IBM 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Management Discussion

International Business Machines Corporation and Subsidiary Companies

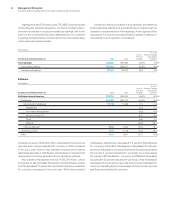

Debt

The company’s funding requirements are continually monitored

and strategies are executed to manage the overall asset and liabil-

ity profile. Additionally, the company maintains sufficient flexibility

to access global funding sources as needed.

($ inmillions)

At December 31: 2015 2014

Total company debt $39,890 $40,722*

Total Global Financing segment debt $27,205 $29,103

Debt to support external clients 23,934 25,531

Debt to support internal clients 3,271 3,572

Non-Global Financing debt 12,684 11,619*

* Reclassified to reflect adoption of the FASB guidance on debt issuance costs in

consolidated financial statements. Refer to noteB, “Accounting Changes,” for

additional information.

Global Financing provides financing predominantly for the com-

pany’s external client assets, as well as for assets under contract

by other IBM units. These assets, primarily for Global Services,

generate long-term, stable revenue streams similar to the Global

Financing asset portfolio. Based on their attributes, these Global

Services assets are leveraged with the balance of the Global

Financing asset base. The debt analysis above is further detailed

in the Global Financing section on pages 72 and 73.

Given the significant leverage, the company presents a

debt-to-capitalization ratio which excludes Global Financing debt

and equity as management believes this is more representative

of the company’s core business operations. This ratio can vary

from period to period as the company manages its global cash

and debt positions. “Core” debt-to-capitalization ratio (excluding

Global Financing debt and equity) was 54.3percent at Decem-

ber31, 2015 compared to 59.2percent at December31, 2014.

Consolidated debt-to-capitalization ratio at December31, 2015

was 73.4percent versus 77.2percent at December31, 2014.

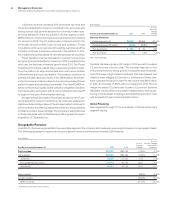

Equity

Total equity increased by $2,410 million from December31, 2014

as a result of an increase in retained earnings of $8,332 million and

common stock of $596million offset by an increase in treasury

stock of $4,803 million mainly due to gross common stock repur-

chases and an increase in other comprehensive losses of $1,731

million primarily due to foreign currency translation adjustments.

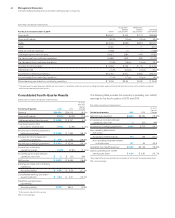

GAAP Reconciliation

The tables below provide a reconciliation of the company’s income

statement results as reported under GAAP to its operating earn-

ings presentation which is a non-GAAP measure. The company’s

calculation of operating (non-GAAP) earnings, as presented, may

differ from similarly titled measures reported by other companies.

Please refer to the “Operating (non-GAAP) Earnings” section on

pages 18 and 19 for the company’s rationale for presenting oper-

ating earnings information.

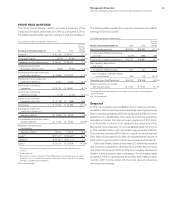

($ inmillions except per share amount)

For the year ended December 31, 2015: GAAP

Acquisition-

Related

Adjustments

Retirement-

Related

Adjustments

Operating

(non-GAAP)

Gross profi t $40,684 $ 373 $ 469 $41,526

Gross profi t margin 49.8% 0.5 pts. 0.6 pts. 50.8%

SG&A $20,430 $(324) $ (533) $19,573

RD&E 5,247 — (48) 5,200

Other (income) and expense (724) (5) — (729)

Total expense and other (income) 24,740 (330) (581) 23,830

Pre-tax income from continuing operations 15,945 703 1,050 17,697

Pre-tax margin from continuing operations 19.5% 0.9 pts. 1.3 pts. 21.6%

Provision for income taxes* $ 2,581 $ 141 $ 316 $ 3,037

Effective tax rate 16.2% 0.2 pts. 0.9 pts. 17.2%

Income from continuing operations $13,364 $ 562 $ 734 $14,659

Income margin from continuing operations 16.3% 0.7 pts. 0.9 pts. 17.9%

Diluted earnings per share from continuing operations $ 13.60 $0.57 $ 0.75 $ 14.92

* The tax impact on operating (non-GAAP) pre-tax income is calculated under the same accounting principles applied to the GAAP pre-tax income which employs an annual

effective tax rate method to the results.