IBM 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 Management Discussion

International Business Machines Corporation and Subsidiary Companies

In 2015, total pre-tax retirement-related plan cost increased by

$598million compared to 2014, primarily driven by an increase in

recognized actuarial losses ($816million), lower expected return

on plan assets ($472million) and higher pension obligations related

to litigation in Spain ($85million), partially offset by lower inter-

est cost ($678million) and lower defined contribution plans cost

($115million).

As discussed in the “Operating (non-GAAP) Earnings” section

on pages18 and 19, the company characterizes certain retire-

ment-related costs as operating and others as non-operating.

Utilizing this characterization, operating retirement-related costs

in 2015 were $1,522 million, a decrease of $99million compared

to 2014, primarily driven by lower defined contribution plans cost

($115million). Non-operating costs of $1,050 million increased

$696million in 2015 compared to the prior year, driven primarily

by an increase in recognized actuarial losses ($816million), lower

expected return on plan assets ($472million), higher pension obli-

gations related to litigation in Spain ($85million), partially offset by

lower interest cost ($678million).

Income Taxes

The continuing operations effective tax rate for 2015 was 16.2per-

cent, a decrease of 5.0points versus the prior year, driven by the

following factors:

• The benefit resulting from the completion of the U.S. 2011–2012

tax audit, including the associated reserve redeterminations

(3.9points); and

• A benefit due to the geographic mix of pre-tax income in

2015 (3.5points); and

• A benefit due to the 2014 tax charge related to the divestiture

of the Systemx business (0.9points); partially offset by

• A reduced benefit year to year in the utilization of foreign tax

credits (2.5points); and

• The year-to-year increase in tax charges related to

intercompany payments made by foreign subsidiaries and

the intercompany licensing of certain IP (0.8points).

The continuing operations operating (non-GAAP) effective tax rate

was 17.2percent, a decrease of 3.8points versus 2014 principally

driven by the same factors described above.

Earnings Per Share

Basic earnings per share is computed on the basis of the weight-

ed-average number of shares of common stock outstanding

during the period. Diluted earnings per share is computed on the

basis of the weighted-average number of shares of common stock

outstanding plus the effect of dilutive potential common shares

outstanding during the period using the treasury stock method.

Dilutive potential common shares include outstanding stock

options and stock awards.

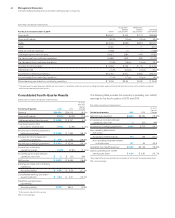

For the year ended December 31: 2015 2014

Yr.-to-Yr.

Percent

Change

Earnings per share of common stock

from continuing operations

Assuming dilution $13.60 $15.59 (12.8)%

Basic $13.66 $15.68 (12.9)%

Diluted operating (non-GAAP) $14.92 $16.53 (9.7)%

Weighted-average shares

outstanding (in millions)

Assuming dilution 982.7 1,010.0 (2.7)%

Basic 978.7 1,004.3 (2.5)%

Actual shares outstanding at December31, 2015 and 2014 were

965.7million and 990.5million, respectively. The average number

of common shares outstanding assuming dilution was 27.3million

shares lower in 2015 versus 2014. The decrease was primarily the

result of the common stock repurchase program.

Results of Discontinued Operations

The loss from discontinued operations, net of tax, was $0.2billion

in 2015 and $3.7billion in 2014. The loss from discontinued opera-

tions in 2014 included a nonrecurring pre-tax charge of $4.7billion,

or $3.4billion, net of tax, which included an impairment to reflect

the fair value less estimated costs to sell the Microelectronics

business and other estimated costs related to the transaction,

including cash consideration. The discontinued operations effec-

tive tax rate in 2015 was 40.3percent compared to 30.2percent

in 2014.