IBM 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

123

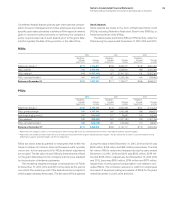

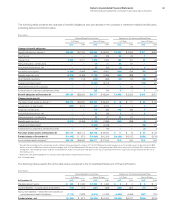

of liability. At December31, 2015, the company has recorded

$526million as prepaid income taxes in India. A significant por-

tion of this balance represents cash tax deposits paid over time to

protect the company’s right to appeal various income tax assess-

ments made by the Indian Tax Authorities.

In the first quarter of 2016, the IRS commenced its audit of

the company’s U.S. tax returns for 2013 and 2014. The company

anticipates that this audit will be completed by the end of 2017.

The company has not provided deferred taxes on $68.1billion

of undistributed earnings of non-U.S. subsidiaries at December31,

2015, as it is the company’s policy to indefinitely reinvest these

earnings in non-U.S. operations. However, the company period-

ically repatriates a portion of these earnings to the extent that it

does not incur an additional U.S. tax liability. Quantification of the

deferred tax liability, if any, associated with indefinitely reinvested

earnings is not practicable.

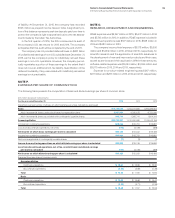

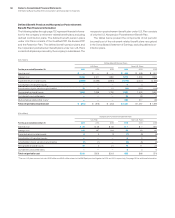

NOTEO.

RESEARCH, DEVELOPMENT AND ENGINEERING

RD&E expense was $5,247 million in 2015, $5,437 million in 2014

and $5,743 million in 2013. In addition, RD&E expense included in

discontinued operations was $197million in 2015, $368million in

2014 and $483million in 2013.

The company incurred total expense of $5,178 million, $5,595

million and $5,959 million in 2015, 2014 and 2013, respectively, for

scientific research and the application of scientific advances to

the development of new and improved products and their uses,

as well as services and their application. Within these amounts,

software-related expense was $3,064 million, $3,064 million and

$3,077 million in 2015, 2014 and 2013, respectively.

Expense for product-related engineering was $267million,

$211million and $267million in 2015, 2014 and 2013, respectively.

NOTEP.

EARNINGS PER SHARE OF COMMON STOCK

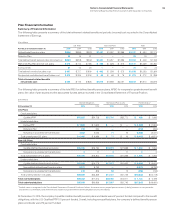

The following table presents the computation of basic and diluted earnings per share of common stock.

($ inmillions except per share amounts)

For the year ended December 31: 2015 2014 2013

Weighted-average number of shares on which earnings per share calculations are based

Basic 978,744,523 1,004,272,584 1,094,486,604

Add—incremental shares under stock-based compensation plans 3,037,001 4,332,155 6,751,240

Add—incremental shares associated with contingently issuable shares 918,744 1,395,741 1,804,313

Assuming dilution 982,700,267 1,010,000,480 1,103,042,156

Income from continuing operations $13,364 $15,751 $16,881

Loss from discontinued operations, net of tax (174) (3,729) (398)

Net income on which basic earnings per share is calculated $13,190 $12,022 $16,483

Income from continuing operations $13,364 $15,751 $16,881

Net income applicable to contingently issuable shares (1) (3) (1)

Income from continuing operations on which diluted earnings per share is calculated $13,363 $15,749 $16,880

Loss from discontinued operations, net of tax, on which basic and diluted earnings

per share is calculated (174) (3,729 ) (398 )

Net income on which diluted earnings per share is calculated $13,189 $12,020 $16,483

Earnings/(loss) per share of common stock

Assuming dilution

Continuing operations $ 13.60 $ 15.59 $ 15.30

Discontinued operations (0.18) (3.69) (0.36)

Total $ 13.42 $ 11.90 $ 14.94

Basic

Continuing operations $ 13.66 $ 15.68 $ 15.42

Discontinued operations (0.18) (3.71) (0.36)

Total $ 13.48 $ 11.97 $ 15.06