IBM 2015 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

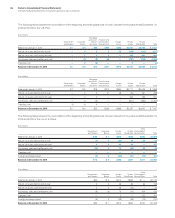

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

129

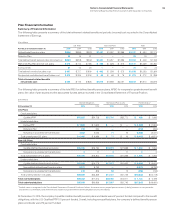

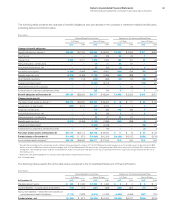

Plan Financial Information

Summary of Financial Information

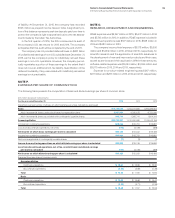

The following table presents a summary of the total retirement-related benefits net periodic (income)/cost recorded in the Consolidated

Statement of Earnings.

($ inmillions)

U.S. Plans Non-U.S. Plans Total

For the year ended December 31: 2015 2014 2013 2015 2014 2013 2015 2014 2013

Defi ned benefi t pension plans $(284) $(833) $(223) $1,421 $1,267 $1,396 $1,137 $ 434 $1,173

Retention Plan 23 15 21 ——— 23 15 21

Total defi ned benefi t pension plans (income)/cost $(261) $(818) $(202) $1,421 $1,267 $1,396 $1,160 $ 449 $1,195

IBM 401(k) Plus Plan and non-U.S. plans $ 676 $ 713 $ 785 $ 442 $ 526 $ 575 $1,117 $1,239 $1,361

Excess 401(k) 21 14 24 ——— 21 14 24

Total defi ned contribution plans cost $ 697 $ 727 $ 809 $ 442 $ 526 $ 575 $1,138 $1,253 $1,384

Nonpension postretirement benefi t plans cost $ 218 $ 206 $ 218 $ 55 $ 66 $ 79 $ 273 $ 272 $ 298

Total retirement-related benefi ts

net periodic cost $ 654 $ 115 $ 826 $1,918 $1,859 $2,051 $2,572 $1,974 $2,876

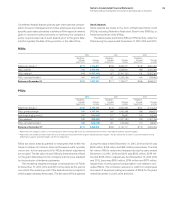

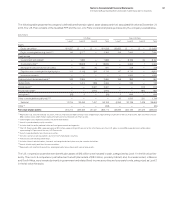

The following table presents a summary of the total PBO for defined benefit pension plans, APBO for nonpension postretirement benefit

plans, fair value of plan assets and the associated funded status recorded in the Consolidated Statement of Financial Position.

($ inmillions)

Benefi t Obligations Fair Value of Plan Assets Funded Status*

At December 31: 2015 2014 2015 2014 2015 2014

U.S. Plans

Overfunded plans

Qualifi ed PPP $51,287 $54,708 $51,716 $55,772 $ 429 $ 1,065

Underfunded plans

Excess PPP $ 1,522 $ 1,602 $ — $ — $ (1,522) $ (1,602)

Retention Plan 312 334 ——(312) (334)

Nonpension postretirement benefi t plan 4,652 5,053 71 16 (4,582) (5,037)

Total underfunded U.S. plans $ 6,486 $ 6,989 $ 71 $ 16 $ (6,415) $ (6,973)

Non-U.S. Plans

Overfunded plans

Qualifi ed defi ned benefi t pension plans $16,766 $16,794 $18,070 $17,888 $ 1,304 $ 1,094

Nonpension postretirement benefi t plans 011 011 00

Total overfunded non-U.S. plans $16,766 $16,804 $18,070 $17,898 $ 1,304 $ 1,094

Underfunded plans

Qualifi ed defi ned benefi t pension plans $22,039 $26,278 $17,677 $21,655 $ (4,362) $ (4,623)

Nonqualifi ed defi ned benefi t pension plans 5,911 6,762 ——(5,911) (6,762)

Nonpension postretirement benefi t plans 618 806 59 73 (558) (733)

Total underfunded non-U.S. plans $28,568 $33,846 $17,737 $21,729 $(10,832) $(12,118)

Total overfunded plans $68,053 $71,512 $69,786 $73,671 $ 1,734 $ 2,159

Total underfunded plans $35,054 $40,836 $17,807 $21,745 $(17,247) $(19,091)

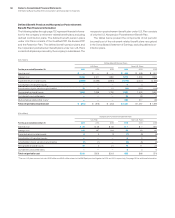

* Funded status is recognized in the Consolidated Statement of Financial Position as follows: Asset amounts as prepaid pension assets; (Liability) amounts as compensation

and benefits (current liability) and retirement and nonpension postretirement benefit obligations (noncurrent liability).

At December31, 2015, the company’s qualified defined benefit pension plans worldwide were 97percent funded compared to the benefit

obligations, with the U.S. Qualified PPP 101percent funded. Overall, including nonqualified plans, the company’s defined benefit pension

plans worldwide were 89percent funded.