IBM 2015 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

121

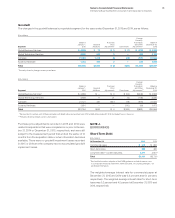

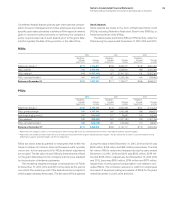

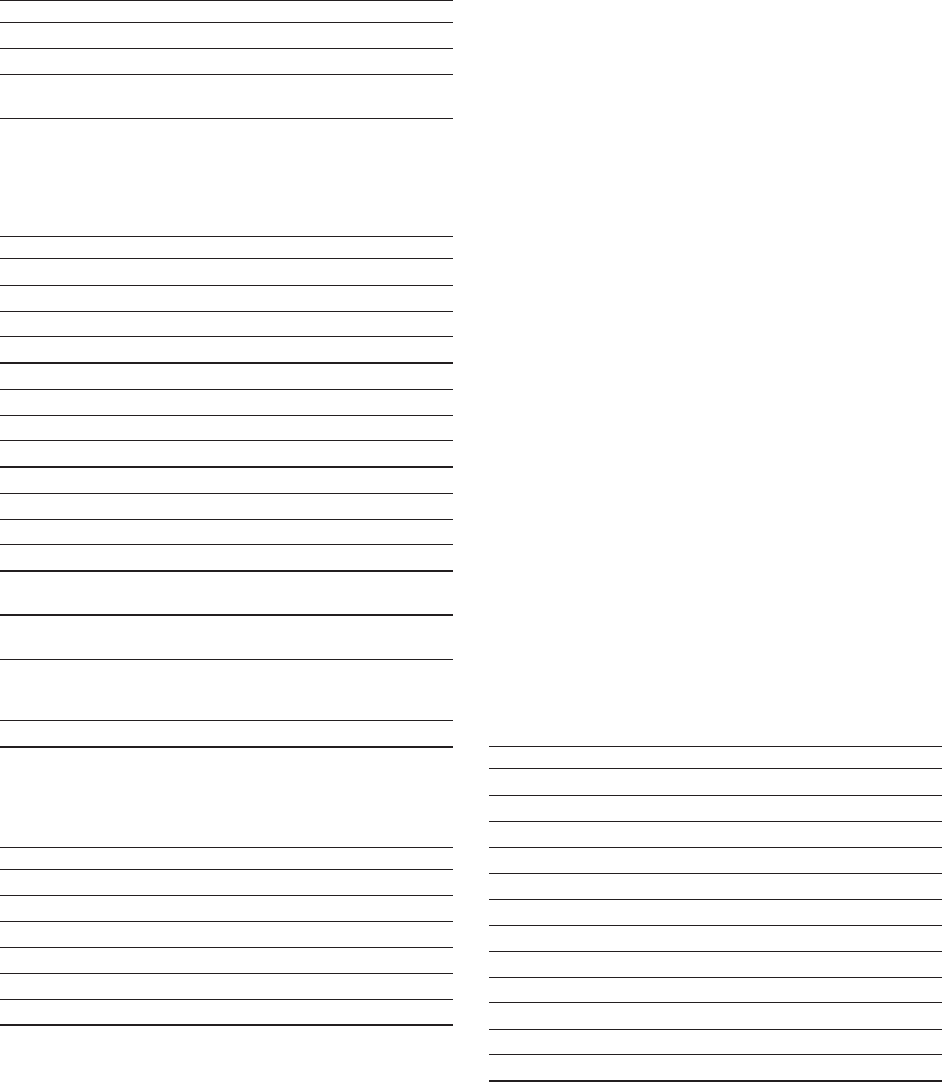

The income from continuing operations provision for income taxes

by geographic operations is as follows:

($ inmillions)

For the year ended December 31: 2015 2014 2013

U.S. operations $ 849 $2,093 $1,315

Non-U.S. operations 1,732 2,141 2,048

Total continuing operations

provision for income taxes $2,581 $4,234 $3,363

The components of the income from continuing operations provi-

sion for income taxes by taxing jurisdiction are as follows:

($ inmillions)

For the year ended December 31: 2015 2014 2013

U.S. federal

Current $ (321) $ 1,134 $1,694

Deferred 553 105 (708)

232 1,239 986

U.S. state and local

Current 128 541 277

Deferred 116 (105) (330)

244 436 (53)

Non-U.S.

Current 2,101 2,825 3,067

Deferred 4(266) (637)

2,105 2,559 2,430

Total continuing operations

provision for income taxes 2,581 4,234 3,363

Discontinued operations

provision for income taxes (117) (1,617) (322)

Provision for social security,

real estate, personal property

and other taxes 3,497 4,068 4,198

Total taxes included in net income $5,961 $ 6,685 $7,238

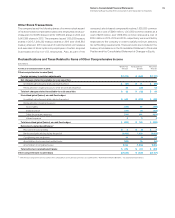

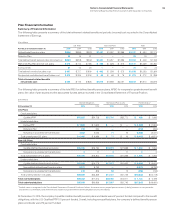

A reconciliation of the statutory U.S. federal tax rate to the com-

pany’s effective tax rate from continuing operations is as follows:

For the year ended December 31: 2015 2014 2013

Statutory rate 35% 35% 35%

Foreign tax differential (17) (14) (13)

State and local 110

Domestic incentives (2) (2) (3)

Other (1) 1 (2)

Effective rate 16% 21% 17%

Percentages rounded for disclosure purposes.

The significant components reflected within the tax rate reconcili-

ation labeled “Foreign tax differential” include the effects of foreign

subsidiaries’ earnings taxed at rates other than the U.S. statutory

rate, foreign export incentives, the U.S. tax impacts of non-U.S.

earnings repatriation and any net impacts of intercompany trans-

actions. These items also reflect audit settlements or changes in

the amount of unrecognized tax benefits associated with each of

these items.

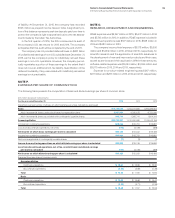

In the fourth quarter of 2015, the U.S. Internal Revenue Ser-

vice (IRS) concluded its examination of the company’s income

tax returns for 2011 and 2012 and issued a final Revenue Agent’s

Report (RAR). The company has agreed with all of the adjustments

in the RAR with the exception of the proposed adjustments related

to the tax implications of an internal restructuring undertaken in

2011. The company disagrees with the IRS on this matter and

intends to protest the proposed adjustments. The company has

redetermined its unrecognized tax benefits for all open years,

based on the RAR and associated information and analysis.

The 2015 continuing operations effective tax rate decreased

5.0points from 2014 as a result of: the completion of the 2011–2012

U.S. tax audit, including reserve redeterminations (3.9points),

a benefit due to the geographic mix of pre-tax income in 2015

(3.5points) and a benefit due to the 2014 tax charge related to the

divestiture of the Systemx business (0.9points).

These decreases were partially offset due to the following: a

reduced benefit year to year in the utilization of foreign tax credits

(2.5points) and the year-to-year increase in tax charges related

to intercompany payments made by foreign subsidiaries and the

intercompany licensing of certain IP (0.8points).

The effect of tax law changes on deferred tax assets and lia-

bilities did not have a material impact on the company’s effective

tax rate.

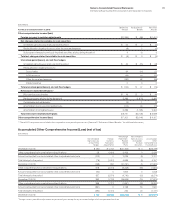

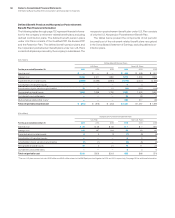

The significant components of deferred tax assets and liabilities

recorded in the Consolidated Statement of Financial Position were:

Deferred Tax Assets

($ inmillions)

At December 31: 2015 2014

Retirement benefi ts $ 4,621 $ 4,795

Share-based and other compensation 963 1,328

Domestic tax loss/credit carryforwards 1,066 858

Deferred income 762 957

Foreign tax loss/credit carryforwards 825 686

Bad debt, inventory and warranty reserves 528 529

Depreciation 329 329

Accruals 904 1,176

Other 931 1,306

Gross deferred tax assets 10,929 11,964

Less: valuation allowance 740 646

Net deferred tax assets $10,189 $11,318