IBM 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

96

The overall weighted-average life of the identified amortizable

intangible assets acquired is 6.8years. These identified intan-

gible assets will be amortized on a straight-line basis over their

useful lives. Goodwill of $442million was assigned to the Software

($430million) and GTS ($11million) segments. It was expected

that approximately 1percent of the goodwill will be deductible

for tax purposes. All acquisitions were for 100percent of the

acquired companies.

2013

In 2013, the company completed 10 acquisitions at an aggregate

cost of $3,219 million.

SoftLayer Technologies, Inc. (SoftLayer)—On July3, 2013, the

company completed the acquisition of 100percent of the pri-

vately held company, SoftLayer, a cloud computing infrastructure

provider based in Dallas, Texas for cash consideration of $1,977

million. SoftLayer joined the company’s Cloud business unit, which

combined SoftLayer with IBM SmartCloud into a global platform.

Goodwill of $1,285 million was assigned to the Global Technology

Services ($1,246 million) and Software ($39million) segments. At

the acquisition date, it was expected that none of the goodwill

would be deductible for tax purposes. The overall weighted-av-

erage useful life of the identified intangible assets acquired is

7.0years.

Other Acquisitions—The Software segment completed acqui-

sitions of eight privately held companies: in the first quarter,

StoredIQ Inc. (StoredIQ) and Star Analytics, Inc. (Star Analytics);

in the second quarter, UrbanCode Inc. (UrbanCode); in the third

quarter, Trusteer, Ltd. (Trusteer) and Daeja Image Systems, Ltd.

(Daeja); and in the fourth quarter, Xtify, Inc. (Xtify), The Now Fac-

tory and Fiberlink Communications (Fiberlink). Systems Hardware

completed one acquisition in the third quarter, CSL International

(CSL), a privately held company. All acquisitions in 2013 were for

100percent of the acquired companies.

The acquisition of StoredIQ advances the company’s efforts

to help clients derive value from big data. The combination of the

company’s and Star Analytics’ software advances the company’s

business analytics initiatives. UrbanCode automates the deliv-

ery of software, helping businesses quickly release and update

mobile, social, big data and cloud applications. CSL deepens

the consolidation cloud capabilities by offering simplified man-

agement of the virtualization environment. Trusteer extends the

company’s data security capabilities further into the cloud, mobile

and endpoint security space. Daeja delivers software that helps

employees across all industries, especially data intensive ones

such as banking, insurance and healthcare, get faster access to

critical business information, and complements the company’s

big data capabilities. Xtify is a leading provider of cloud-based

mobile messaging tools that help organizations improve mobile

sales, drive in-store traffic and engage customers with personal-

ized offers. The Now Factory is a provider of analytics software that

helps communications service providers (CSPs) deliver better cus-

tomer experiences and drive new revenue opportunities. Fiberlink

is a mobile management and security company, that supports the

company’s expanding vision for enterprise mobility management,

which encompasses secure transactions between businesses,

partners, and customers.

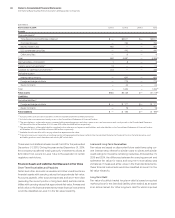

The following table reflects the purchase price related to these acquisitions and the resulting purchase price allocations as of Decem-

ber31, 2013.

2013 Acquisitions

($ inmillions)

Amortization

Life (in Years) SoftLayer

Other

Acquisitions

Current assets $ 80 $ 97

Fixed assets/noncurrent assets 300 41

Intangible assets

Goodwill N/A 1,285 961

Completed technology 5–7 290 181

Client relationships 6–7 245 97

In-process R&D N/A 2 —

Patents/trademarks 2–7 75 32

Total assets acquired 2,277 1,408

Current liabilities (56) (61)

Noncurrent liabilities (244) (105)

Total liabilities assumed (300) (166)

Total purchase price $1,977 $1,242

N/A—Not applicable