IBM 2015 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

133

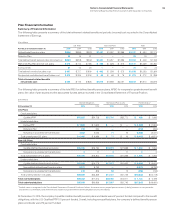

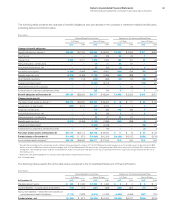

Assumptions Used to Determine Plan Financial Information

Underlying both the measurement of benefit obligations and net

periodic (income)/cost are actuarial valuations. These valuations

use participant-specific information such as salary, age and years

of service, as well as certain assumptions, the most significant of

which include estimates of discount rates, expected return on plan

assets, rate of compensation increases, interest crediting rates and

mortality rates. The company evaluates these assumptions, at a

minimum, annually, and makes changes as necessary.

The table below presents the assumptions used to measure

the net periodic (income)/cost and the year-end benefit obligations

for retirement-related benefit plans.

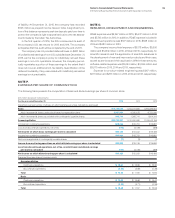

Defi ned Benefi t Pension Plans

U.S. Plans Non-U.S. Plans

2015 2014 2013 2015 2014 2013

Weighted-average assumptions used to measure net

periodic (income)/cost for the year ended December 31

Discount rate 3.70% 4.50% 3.60% 2.34% 3.32% 3.23%

Expected long-term returns on plan assets 7.50% 8.00% 8.00% 5.67% 6.08% 6.21%

Rate of compensation increase N/A N/A N/A 2.49% 2.52% 2.51%

Weighted-average assumptions used to measure

benefi t obligations at December 31

Discount rate 4.00% 3.70% 4.50% 2.40% 2.34% 3.32%

Rate of compensation increase N/A N/A N/A 2.40% 2.49% 2.52%

N/A—Not applicable

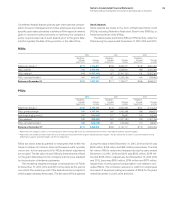

Nonpension Postretirement Benefi t Plans

U.S. Plan Non-U.S. Plans

2015 2014 2013 2015 2014 2013

Weighted-average assumptions used to measure net

periodic cost for the year ended December 31

Discount rate 3.40% 4.10% 3.30% 7.51% 7.78% 6.43%

Expected long-term returns on plan assets N/A N/A 0.35% 10.17% 10.22% 9.01%

Weighted-average assumptions used to measure

benefi t obligations at December 31

Discount rate 3.70% 3.40% 4.10% 7.06% 7.51% 7.78%

N/A—Not applicable

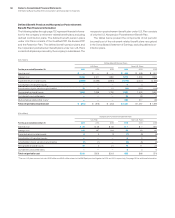

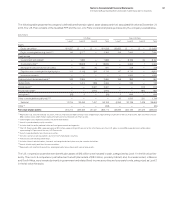

Discount Rate

The discount rate assumptions used for retirement-related ben-

efit plans accounting reflect the yields available on high-quality,

fixed-income debt instruments at the measurement date. For

the U.S. and certain non-U.S. countries, a portfolio of high-qual-

ity corporate bonds is used to construct a yield curve. The cash

flows from the company’s expected benefit obligation payments

are then matched to the yield curve to derive the discount rates.

In other non-U.S. countries, where the markets for high-quality

long-term bonds are not generally as well developed, a portfo-

lio of long-term government bonds is used as a base, to which a

credit spread is added to simulate corporate bond yields at these

maturities in the jurisdiction of each plan, as the benchmark for

developing the respective discount rates.