IBM 2015 Annual Report Download - page 94

Download and view the complete annual report

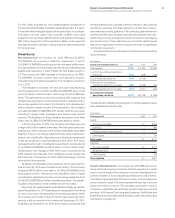

Please find page 94 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

92

Estimated Residual Values of Lease Assets

The recorded residual values of lease assets are estimated at

the inception of the lease to be the expected fair value of the

assets at the end of the lease term. The company periodically

reassesses the realizable value of its lease residual values. Any

anticipated increases in specific future residual values are not rec-

ognized before realization through remarketing efforts. Anticipated

decreases in specific future residual values that are considered to

be other-than-temporary are recognized immediately upon iden-

tification and are recorded as an adjustment to the residual value

estimate. For sales-type and direct-financing leases, this reduction

lowers the recorded net investment and is recognized as a loss

charged to financing income in the period in which the estimate is

changed, as well as an adjustment to unearned income to reduce

future-period financing income.

Common Stock

Common stock refers to the $.20 par value per share capital stock

as designated in the company’s Certificate of Incorporation. Trea-

sury stock is accounted for using the cost method. When treasury

stock is reissued, the value is computed and recorded using a

weighted-average basis.

Earnings Per Share of Common Stock

Earnings per share (EPS) is computed using the two-class method.

The two-class method determines EPS for each class of common

stock and participating securities according to dividends and

dividend equivalents and their respective participation rights

in undistributed earnings. Basic EPS of common stock is com-

puted by dividing net income by the weighted-average number

of common shares outstanding for the period. Diluted EPS of

common stock is computed on the basis of the weighted-aver-

age number of shares of common stock plus the effect of dilutive

potential common shares outstanding during the period using the

treasury stock method. Dilutive potential common shares include

outstanding stock awards, convertible notes and stock options.

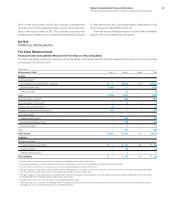

NOTEB.

ACCOUNTING CHANGES

New Standards to be Implemented

In January 2016, the Financial Accounting Standards Board (FASB)

issued guidance which addresses aspects of recognition, mea-

surement, presentation and disclosure of financial instruments.

Certain equity investments will be measured at fair value with

changes recognized in net income. The amendment also sim-

plifies the impairment test of equity investments that lack readily

determinable fair value. The guidance is effective January1, 2018

and early adoption is not permitted except for limited provisions.

The guidance is not expected to have a material impact in the

consolidated financial results.

In September 2015, the FASB issued guidance eliminating the

requirement that an acquirer in a business combination account

for a measurement-period adjustment retrospectively. Instead, an

acquirer will recognize a measurement-period adjustment during

the period in which the amount of the adjustment is determined.

In addition, the portion of the amount recorded in current-period

earnings by line item that would have been recorded in previous

reporting periods if the adjustment to the provisional amounts had

been recognized as of the acquisition date should be presented

separately on the face of the income statement or disclosed in the

notes. The guidance was effective January1, 2016 on a prospec-

tive basis. The guidance is not expected to have a material impact

in the consolidated financial results.

In July 2015, the FASB issued guidance which requires all inven-

tories, except those using the last-in, first-out or retail methods, to

be measured at the lower of cost and net realizable value. Net real-

izable value is the estimated selling price in the ordinary course of

business, less reasonably predictable cost of completion, disposal,

and transportation. The guidance is effective January1, 2017 with

early adoption permitted. The guidance is not expected to have a

material impact in the consolidated financial results.

In May 2015, the FASB issued guidance which removed the

requirement to categorize within the fair value hierarchy all invest-

ments for which fair value is measured using the net asset value

per share practical expedient. The amendments also removed the

requirement to make certain disclosures for all investments that

are eligible to be measured at fair value using the net asset value

per share practical expedient. Rather, those disclosures are limited

to investments for which the entity has elected to measure the fair

value using that practical expedient. The guidance was effective

January1, 2016. The guidance was a change in disclosure only

and will not have an impact in the consolidated financial results.

In April 2015, the FASB issued guidance about whether a

cloud computing arrangement includes a software license. If a

cloud computing arrangement includes a software license, then

the customer should account for the software license element of

the arrangement consistent with the acquisition of other software

licenses. If a cloud computing arrangement does not include a

software license, the customer should account for the arrange-

ment as a services contract. All software licenses recognized

under this guidance will be accounted for consistent with other

licenses of intangible assets. The guidance was effective Janu-

ary1, 2016 and the company will adopt it on a prospective basis.

The guidance is not expected to have a material impact in the

consolidated financial results.