IBM 2015 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

135

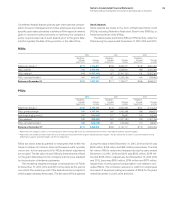

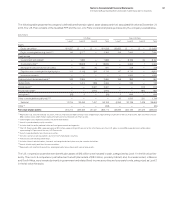

Healthcare Cost Trend Rate

For nonpension postretirement benefit plan accounting, the

company reviews external data and its own historical trends for

healthcare costs to determine the healthcare cost trend rates.

However, the healthcare cost trend rate has an insignificant effect

on plan costs and obligations as a result of the terms of the plan

which limit the company’s obligation to the participants. The com-

pany assumes that the healthcare cost trend rate for 2016 will be

7percent. In addition, the company assumes that the same trend

rate will decrease to 5percent over the next eight years. A one

percentage point increase or decrease in the assumed health-

care cost trend rate would not have had a material effect on 2015,

2014 and 2013 net periodic cost or the benefit obligations as of

December31, 2015 and 2014.

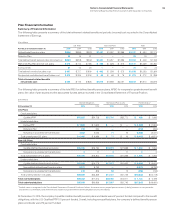

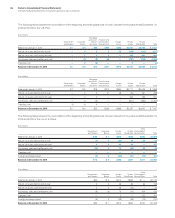

Plan Assets

Retirement-related benefit plan assets are recognized and

measured at fair value. Because of the inherent uncertainty of

valuations, these fair value measurements may not necessarily

reflect the amounts the company could realize in current market

transactions.

Investment Policies and Strategies

The investment objectives of the Qualified PPP portfolio are

designed to generate returns that will enable the plan to meet

its future obligations. The precise amount for which these obli-

gations will be settled depends on future events, including the

retirement dates and life expectancy of the plans’ participants.

The obligations are estimated using actuarial assumptions, based

on the current economic environment and other pertinent factors

described on pages 133 through 134. The Qualified PPP portfolio’s

investment strategy balances the requirement to generate returns,

using potentially higher yielding assets such as equity securities,

with the need to control risk in the portfolio with less volatile assets,

such as fixed-income securities. Risks include, among others,

inflation, volatility in equity values and changes in interest rates that

could cause the plan to become underfunded, thereby increasing

its dependence on contributions from the company. To mitigate

any potential concentration risk, careful consideration is given to

balancing the portfolio among industry sectors, companies and

geographies, taking into account interest rate sensitivity, depen-

dence on economic growth, currency and other factors that affect

investment returns. In 2014, the company changed its investment

strategy, modifying the target asset allocation, primarily by reduc-

ing equity securities and increasing debt securities. This change

was designed to reduce the potential negative impact that equity

markets might have on the funded status of the plan. The Qualified

PPP portfolio’s target allocation is 34percent equity securities,

56percent fixed-income securities, 5percent real estate and

5percent other investments.

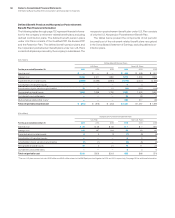

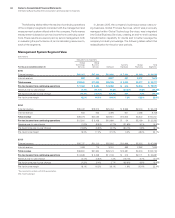

The assets are managed by professional investment firms

and investment professionals who are employees of the com-

pany. They are bound by investment mandates determined by

the company’s management and are measured against specific

benchmarks. Among these managers, consideration is given, but

not limited to, balancing security concentration, issuer concentra-

tion, investment style and reliance on particular active and passive

investment strategies.

Market liquidity risks are tightly controlled, with $5,219 million

of the Qualified PPP portfolio as of December 31, 2015 invested

in private market assets consisting of private equities and private

real estate investments, which are less liquid than publicly traded

securities. In addition, the Qualified PPP portfolio had $2,547 mil-

lion in commitments for future investments in private markets to be

made over a number of years. These commitments are expected

to be funded from plan assets.

Derivatives are used as an effective means to achieve

investment objectives and/or as a component of the plan’s risk

management strategy. The primary reasons for the use of deriv-

atives are fixed income management, including duration, interest

rate management and credit exposure, cash equitization and to

manage currency and commodity strategies.

Outside the U.S., the investment objectives are similar to those

described above, subject to local regulations. The weighted-av-

erage target allocation for the non-U.S. plans is 29percent equity

securities, 58percent fixed-income securities, 2percent real

estate and 11percent other investments, which is consistent with

the allocation decisions made by the company’s management.

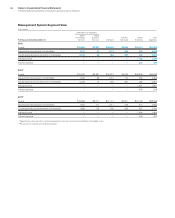

The table on page136 details the actual equity, fixed income,

real estate and other types of investments for non-U.S. plans. In

some countries, a higher percentage allocation to fixed income

is required to manage solvency and funding risks. In others, the

responsibility for managing the investments typically lies with a

board that may include up to 50percent of members elected

by employees and retirees. This can result in slight differences

compared with the strategies previously described. Generally,

these non-U.S. plans do not invest in illiquid assets and their use

of derivatives is consistent with the U.S. plan and mainly for cur-

rency hedging, interest rate risk management, credit exposure and

alternative investment strategies.

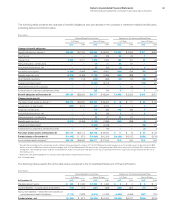

The company’s nonpension postretirement benefit plans are

underfunded or unfunded. For some plans, the company main-

tains a nominal, highly liquid trust fund balance to ensure timely

benefit payments.