IBM 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22 Management Discussion

International Business Machines Corporation and Subsidiary Companies

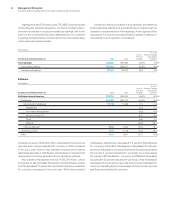

At December31, 2015, the company continued to have the

financial flexibility to support the business over the long term. Cash

and marketable securities at year end was $8.2billion, a decrease

of $0.3billion from December31, 2014. Key drivers in the balance

sheet and total cash flows were:

Total assets decreased $6.8billion ($0.3billion adjusted for

currency) from December31, 2014 driven by:

• Decreases in total receivables ($4.4billion), deferred taxes

($1.9billion) and prepaid expenses and sundry assets

($1.1billion); partially offset by

• Increased goodwill ($1.5billion).

Total liabilities decreased $9.2billion ($4.7billion adjusted for cur-

rency) from December31, 2014 driven by:

• Decreases in other liabilities ($2.3billion), taxes ($2.2billion),

retirement-related liabilities ($1.8billion), deferred income

($0.8billion), total debt ($0.8billion) and accounts payable

($0.8billion).

Total equity of $14.4billion increased $2.4billion from Decem-

ber31, 2014 as a result of:

• Higher retained earnings ($8.3billion) and higher common

stock ($0.6billion); partially offset by

• Increased treasury stock ($4.8billion) and increased

accumulated other comprehensive losses ($1.7billion).

The company generated $17.0billion in cash flow provided by

operating activities, an increase of $0.1billion when compared to

2014, driven primarily by lower income tax payments, offset by

net income performance. Net cash used in investing activities of

$8.2billion was $5.2billion higher than 2014, primarily driven by a

decrease in cash provided from divestitures ($2.8billion) and an

increase in net cash used for acquisitions ($2.7billion). Net cash

used in financing activities of $9.2billion decreased $6.3billion

compared to the prior year, driven primarily by a decrease in cash

used for gross common stock repurchases ($9.1billion), partially

offset by lower net debt issuances ($1.8billion) and higher dividend

payments ($0.6billion).

The 2015 results are a reflection of the continuing transition in

the company’s business as it addresses the significant shifts in the

industry, as well as some of the cyclical challenges of the global

business environment. This transformation is taking place over

the longer term. In 2015, the company strengthened its existing

portfolio while investing aggressively in new opportunities such

as Watson Health, Watson Internet of Things and IBM Cloud. In

January 2016, the company disclosed that it is expecting GAAP

earnings of at least $12.45 and operating (non-GAAP) earnings of

at least $13.50 per diluted share for 2016.

DESCRIPTION OF BUSINESS

Please refer to IBM’s Annual Report on Form 10-K filed with

the SEC on February23, 2016 for a more detailed version

of this Des cription of Business, especially Item 1A. entitled

“Risk Factors.”

The company creates value for clients through integrated solu-

tions and products that leverage: data, information technology,

deep expertise in industries and business processes, and a

broad ecosystem of partners and alliances. IBM solutions typi-

cally create value by enabling new capabilities for clients that

transform their businesses and help them engage with their cus-

tomers and employees in new ways. These solutions draw from

an industry-leading portfolio of consulting and IT implementation

services, cloud and cognitive offerings, and enterprise systems

and software; all bolstered by one of the world’s leading research

organizations.

Strategy

IBM has transformed throughout its 100+ year history, and in its

current transformation, IBM is leading a reordering of the tech-

nology industry.

In 2014, the company’s strategic imperatives were declared

around the three main forces behind “digital”: big data and ana-

lytics, cloud and engagement. Since 2010, IBM has invested

approximately $30 billion in these areas, built out the IBM Cloud

on a global scale, established the Watson Group, announced 50

acquisitions and entered into major partnerships, including the

landmark alliance with Apple to bring mobile to the enterprise.

As IBM’s clients transform, “digital” itself is not the destina-

tion, but a foundation to create a truly Cognitive Enterprise. This is

resulting in new types of interactions between people, organiza-

tions and machines.

Through these developments, IBM is emerging as more than

a hardware, software and services company; IBM is transforming

into a cognitive solutions and cloud platform company. Key tenets

of the company’s highly differentiated strategy include:

Cognitive Solutions: Cognitive, advanced analytics and key data

are being integrated into all leading solutions.

Cloud Platform: New solutions will be built on the IBM Cloud and

the company’s offerings will be cloud-enabled. The company is

continuing to build the premier cloud stack, developer environment

and most secure hybrid cloud platform in the industry.

Industry Focus: Because industry context is so important to the

value of IBM’s solutions, these solutions will be built for the needs

of individual industries and professions.