IBM 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

132

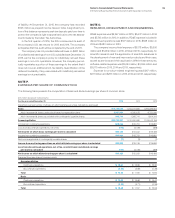

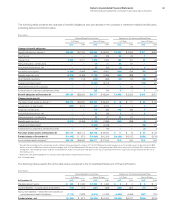

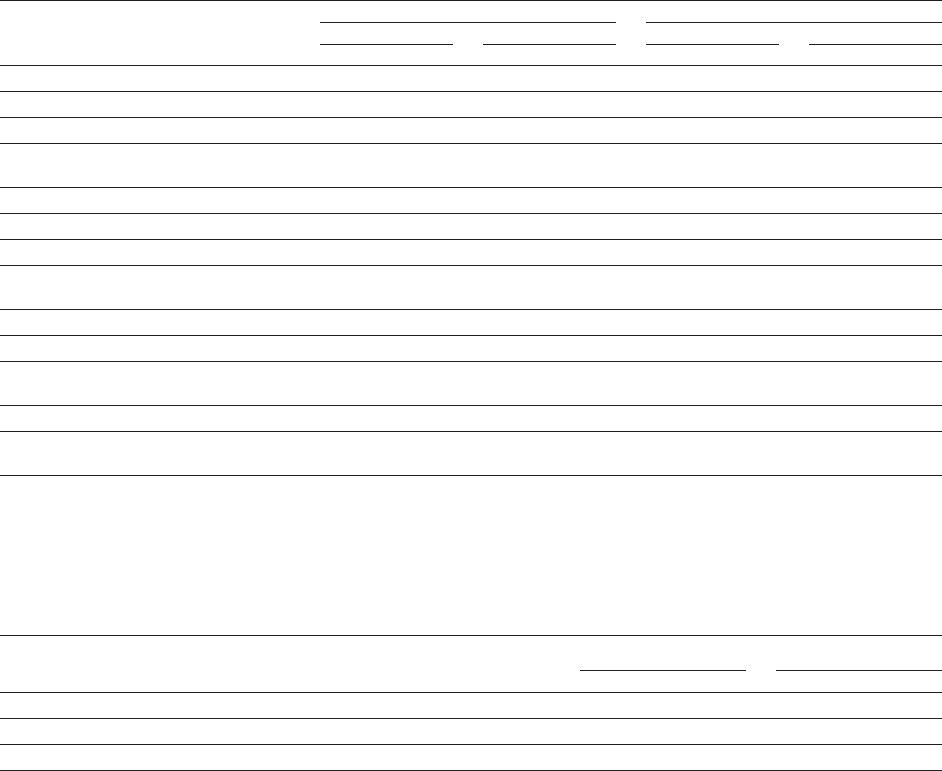

The following table presents the pre-tax net loss and prior service costs/(credits) and transition (assets)/liabilities recognized in OCI and

the changes in the pre-tax net loss, prior service costs/(credits) and transition (assets)/liabilities recognized in AOCI for the retirement-

related benefit plans.

($ inmillions)

Defi ned Benefi t Pension Plans Nonpension Postretirement Benefi t Plans

U.S. Plans Non-U.S. Plans U.S. Plan Non-U.S. Plans

2015 2014 2015 2014 2015 2014 2015 2014

Net loss at January 1 $18,442 $13,709 $21,676 $19,777 $ 852 $304 $189 $161

Current period loss/(gain) 2,576 5,789 661 3,324 (204) 548 (51) 38

Curtailments and settlements ——(33) (25) ——01

Amortization of net loss included

in net periodic (income)/cost (1,654) (1,056) (1,581) (1,400) (39) 0(10) (11)

Net loss at December 31 $19,363 $18,442 $20,724 $21,676 $ 609 $852 $128 $189

Prior service costs/(credits) at January 1 $ 110 $ 120 $ (386) $ (496)$ 23 $ 15 $ (26) $ (32)

Current period prior service costs/(credits) ——(6) (1)——00

Amortization of prior service (costs)/credits

included in net periodic (income)/cost (10) (10)98 111 7755

Prior service costs/(credits) at December 31 $ 101 $ 110 $ (294) $ (386) $ 30 $ 23 $ (21) $ (26)

Transition (assets)/liabilities at January 1 $ — $ — $ 0 $ 0 $ — $ — $ 0 $ 0

Amortization of transition assets/(liabilities)

included in net periodic (income)/cost ——00——00

Transition (assets)/liabilities at December 31 $ — $ — $ 0 $ 0 $ — $ — $ 0 $ 0

Total loss recognized in accumulated other

comprehensive income/(loss)*$19,464 $18,552 $20,429 $21,290 $ 639 $875 $106 $163

* See noteL, “Equity Activity,” for the total change in AOCI, and the Consolidated Statement of Comprehensive Income for the components of net periodic (income)/cost, including

the related tax effects, recognized in OCI for the retirement-related benefit plans.

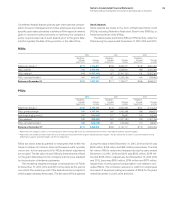

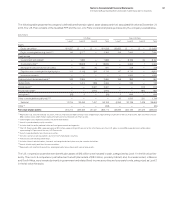

The following table presents the pre-tax estimated net loss, estimated prior service costs/(credits) and estimated transition (assets)/

liabilities of the retirement-related benefit plans that will be amortized from AOCI into net periodic (income)/cost in 2016.

($ inmillions)

Defi ned Benefi t

Pension Plans

Nonpension Postretirement

Benefi t Plans

U.S. Plans Non-U.S. Plans U.S. Plan Non-U.S. Plans

Net loss $1,331 $1,361 $19 $8

Prior service costs/(credits) 10 (96) (7) (4)

Transition (assets)/liabilities ————

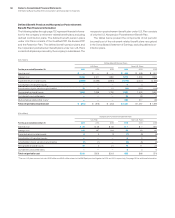

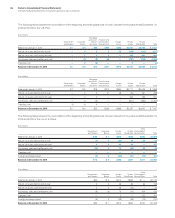

On March24, 2014, the Supreme Court of Spain issued a ruling

against IBM Spain in litigation involving its defined benefit and

defined contribution plans. As a result of the ruling, the company

recorded pre-tax retirement-related obligations of $233million in

2015 and $148million in 2014 in selling, general and administrative

expense in the Consolidated Statement of Earnings. These obliga-

tions are reflected in “Non-U.S. Plans—Multi-employer plans/other

costs” in the table on page130. See noteM, “Contingencies and

Commitments,” on page119 for additional information regarding

pension plan litigation matters.