expense and Other (Income)

($ inmillions)

For the fourth quarter: 2015 2014

Yr.-to-Yr.

Percent/

Margin

Change

Total consolidated expense

and other (income) $6,308 $5,767 9.4%

Non-operating adjustments

Amortization of acquired

intangible assets (80) (93) (13.7)

Acquisition-related charges (15) (2) 646.7

Non-operating retirement-related

(costs)/income (100) (74) 33.8

Operating (non-GAAP)

expense and other (income) $6,114 $5,598 9.2%

Total co nso lid ated

expense-to-revenue ratio 28.6% 23.9% 4.7 pts.

Operating (non-GAAP)

expense-to-revenue ratio 27.7% 23.2% 4.5 pts.

Total expense and other (income) increased 9.4percent in the

fourth quarter with an expense-to-revenue ratio of 28.6percent

compared to 23.9percent in the fourth quarter of 2014. Total

operating (non-GAAP) expense and other (income) increased

9.2percent in the fourth quarter. The increase in total operating

expense and other (income) was primarily driven by divestiture

gains in the prior-year period (24points), partially offset by lower

workforce rebalancing charges in the current year (10points) and

the impact of currency in the fourth quarter of 2015 compared

with the prior year (8points). There were several large items that

impacted the growth rate this quarter. In the fourth quarter of

2014, other (income) and expense included the pre-tax gain from

the Systemx divestiture of $1.4billion; while selling, general and

administrative expense included a workforce rebalancing charge

of $577million with essentially none in the current year period.

The fourth quarter of 2015 included a charge of $86million for the

impairment of the equity securities received as consideration in the

System x divestiture. Outside these larger items, the fourth-quarter

expense dynamics were consistent with the rest of the year as the

company accelerates shifts within the operational expense base

driving productivity and efficiency in some areas, while increasing

investment in support of the strategic imperatives.

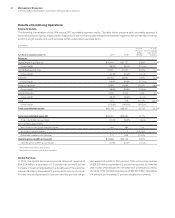

Results of Discontinued Operations

Income from discontinued operations, net of tax, was $3million

in the fourth quarter of 2015 compared with a loss of $31million

in 2014.

Cash Flow

The company generated $5,278 million in cash flow provided by

operating activities, a decrease of $781million compared to the

fourth quarter of 2014 driven by operational performance within

net income, partially offset by declines in income tax payments.

Net cash used in investing activities of $5,445 million increased

$4,209 million compared to the prior year, primarily due to acqui-

sitions in the fourth quarter of the current year and cash received

for the Systemx divestiture in the prior year period. Net cash used

in financing activities of $1,348 million decreased $4,351 million

compared to the prior year, primarily due to a decline in net cash

payments to settle debt, partially offset by an increase in cash used

for gross common stock repurchases.