IBM 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

94

cross-reference medical images against billions of data points

already in the Watson Health Cloud. Goodwill of $695million has

been assigned to the Software segment. At the acquisition date, it

was expected that none of the goodwill would be deductible for tax

purposes. The overall weighted-average useful life of the identified

intangible assets acquired is 7.0years.

Cleversafe, Inc. (Cleversafe)—On November6, 2015, the company

completed the acquisition of 100percent of Cleversafe, a privately

held company, for cash consideration of $1,309 million. Cleversafe

is a leading developer and manufacturer of object-based storage

software and appliances. Cleversafe will be integrated into the

company’s Cloud business to give clients strategic data flexibility,

simplified management and consistency with on-premise, cloud

and hybrid cloud deployment options. Goodwill of $1,000 million

has been assigned to the Global Technology Services ($590mil-

lion) and Systems Hardware ($410million) segments. At the

acquisition date, it was expected that none of the goodwill would

be deductible for tax purposes. The overall weighted-average

useful life of the identified intangible assets acquired is 6.9years.

Other Acquisitions—The Software segment completed acqui-

sitions of eight privately held businesses: in the first quarter,

AlchemyAPI, Inc. (AlchemyAPI) and Blekko, Inc. (Blekko); in the

second quarter, Explorys, Inc. (Explorys) and Phytel, Inc. (Phytel); in

the third quarter, Compose, Inc. (Compose) and StrongLoop, Inc.

(StrongLoop); and in the fourth quarter, Clearleap, Inc. (Clearleap)

and IRIS Analytics. Global Technology Services (GTS) completed

acquisitions of two privately held businesses: in the second

quarter, Blue Box Group, Inc. (Blue Box); and in the fourth quarter,

Gravitant, Inc. (Gravitant). Global Business Services (GBS) com-

pleted acquisitions of two privately held businesses in the fourth

quarter, Advanced Application Corporation (AAC) and Meteorix,

LLC. (Meteorix).

Each acquisition is expected to enhance the company’s port-

folio of product and services capabilities. AlchemyAPI is a leading

provider of scalable cognitive computing application program

interface services and computing applications. Blekko technology

provides advanced Web-crawling, categorization and intelligent

filtering. Explorys provides secure cloud-based solutions for

clinical integration, at-risk population management, cost of care

measurement and pay-for-performance. Phytel is a leading pro-

vider of SaaS-based population health management offerings that

help providers identify patients at risk for care gaps and engage the

patient to begin appropriate preventative care. Blue Box provides

hosted, managed, OpenStack-based production-grade private

clouds for the enterprise and service provider markets. Compose

offers auto-scaling, production-ready databases to help software

development teams deploy data services efficiently. StrongLoop

is a leading provider of application development software that

enables software developers to build applications using applica-

tion programming interfaces. AAC engages in system integration

application development, software support and services. AAC was

an affiliate of JBCC Holdings Inc. and IBM Japan Ltd. The company

acquired all the shares of AAC which became a wholly owned

subsidiary as of October1, 2015. Gravitant develops cloud-based

software to enable organizations to easily plan, buy and manage,

or “broker” software and computing services from multiple suppli-

ers across hybrid clouds. Meteorix offers consulting, deployment,

integration and on-going post production services for Workday

Financial Management and Human Capital Management applica-

tions. Clearleap is a provider of cloud-based video services. IRIS

Analytics provides technology and consultancy services to the

payments industry to detect electronic payment fraud.

All acquisitions were for 100percent of the acquired companies

with the exception of the AAC acquisition.

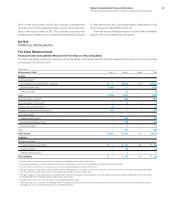

The following table reflects the purchase price related to these

acquisitions and the resulting purchase price allocations as of

December31, 2015.

2015 Acquisitions

($ inmillions)

Amortization

Life (in Years) Merge Cleversafe

Other

Acquisitions

Current assets $ 94 $ 23 $ 60

Fixed assets/noncurrent assets 128 63 82

Intangible assets

Goodwill N/A 695 1,000 895

Completed technology 5–7 133 364 163

Client relationships 5–7 145 23 95

Patents/trademarks 2–7 54 11 23

Total assets acquired 1,248 1,484 1,318

Current liabilities (73) (15) (34)

Noncurrent liabilities (139) (160) (73)

Total liabilities assumed (212) (175) (107)

Total purchase price $1,036 $1,309 $1,210

N/A—Not applicable