IBM 2015 Annual Report Download - page 100

Download and view the complete annual report

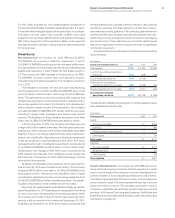

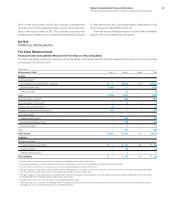

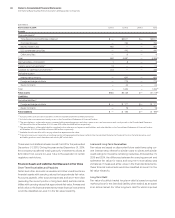

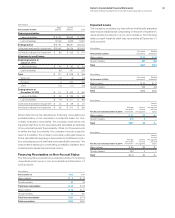

Please find page 100 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

98

IBM and Lenovo entered into a strategic relationship which

included a global OEM and reseller agreement for sales of IBM’s

industry-leading entry and midrange Storwize disk storage

systems, tape storage systems, General Parallel File System soft-

ware, SmartCloud Entry offering, and elements of IBM’s system

software, including Systems Director and Platform Computing

solutions. Effective with the initial closing of the transaction, Lenovo

assumed related customer service and maintenance operations.

IBM will continue to provide maintenance delivery on Lenovo’s

behalf for an extended period of time. In addition, as part of the

transaction agreement, the company will provide Lenovo with cer-

tain transition services, including IT and supply chain services.

The initial term for these transition services ranges from less than

one year to three years. Lenovo can renew certain services for an

additional year.

The initial closing was completed on October1, 2014. A subse-

quent closing occurred in most other countries in which there was

a large business footprint on December31, 2014. The remaining

countries closed on March31, 2015 resulting in a pre-tax gain of

$16million in the first quarter of 2015. In the second quarter of 2015,

an additional pre-tax gain of $36million was recorded attributed to

certain adjustments resolved during the quarter. An assessment

of the ongoing contractual terms of the transaction resulted in the

recognition of a pre-tax gain of $11million in the fourth quarter of

2015. A total pre-tax gain of $63million was recognized in 2015.

Overall, the company expects to recognize a total pre-tax gain

on the sale of approximately $1.6billion, which does not include

associated costs related to transition and performance-based

costs. Net of these charges, the pre-tax gain is approximately

$1.2billion, of which $1.1billion was recorded in the fourth quarter

of 2014. The balance of the gain is expected to be recognized in

2019 upon conclusion of the maintenance agreement.

Customer Care—On September10, 2013, IBM and SYNNEX

announced a definitive agreement in which SYNNEX would

acquire the company’s worldwide customer care business pro-

cess outsourcing services business for $501million, consisting

of approximately $430million in cash, net of balance sheet

adjustments, and $71million in SYNNEX common stock, which

represented less than 5percent equity ownership in SYNNEX. As

part of the transaction, SYNNEX entered into a multi-year agree-

ment with the company, and Concentrix, SYNNEX’s outsourcing

business, became an IBM strategic business partner for global

customer care business process outsourcing services.

The initial closing was completed on January31, 2014, with

subsequent closings occurring in 2014. For the full year of 2014,

the company recorded a pre-tax gain of $202million related to

this transaction.

In the second quarter of 2015, resolution of the final balance

sheet adjustments was concluded. An assessment of the ongoing

contractual terms of the transaction resulted in the recognition of

a pre-tax gain of $7million in 2015. Through December31, 2015,

the cumulative pre-tax gain attributed to this transaction was

$209million.

Retail Store Solutions—On April17, 2012, the company announced

that it had signed a definitive agreement with Toshiba TEC for

the sale of its Retail Store Solutions business. As part of the

transaction, the company agreed to transfer the maintenance

business to Toshiba TEC within three years of the original closing

of the transaction.

The company completed the final phase of the transfer of the

maintenance workforce to Toshiba in the second quarter of 2015.

The parts and inventory transfer to Toshiba will commence in 2018.

An assessment of the ongoing contractual terms of the transaction

resulted in the recognition of a pre-tax gain of $8million in 2015.

Overall, the company has recognized a cumulative total pre-tax

gain on the sale of $519million.

Others—In addition to those above, the company completed the

following divestitures:

2015—In the fourth quarter of 2015, the company completed the

divestiture of its Kenexa Compensation Portfolio business to

SCMC Acquisition, LLC. and the divestiture of the Rational System

Architect and SPSS Data Collections suite of products to UNICOM.

In the second quarter of 2015, the company completed the dives-

titure of its Travel & Transportation kiosk business to Embross

North America Ltd., and the divestiture of its Telecom Expense

Management product to Tangoe, Inc. In the first quarter of 2015,

the company completed the divestiture of the Algorithmics Col-

lateral Management suite of products to SmartStream, Inc. and

the divestiture of the Commerce ILOG Supply Chain Optimization

Tools suite of products to Llamasoft, Inc.

All of the above transactions closed in 2015 and the financial

terms related to these transactions were not material. Overall, the

company recorded a pre-tax gain of $81million related to these

transactions in 2015.

2014—In the second quarter of 2014, the company completed the

divestitures of its solidDB suite of products to UNICOM Systems,

Inc. and its Human Capital Management business line in France

to Sopra Group. In the third quarter of 2014, the company com-

pleted the divestiture of its Cognos Finance product to UNICOM

Systems, Inc., its IMS Tools Suite of products to Rocket Software,

Inc., its Sterling Transportation Management System to Kewill Inc.,

and its ILOG JViews and Elixir Visualization products to Rogue

Wave Software, Inc. In the fourth quarter of 2014, the company

completed the divestiture of its Focal Point and PurifyPlus product

suite to UNICOM Systems, Inc.

All of the above transactions closed in 2014 and the financial

terms related to these transactions were not material. Overall, the

company recorded a pre-tax gain of $132million related to these

transactions in 2014.