IBM 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

104

Other Risks

The company may hold warrants to purchase shares of common

stock in connection with various investments that are deemed

derivatives because they contain net share or net cash settlement

provisions. The company records the changes in the fair value

of these warrants in other (income) and expense in the Consol-

idated Statement of Earnings. The company did not have any

warrants qualifying as derivatives outstanding at December31,

2015 and 2014.

The company is exposed to a potential loss if a client fails to pay

amounts due under contractual terms. The company may utilize

credit default swaps to economically hedge its credit exposures.

These derivatives have terms of one year or less. The swaps are

recorded at fair value with gains and losses reported in other

(income) and expense in the Consolidated Statement of Earnings.

The company did not have any derivative instruments relating to

this program outstanding at December31, 2015 and 2014.

The company is exposed to market volatility on certain invest-

ment securities. The company may utilize options or forwards

to economically hedge its market exposure. The derivatives are

recorded at fair value with gains and losses reported in other

(income) and expense in the Consolidated Statement of Earnings.

At December31, 2015 and 2014, the total notional amount of deriv-

ative instruments in economic hedges of investment securities was

less than $0.1billion for both periods.

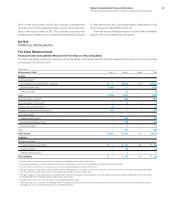

The following tables provide a quantitative summary of the

derivative and non-derivative instrument-related risk management

activity as of December31, 2015 and 2014, as well as for the years

ended December31, 2015, 2014 and 2013, respectively.

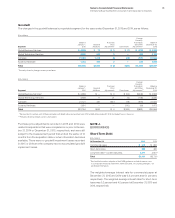

Fair Values of Derivative Instruments in the Consolidated Statement of Financial Position

($ inmillions)

Fair Value of Derivative Assets Fair Value of Derivative Liabilities

At December 31:

Balance Sheet

Classifi cation 2015 2014

Balance Sheet

Classifi cation 2015 2014

Designated as hedging instruments

Interest rate contracts

Prepaid expenses and

other current assets $ — $ 5

Other accrued

expenses and liabilities $ — $ 0

Investments and

sundry assets 656 628 Other liabilities 3—

Foreign exchange contracts

Prepaid expenses and

other current assets 197 632

Other accrued

expenses and liabilities 70 50

Investments and

sundry assets 517 Other liabilities 19 21

Fair value of

derivative assets $858 $1,281

Fair value of

derivative liabilities $ 92 $ 72

Not designated as hedging instruments

Foreign exchange contracts

Prepaid expenses and

other current assets $ 90 $ 90

Other accrued

expenses and liabilities $ 75 $ 101

Investments and

sundry assets 40 37 Other liabilities —4

Equity contracts

Prepaid expenses and

other current assets 624

Other accrued

expenses and liabilities 19 14

Investments and

sundry assets —0Other liabilities —5

Fair value of

derivative assets $136 $ 151

Fair value of

derivative liabilities $ 94 $ 125

Total debt designated as hedging instruments

Short-term debt N/A N/A $ — $ 0

Long-term debt N/A N/A $7,945 $7,747*

Total $994 $1,432 $8,131 $7,944 *

* Reclassified to reflect adoption of the FASB guidance on debt issuance costs in consolidated financial statements. Refer to noteB, “Accounting Changes,” for additional information.

N/A—Not applicable