IBM 2015 Annual Report Download - page 48

Download and view the complete annual report

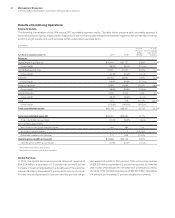

Please find page 48 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46 Management Discussion

International Business Machines Corporation and Subsidiary Companies

adjusted for currency) and Rational decreased 31.6percent

(28percent adjusted for currency). Other middleware decreased

14.0percent as reported and 9percent adjusted for currency.

Operating systems decreased 12.2percent as reported and

7percent adjusted for currency.

While the transactional performance in the quarter was

consistent with the third quarter of the year; the fourth quarter

has a higher transactional mix. This had a larger impact on total

software performance resulting in a deceleration in the software

performance in the fourth quarter. Many large clients with multi-

year contracts continue to utilize the flexibility on deployment of

their software as they build out their environments with the com-

pany’s broad portfolio. Outside the company’s top 250clients,

software revenue increased low single digits adjusted for currency

in the quarter.

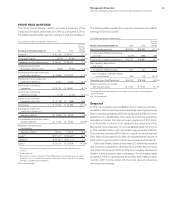

The Software gross profit margin decreased 2.0points to

88.0percent in the fourth quarter of 2015 compared to the prior

year. Software pre-tax income of $2,959 million in the fourth quar-

ter decreased 21.4percent, with a pre-tax margin of 39.4percent,

a decrease of 5.3points. Profit performance in Software con-

tinues to reflect the overall revenue trajectory, a higher level of

investments in areas like Watson, Watson Health, Watson IoT and

Bluemix, and an impact from currency translation.

Systems Hardware

In the fourth quarter of 2015, Systems Hardware revenue of $2,372

million decreased 1.4percent as reported but grew 3percent

adjusted for currency compared to the prior year period. This

was the fourth consecutive quarter of growth in both zSystems

and Power Systems, adjusted for currency. zSystems revenue

increased 15.6percent as reported and 21percent adjusted for

currency. MIPS shipments increased 28percent year to year. Since

the launch of z13 in the first quarter of 2015, there has been strong

double-digit revenue growth on an adjusted basis in every quar-

ter of the year. Power Systems revenue increased 3.8percent as

reported and 8percent adjusted for currency in the fourth quar-

ter compared to the prior year. This was the strongest quarterly

performance during 2015. In Power, the company continues to

serve a high-value market while adding capabilities and finding

new economic models to grow over time. However, in the fourth

quarter the strong growth in servers was mitigated by a year-to-

year decline in Storage. Storage revenue decreased 11.2percent

as reported and 7percent adjusted for currency and continued to

be impacted by weakness in traditional disk and tape.

The Systems Hardware gross profit margin of 48.0percent

decreased 1.6points in the fourth quarter of 2015 compared to

the prior year. The decrease was due to margin (4.3points) driven

by zSystems, partially offset by a more favorable product mix.

Systems Hardware pre-tax income of $349million in the fourth

quarter decreased 10.1percent year to year with a pre-tax margin

of 13.9percent, down 1.5points year to year.

Global Financing

Global Financing Revenue of $454million was down 14.6per-

cent as reported and 6percent adjusted for currency due to

decreases in financing revenue and used equipment sales reve-

nue. The Global Financing fourth quarter pre-tax income increased

28.3percent to $674million and the pre-tax margin increased

8.5points to 55.4percent. The increase in pre-tax income was

driven by an increase in gross profit ($97million) and decreases in

financing receivable provisions ($41million) and SG&A expenses

($11million).

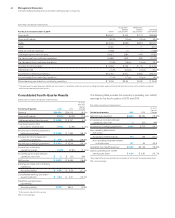

Geographic Revenue

Total geographic revenue of $21,988 million decreased 8.3per-

cent as reported and 2percent adjusted for currency in the fourth

quarter of 2015 compared to the prior year. Major market countries

decreased 6.9percent as reported and 2percent adjusted for

currency. Adjusted for currency, Europe returned to growth, led by

continued growth in Germany, France and the UK. In Asia Pacific,

Japan continued to grow year to year, adjusted for currency. U.S.

revenue was down in the fourth quarter compared to the prior

year. Overall, growth market countries decreased 13.6percent as

reported and 4percent adjusted for currency, relatively consistent

with the previous two quarters. From a regional perspective, on an

adjusted basis, growth in Latin America and the Middle East and

Africa region was more than offset by declines in the Asia Pacific

growth market countries.

Americas revenue of $10,251 million decreased 7.6percent as

reported and 4percent adjusted for currency compared to the

fourth quarter of 2014 with a decline in North America and growth

in Latin America on an adjusted basis. The U.S. decreased 5.5per-

cent year to year. Although there was strong growth in the U.S. in

Systems Hardware, it was offset by weak services and transac-

tional software performance. Canada was down 14.6percent as

reported and was flat adjusted for currency. In Latin America, on

an adjusted basis, there was growth across a number of the larger

countries including Brazil, Mexico, Argentina, and Colombia.