IBM 2015 Annual Report Download - page 89

Download and view the complete annual report

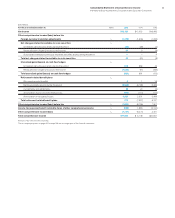

Please find page 89 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

87

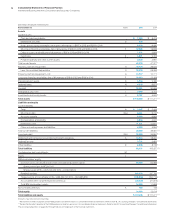

Business Combinations and

Intangible Assets Including Goodwill

The company accounts for business combinations using the

acquisition method and accordingly, the identifiable assets

acquired, the liabilities assumed, and any noncontrolling interest

in the acquiree are recorded at their acquisition date fair values.

Goodwill represents the excess of the purchase price over the

fair value of net assets, including the amount assigned to identifi-

able intangible assets. The primary drivers that generate goodwill

are the value of synergies between the acquired entities and the

company and the acquired assembled workforce, neither of which

qualifies as a separately identifiable intangible asset. Goodwill

recorded in an acquisition is assigned to applicable reporting

units based on expected revenues. Identifiable intangible assets

with finite lives are amortized over their useful lives. Amortization

of completed technology is recorded in Cost, and amortization of

all other intangible assets is recorded in SG&A expense. Acquisi-

tion-related costs, including advisory, legal, accounting, valuation

and other costs, are expensed in the periods in which the costs

are incurred. The results of operations of acquired businesses

are included in the Consolidated Financial Statements from the

acquisition date.

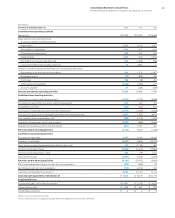

Impairment

Long-lived assets, other than goodwill and indefinite-lived intangi-

ble assets, are tested for impairment whenever events or changes

in circumstances indicate that the carrying amount may not be

recoverable. The impairment test is based on undiscounted cash

flows and, if impaired, the asset is written down to fair value based

on either discounted cash flows or appraised values. Goodwill

and indefinite-lived intangible assets are tested annually, in the

fourth quarter, for impairment and whenever changes in circum-

stances indicate an impairment may exist. Goodwill is tested

at the reporting unit level which is the operating segment, or a

business, which is one level below that operating segment (the

“component” level) if discrete financial information is prepared and

regularly reviewed by management at the segment level. Compo-

nents are aggregated as a single reporting unit if they have similar

economic characteristics.

Depreciation and Amortization

Property, plant and equipment are carried at cost and depreciated

over their estimated useful lives using the straight-line method. The

estimated useful lives of certain depreciable assets are as follows:

buildings, 30 to 50years; building equipment, 10 to 20years; land

improvements, 20years; plant, laboratory and office equipment,

2 to 20years; and computer equipment, 1.5 to 5years. Leasehold

improvements are amortized over the shorter of their estimated

useful lives or the related lease term, rarely exceeding 25years.

Capitalized software costs incurred or acquired after techno-

logical feasibility has been established are amortized over periods

ranging up to 3years. Capitalized costs for internal-use software

are amortized on a straight-line basis over periods ranging up

to 2years. Other intangible assets are amortized over periods

between 1 and 7years.

Environmental

The cost of internal environmental protection programs that are

preventative in nature are expensed as incurred. When a cleanup

program becomes likely, and it is probable that the company will

incur cleanup costs and those costs can be reasonably estimated,

the company accrues remediation costs for known environmental

liabilities. The company’s maximum exposure for all environmental

liabilities cannot be estimated and no amounts are recorded for

environmental liabilities that are not probable or estimable.

Asset Retirement Obligations

Asset retirement obligations (ARO) are legal obligations associ-

ated with the retirement of long-lived assets. These liabilities are

initially recorded at fair value and the related asset retirement costs

are capitalized by increasing the carrying amount of the related

assets by the same amount as the liability. Asset retirement costs

are subsequently depreciated over the useful lives of the related

assets. Subsequent to initial recognition, the company records

period-to-period changes in the ARO liability resulting from the

passage of time in interest expense and revisions to either the

timing or the amount of the original expected cash flows to the

related assets.

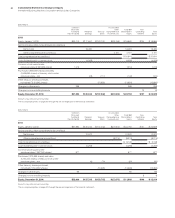

Defined Benefit Pension and

Nonpension Postretirement Benefit Plans

The funded status of the company’s defined benefit pension plans

and nonpension postretirement benefit plans (retirement-related

benefit plans) is recognized in the Consolidated Statement of

Financial Position. The funded status is measured as the difference

between the fair value of plan assets and the benefit obligation at

December31, the measurement date. For defined benefit pen-

sion plans, the benefit obligation is the projected benefit obligation

(PBO), which represents the actuarial present value of benefits

expected to be paid upon retirement based on employee services

already rendered and estimated future compensation levels. For

the nonpension postretirement benefit plans, the benefit obligation

is the accumulated postretirement benefit obligation (APBO), which

represents the actuarial present value of postretirement benefits

attributed to employee services already rendered. The fair value

of plan assets represents the current market value of assets held

in an irrevocable trust fund, held for the sole benefit of partici-

pants, which are invested by the trust fund. Overfunded plans, with

the fair value of plan assets exceeding the benefit obligation, are

aggregated and recorded as a prepaid pension asset equal to this

excess. Underfunded plans, with the benefit obligation exceeding

the fair value of plan assets, are aggregated and recorded as a

retirement and nonpension postretirement benefit obligation equal

to this excess.

The current portion of the retirement and nonpension postre-

tirement benefit obligations represents the actuarial present value

of benefits payable in the next 12 months exceeding the fair value

of plan assets, measured on a plan-by-plan basis. This obligation

is recorded in compensation and benefits in the Consolidated

Statement of Financial Position.