IBM 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 Management Discussion

International Business Machines Corporation and Subsidiary Companies

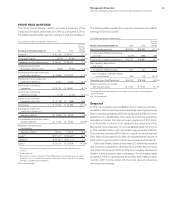

Software

($ inmillions)

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Software external revenue $25,434 $25,932 (1.9)% (0.9)%

Middleware $21,474 $21,557 (0.4)% 0.6%

Key branded middleware 17,098 17,322 (1.3) (0.2)

WebSphere 2.7 3.5

Information Management (4.1) (3.0)

Workforce Solutions (6.1) (5.1)

Tivoli 2.0 3.0

Rational (3.3) (1.3)

Other middleware 4,376 4,235 3.3 4.2

Operating systems 2,119 2,447 (13.4) (12.6)

Other 1,841 1,929 (4.5) (3.7)

Software revenue of $25,434 million decreased 1.9percent (1per-

cent adjusted for currency) in 2014 compared to 2013. Middleware

decreased 0.4percent (increased 1percent adjusted for currency)

while operating systems were down 13.4percent (13percent

adjusted for currency). The decline in operating systems impacted

total software revenue growth year to year at constant currency by

approximately 1point. The company had solid growth in many of

its solution areas, including security, mobile and cloud. In addition,

across the software brands, SaaS offerings grew rapidly through-

out the year, increasing approximately 50percent compared to

2013. In the first quarter of 2014, the company launched Bluemix,

a cloud Platform-as-a Service for the enterprise and, during the

year, the Software business completed five acquisitions adding to

its capabilities in mobile, cloud and security. Across Software, the

company is transitioning its portfolio to capture growth areas while

continuing to drive innovation in its core franchises. It is growing

and building capabilities in emerging areas like SaaS, mobile and

security. Performance in 2014 reflected business model changes

that impacted the transactional revenue growth. Given clients’

substantial investment in the IBM software platform, the com-

pany has been providing more flexibility on how clients deploy

its software acquired through enterprise licensing agreements.

This enables clients to more effectively manage their capacity and

commit to the company’s platforms for the long term, however, it

does impact period transactional revenue.

Key branded middleware revenue accounted for 67percent of

total Software revenue in 2014. While there was growth in several

strategic areas like cloud, mobile and security, other parts of the

portfolio declined on a year-to-year basis.

WebSphere revenue performance was driven by growth in

Application Server, Business Integration and Commerce offerings.

In Commerce, there was strong momentum in Commerce-as-a-

Service, which included the acquisitions of Silverpop and Aspera.

MobileFirst, the comprehensive portfolio of mobile software and

services that enable clients to manage, integrate and leverage

mobile devices, contributed to the significant growth of the com-

pany’s mobile business.

Within Information Management, with the acquisition of Clou-

dant, the company has added Database-as-a-Service capability.

Cloudant extends the company’s mobile and cloud platforms by

enabling developers to easily and quickly create next-generation

mobile and Web-based applications.

Workforce Solutions revenue performance was impacted by

the transition from on premise Notes to SaaS offerings. The com-

pany is working to transform this business and build recurring

revenue streams from the SaaS offerings.

Year-to-year revenue growth in Tivoli was driven by security

software which grew at double digit rates. As cybersecurity threats

are a key issue faced by all customers, these strong results were

driven in part by incremental requirements for security with the

expansion into cloud and mobile computing.

Operating systems revenue decline was primarily driven by

declines in Power Systems.

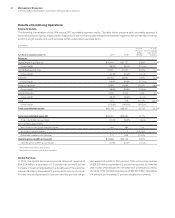

($ inmillions)

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent/

Margin

Change

Software

External gross profi t $22,533 $23,032 (2.2)%

External gross profi t margin 88.6% 88.8% (0.2 ) pts.

Pre-tax income $10,699 $11,106 (3.7)%

Pre-tax margin 37.0% 38.1% (1.2 ) pts.

Across software, the company continued to drive innovation and

capture growth areas, integrating analytics and security capabili-

ties that are needed to operate seamlessly in a hybrid environment.

For example, the company introduced several new offerings that