IBM 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 Management Discussion

International Business Machines Corporation and Subsidiary Companies

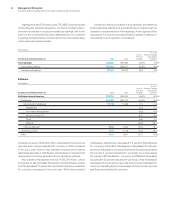

Signings include GTS Outsourcing, ITS, GBS Outsourcing and

Consulting and Systems Integration contracts. Contract exten-

sions and increases in scope are treated as signings only to the

extent of the incremental new value. Maintenance is not included

in signings as maintenance contracts tend to be more steady state,

where revenues equal renewals.

Contract portfolios purchased in an acquisition are treated as

positive backlog adjustments provided those contracts meet the

company’s requirements for initial signings. A new signing will be

recognized if a new services agreement is signed incidental or

coincidental to an acquisition or divestiture.

($ inmillions)

For the year ended December 31: 2015 2014

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Total sign ings $48,243 $51,569 (6.5)% 2.8%

Outsourcing signings $25,196 $26,517 (5.0)% 4.9%

Transactional signings 23,046 25,052 (8.0) 0.5

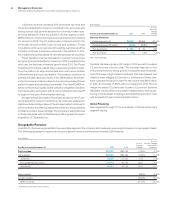

Software

($ inmillions)

For the year ended December 31: 2015 2014

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Software external revenue $22,932 $25,434 (9.8)% (3.5)%

Middleware $19,473 $21,474 (9.3)% (3.0)%

Key branded middleware 15,778 17,098 (7.7) (1.5)

WebSphere (5.3) 0.2

Information Management (8.0) (1.6)

Workforce Solutions (8.1) (0.6)

Tivoli (6.3) 0.1

Rational (20.3) (15.1)

Other middleware 3,695 4,376 (15.6) (8.7)

Operating systems 1,815 2,119 (14.3) (8.1)

Other 1,644 1,841 (10.7) (4.9)

Software revenue of $22,932million decreased 9.8percent as

reported and 4percent adjusted for currency in 2015 compared

to the prior year. Year-to-year software revenue performance

reflected a decrease in middleware with declines in transactional

revenue and a continuing headwind from operating systems.

Key branded middleware revenue of $15,778 million, which

accounted for approximately 69percent of total software revenue

in 2015, decreased 7.7percent as reported and 2percent adjusted

for currency compared to the prior year. Within key branded

middleware, WebSphere decreased 5.3percent (flat adjusted

for currency), Information Management decreased 8.0percent

(2percent adjusted for currency), Workforce Solutions decreased

8.1percent (1percent adjusted for currency), Tivoli decreased

6.3percent (flat adjusted for currency), and Rational decreased

20.3percent (15percent adjusted for currency). Other middleware

decreased 15.6percent as reported and 9percent adjusted for

currency. Operating systems decreased 14.3percent as reported

and 8percent adjusted for currency.