IBM 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60 Management Discussion

International Business Machines Corporation and Subsidiary Companies

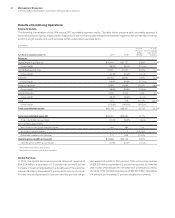

OTHER INFORMATION

Looking Forward

The company’s strategies, investments and actions are all taken

with an objective of optimizing long-term performance. A long-term

perspective ensures that the company is well-positioned to take

advantage of major shifts occurring in technology, business and

the global economy.

Within the IT industry, there are major shifts occurring—driven

by data and analytics, cloud and changes in the ways individuals

and enterprises are engaging. In 2015, the company had continued

strong performance in its strategic imperatives that are focused on

these market shifts. The company’s cloud, analytics, mobile, social

and security solutions together generated $29billion in revenue,

which is approximately 35percent of total consolidated revenue.

Revenue from the strategic imperatives increased 17percent

compared to 2014, or 26percent excluding the impacts of cur-

rency and the divested System x and customer care businesses.

In 2015, the company continued to take significant actions to drive

the shift towards its strategic imperatives with targeted invest-

ments, as well as moving away from areas that do not support the

strategic profile.

The company’s strategic direction is clear and compelling, and

the company continues its shift to the higher value areas of enter-

prise IT. The strong revenue growth in the strategic imperatives

confirms that, as does the overall profitability of the business. The

company expects revenue from its strategic imperatives to con-

tinue to deliver strong growth. These offerings are as high value

as other parts of the business, which continue to manage clients’

most critical business processes. As investments in the strategic

imperatives begin to reach scale, the company expects modest

margin improvement. In addition, the company expects to continue

to allocate its capital efficiently and effectively to investments, and

to return value to its shareholders through a combination of divi-

dends and share repurchases. Over the longer term, in considering

the opportunities it will continue to develop, the company expects

to have the ability to generate low single-digit revenue growth,

and with a higher value business mix, high single-digit operating

(non-GAAP) earnings per share growth, with free cash flow reali-

zation in the 90’s percent range.

In the near term, there are a few dynamics that are inconsistent

with that longer term trajectory. Specifically, in 2016, the company

will be continuing to manage and drive the ongoing transformation

in the business. As an example, GBS continues its transition, with

strong growth in strategic imperatives offset by declines in the

more traditional areas. The company will continue to engineer this

shift. The company expects a continued impact to its software

transaction revenue growth, as many of its largest customers con-

tinue to utilize the flexibility that the company has provided, as they

commit to the company’s platform for the longer term. In addition,

while the company is fully participating in the shift to cloud, the

margins in that business are impacted by the level of investment

the company is making, and the fact that the business is not yet

at scale.

The company also expects a continued significant impact

from currency in 2016. At mid-January 2016 spot rates, the impact

to revenue growth is expected to be 2 to 3 points for the year, but,

as with all companies with a similar global business profile, with the

dollar strengthening, the company also expects that currency will

have a significant impact on its profit growth. The profit impact will

be more significant than in 2015 because of translation impact and

the year-to-year impact from prior year cash flow hedging gains.

At mid-January 2016 spot rates, the company expects currency

to impact pre-tax profit growth by approximately $1.3billion, or at

least a dollar of earnings per share.

Overall, looking forward to 2016, the company expects to con-

tinue to grow in many areas of the business, including continued

strong growth in the strategic imperatives. The company expects

a modest expansion in gross margin, and to continue to invest at

a high level, shifting to areas that have the best opportunity. As

is typical, the company also expects over the course of 2016 to

acquire key capabilities, rebalance its workforce, resolve various

matters including tax, and return value to shareholders. This is

all taken into account in the full-year view. Overall, the company

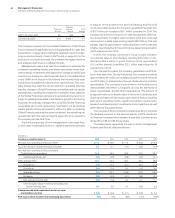

expects GAAP earnings per share from continuing operations for

2016 to be at least $12.45. Excluding acquisition-related charges

of $0.66 per share and non-operating retirement-related items

of $0.39 per share, operating (non-GAAP) earnings per share is

expected to be at least $13.50. For the first quarter of 2016, the

company expects operating (non-GAAP) earnings per share to be

approximately 15percent of the full-year expectation.

From a segment perspective, in 2015, mainframe revenues

increased as a result of the release of the z13, and Power improved

as it was repositioned to address broader opportunities in the

Linux environment. The company is expecting mainframe reve-

nues to decline in 2016 as it enters the back half of the product

cycle. Mainframe margins are expected to improve in the latter half

of 2016 in line with that cycle. Services backlog improved in 2015

to $121billion with increased signings in the year, specifically in the

strategic imperatives. Both GTS and GBS increased signings for

the full year at constant currency and the company expects to con-

tinue to move clients into hybrid environments. There is continued

ability to expand margins in the globalization of service delivery.

The software annuity base, representing approximately 70per-

cent of software revenue, continued to grow. Software renewal

rates remain high and growth from Software-as-a-Service offer-

ings is expected. Transactional mix will not be as impactful in the