IBM 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

125

Committee. Awards that are given as part of annual total compen-

sation for senior management and other employees are made on

specific cycle dates scheduled in advance. With respect to awards

given in connection with promotions or new hires, the company’s

policy requires approval of such awards prior to the grant date,

which is typically the date of the promotion or the date of hire.

Stock Awards

Stock awards are made in the form of Restricted Stock Units

(RSUs), including Retention Restricted Stock Units (RRSUs), or

Performance Share Units (PSUs).

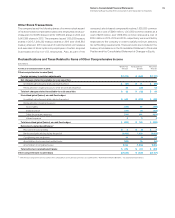

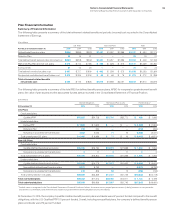

The tables below summarize RSU and PSU activity under the

Plans during the years ended December31, 2015, 2014 and 2013.

RSUs

2015 2014 2013

Weighted-

Average

Grant Price

Number

of Units

Weighted-

Average

Grant Price

Number

of Units

Weighted-

Average

Grant Price

Number

of Units

Balance at January1 $171 7,734,277 $166 8,635,317 $148 9,841,461

RSUs granted 143 4,230,186 172 2,525,947 189 2,541,081

RSUs released 164 (3,567,495) 157 (2,401,761) 131 (2,952,363)

RSUs canceled/forfeited 167 (869,627) 167 (1,025,226) 154 (794,862)

Balance at December 31 $159 7,527,341 $171 7,734,277 $166 8,635,317

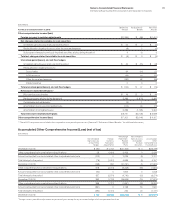

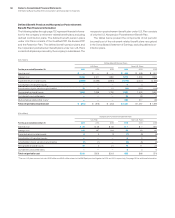

PSUs

2015 2014 2013

Weighted-

Average

Grant Price

Number

of Units

Weighted-

Average

Grant Price

Number

of Units

Weighted-

Average

Grant Price

Number

of Units

Balance at January1 $185 3,140,707 $178 2,824,294 $151 3,172,201

PSUs granted at target 153 1,137,242 180 1,430,098 195 869,875

Performance adjustments* 185 (168,055) 157 29,960 118 152,069

PSUs released 185 (840,552) 157 (1,027,181) 118 (1,321,784)

PSUs canceled/forfeited 184 (340,410) 187 (116,464) 170 (48,067)

Balance at December 31** $173 2,928,932 $185 3,140,707 $178 2,824,294

* Represents the change in shares issued to employees after vesting of PSUs because final performance metrics were above or below specified targets.

** Represents the number of shares expected to be issued based on achievement of grant date performance targets. The actual number of shares issued will depend on final

performance against specified targets over the vesting period.

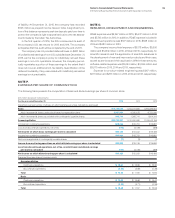

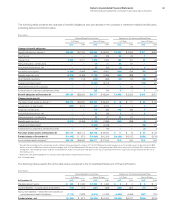

RSUs are stock awards granted to employees that entitle the

holder to shares of common stock as the award vests, typically

over a one- to five-year period. For RSUs, dividend equivalents

are not paid. The fair value of such RSUs is determined and fixed

on the grant date based on the company’s stock price adjusted

for the exclusion of dividend equivalents.

The remaining weighted-average contractual term of RSUs

at December31, 2015, 2014 and 2013 is the same as the period

over which the remaining cost of the awards will be recognized,

which is approximately three years. The fair value of RSUs granted

during the years ended December31, 2015, 2014 and 2013 was

$606million, $434million and $481million, respectively. The total

fair value of RSUs vested and released during the years ended

December31, 2015, 2014 and 2013 was $583million, $378mil-

lion and $386million, respectively. As of December31, 2015, 2014

and 2013, there was $800million, $754million and $871million,

respectively, of unrecognized compensation cost related to non-

vested RSUs. The company received no cash from employees

as a result of employee vesting and release of RSUs for the years

ended December31, 2015, 2014 and 2013.