IBM 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

106

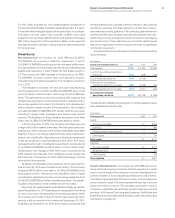

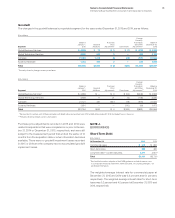

NOTEE.

INVENTORIES

($ inmillions)

At December 31: 2015 2014

Finished goods $ 352 $ 430

Work in process and raw materials 1,199 1,674

Total $1,551 $2,103

NOTEF.

FINANCING RECEIVABLES

The following table presents financing receivables, net of allow-

ances for credit losses, including residual values.

($ inmillions)

At December 31: 2015 2014

Current

Net investment in sales-type

and direct fi nancing leases $ 3,057 $ 3,781

Commercial fi nancing receivables 8,948 8,423

Client loan and installment

payment receivables (loans) 7,015 7,631

Total $19,020 $19,835

Noncurrent

Net investment in sales-type

and direct fi nancing leases $ 4,501 $ 4,449

Client loan and installment

payment receivables (loans) 5,512 6,660

Total $10,013 $11,109

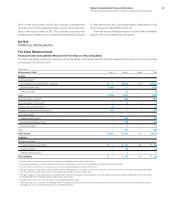

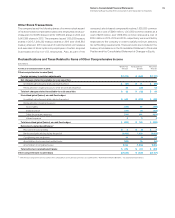

Net investment in sales-type and direct financing leases relates

principally to the company’s systems products and are for terms

ranging generally from two to six years. Net investment in sales-

type and direct financing leases includes unguaranteed residual

values of $645million and $671million at December31, 2015 and

2014, respectively, and is reflected net of unearned income of

$536million and $517million, and net of the allowance for credit

losses of $213million and $165million at those dates, respectively.

Scheduled maturities of minimum lease payments outstanding at

December31, 2015, expressed as a percentage of the total, are

approximately: 2016, 44percent; 2017, 27percent; 2018, 18per-

cent; 2019, 8percent; and 2020 and beyond, 3percent.

Commercial financing receivables, net of allowance for credit

losses of $19million and $17million at December31, 2015 and

2014, respectively, relate primarily to inventory and accounts

receivable financing for dealers and remarketers of IBM and OEM

products. Payment terms for inventory and accounts receivable

financing generally range from 30 to 90 days.

Client loan and installment payment receivables (loans), net

of allowance for credit losses of $377million and $396million

at December31, 2015 and 2014, respectively, are loans that are

provided primarily to clients to finance the purchase of hardware,

software and services. Payment terms on these financing arrange-

ments are generally for terms up to seven years.

Client loan and installment payment financing contracts are

priced independently at competitive market rates. The company

has a history of enforcing these financing agreements.

The company utilizes certain of its financing receivables as col-

lateral for nonrecourse borrowings. Financing receivables pledged

as collateral for borrowings were $545million and $642million at

December31, 2015 and 2014, respectively. These borrowings are

included in noteJ, “Borrowings,” on pages 111 to 113.

The company did not have any financing receivables held for

sale as of December31, 2015 and 2014.

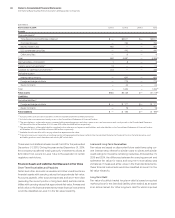

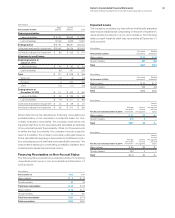

Financing Receivables by Portfolio Segment

The following tables present financing receivables on a gross

basis, excluding the allowance for credit losses and residual

value, by portfolio segment and by class, excluding commercial

financing receivables and other miscellaneous financing receiv-

ables at December31, 2015 and 2014. The company determines

its allowance for credit losses based on two portfolio segments:

lease receivables and loan receivables, and further segments the

portfolio into two classes: major markets and growth markets.

($ inmillions)

At December 31, 2015:

Major

Markets

Growth

Markets Total

Financing receivables

Lease receivables $ 5,517 $1,524 $ 7,041

Loan receivables 9,739 3,165 12,904

Ending balance $15,256 $4,689 $19,945

Collectively evaluated for impairment $15,180 $4,227 $19,406

Individually evaluated for impairment $ 76 $ 462 $ 539

Allowance for credit losses

Beginning balance at

January1, 2015

Lease receivables $ 32 $ 133 $ 165

Loan receivables 79 317 396

Total $ 111 $ 450 $ 561

Write-offs (14) (48) (62)

Provision 20 122 141

Other (8) (43) (51)

Ending balance at

December 31, 2015 $ 109 $ 481 $ 590

Lease receivables $ 25 $ 188 $ 213

Loan receivables $ 83 $ 293 $ 377

Collectively evaluated for impairment $ 43 $ 36 $ 79

Individually evaluated for impairment $ 65 $ 445 $ 511