IBM 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

Management Discussion

International Business Machines Corporation and Subsidiary Companies

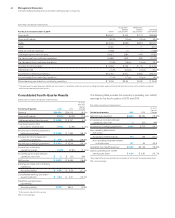

PRIOR YEAR IN REVIEW

The “Prior Year in Review” section provides a summary of the

company’s financial performance in 2014 as compared to 2013.

For additional information, see the company’s 2014 Annual Report.

($ and shares inmillions except per share amounts)

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent/

Margin

Change

Revenue $ 92,793 $ 98,367 (5.7)%*

Gross profi t margin 50.0% 49.5% 0.5 pts.

Total expense and other (income) $ 26,421 $ 28,440 (7.1)%

Total expense and other

(income)-to-revenue ratio 28.5% 28.9%(0.4) pts.

Income before income taxes from

continuing operations $ 19,986 $ 20,244 (1.3)%

Provision for income taxes from

continuing operations 4,234 3,363 25.9%

Income from continuing

operations $ 15,751 $ 16,881 (6.7)%

Income from continuing

operations margin 17.0% 17.2%(0.2) pts.

Loss from discontinued

operations, net of tax $ (3,729) $ (398)NM

Net income $ 12,022 $ 16,483 (27.1)%

Earnings per share from

continuing operations:

Assuming dilution $ 15.59 $ 15.30 1.9%

Consolidated earnings per share—

assuming dilution $ 11.90 $ 14.94 (20.3)%

Weighted-average shares

outstanding:

Assuming dilution 1,010.0 1,103.0 (8.4)%

Assets** $117,271+$125,641+(6.7)%

Liabilities** $105,257+$102,711+2.5%

Equity** $ 12,014 $ 22,929 (47.6)%

*

(4.0)percent adjusted for currency; (1.5)percent adjusted for divestitures and

currency.

** At December31.

+ Reclassified to reflect adoption of the FASB guidance on deferred taxes and debt

issuance costs in consolidated financial statements. Refer to noteB, “Accounting

Changes,” for additional information.

NM—Not meaningful

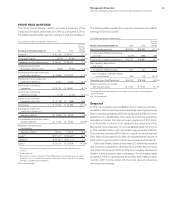

The following table provides the company’s operating (non-GAAP)

earnings for 2014 and 2013.

($ inmillions except per share amounts)

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent

Change

Net income as reported $12,022 $16,483 (27.1)%

Loss from discontinued operations,

net of tax (3,729) (398) NM

Income from continuing operations $15,751 $16,881 (6.7)%

Non-operating adjustments

(net of tax)

Acquisition-related charges 670 747 (10.3)

Non-operating retirement-related

costs/(income) 280 729 (61.5)

Operating (non-GAAP) earnings* $16,702 $18,356 (9.0)%

Diluted operating (non-GAAP)

earnings per share $ 16.53 $ 16.64 (0.7)%

* See page59 for a more detailed reconciliation of net income to operating (non-

GAAP) earnings.

NM—Not meaningful

Snapshot

In 2014, the company reported $92.8billion in revenue, and deliv-

ered $20.0billion in pre-tax income and diluted earnings per share

from continuing operations of $15.59 as reported and $16.53 on an

operating (non-GAAP) basis. The results of continuing operations

excluded net losses from discontinued operations of $3.7billion

in 2014 and $0.4billion in 2013 related to the divestiture of the

Microelectronics business. On a consolidated basis, net income

in 2014 was $12.0billion, with diluted earnings per share of $11.90.

The company generated $16.9billion in cash from operations and

$12.4billion in free cash flow in 2014, driving shareholder returns of

$17.9billion in gross common stock repurchases and dividends.

Total consolidated revenue decreased 5.7percent as reported

and 1percent adjusted for divestitures (3points) and currency

(2points) in 2014 versus 2013. In 2014, the company divested its

Systemx and customer care businesses. The company made

progress in 2014 in repositioning its portfolio and making invest-

ments to shift into the areas with the most value in enterprise

information technology.