IBM 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

Management Discussion

International Business Machines Corporation and Subsidiary Companies

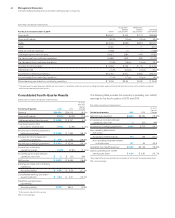

Global Services

In the fourth quarter of 2015, the Global Services segments,

GTS and GBS, delivered combined revenue of $12,422 million, a

decrease of 8.1percent as reported and 1percent adjusted for cur-

rency. Combined pre-tax income in the fourth quarter decreased

0.1percent year to year and the pre-tax margin increased 1.3points

to 17.2percent.

Global Technology Services revenue of $8,126 million de-

creased 7.1percent as reported, but grew 1percent adjusted

for currency. This was the third consecutive quarter of revenue

growth, adjusted for currency and divestitures. Outsourcing rev-

enue of $4,262 million decreased 9.1percent as reported and

1percent adjusted for currency. ITS revenue of $2,360 million

decreased 2.6percent as reported but grew 5percent adjusted

for currency. Maintenance revenue of $1,505 million decreased

8.0percent as reported but was flat adjusted for currency.

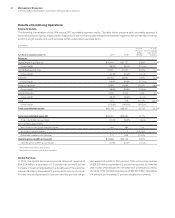

Within GTS, strategic imperatives including hybrid cloud ser-

vices grew strong double digits in the fourth quarter adjusted for

currency. This included strong demand for SoftLayer which again

grew double digits on an adjusted basis. The company continues

to expand its cloud capabilities through acquisitions including

Gravitant, Inc. and Clearleap, Inc. announced in the fourth quarter

of 2015.

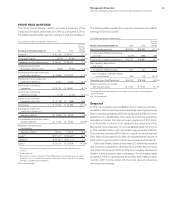

The GTS gross profit margin decreased 1.5points to 37.7per-

cent in the fourth quarter of 2015 compared to prior year. This

decline was driven by investments in cloud data centers and the

acceleration of new contracts, which generally have lower up-front

margins. In the fourth quarter, pre-tax income increased 4.5per-

cent to $1,486 million and pre-tax margin was up 1.9points to

17.8percent. The margin increase was driven by lower workforce

rebalancing charges and savings from actions taken throughout

the year to drive efficiency in the delivery model. These savings

were offset by higher investment as the company continues to

invest to contemporize clients IT systems, transforming them

into digital enterprises. The company is scaling its cloud foot-

print with 46cloud centers opened around the world. Currency

also continued to impact margin in the fourth quarter and was

the largest impact on year-to-year profit growth given the strong

dollar environment.

Global Business Services revenue of $4,297 million decreased

9.9percent as reported and 4percent adjusted for currency in the

fourth quarter of 2015 compared to the prior year. GBS outsourc-

ing revenue of $1,223 million decreased 9.7percent as reported

and 4percent adjusted for currency. C&SI revenue of $3,074 mil-

lion declined 10.0percent as reported and 4percent adjusted for

currency.

Revenue continued to be impacted by the company’s shift

away from traditional enterprise application implementations as

clients move from these engagements to initiatives that focus on

digitizing their business with analytics, cloud and mobile tech-

nologies. Revenue from the strategic imperatives within the GBS

segment increased double digits adjusted for currency in the

fourth quarter compared to the prior year.

The GBS gross profit margin decreased 3.3points to 28.2per-

cent in the fourth quarter compared to the prior year. Pre-tax

income decreased 8.6percent to $708million and pre-tax margin

was up 0.2points to 16.0percent. Current year benefit from lower

workforce rebalancing charges was offset by the impact of price

pressure in declining areas of the business and continued invest-

ment in analytics, cloud and mobility practices. In addition, the

company is investing to scale a new cognitive consulting practice

that is focused on helping clients unlock the transformative value

of cognitive business.

Within Global Services, the company has continued momen-

tum in services offerings that modernize clients’ IT systems and

move their operations into the cloud-based mobile world.

Software

In the fourth quarter of 2015, Software revenue of $6,767 million

decreased 10.7percent as reported and 6percent adjusted for

currency compared to the prior year period. Annuity content grew

year to year, but transactional content declined. Key branded mid-

dleware revenue of $4,858 million, which accounted for 72percent

of total software revenue in the fourth quarter, decreased 10.4per-

cent as reported and 6percent adjusted for currency with declines

across all brands. Within key branded middleware, WebSphere

decreased 9.2percent (5percent adjusted for currency), Infor-

mation Management decreased 10.2percent (5percent adjusted

for currency), Tivoli decreased 5.8percent (1percent adjusted for

currency), Workforce Solutions decreased 9.9percent (4percent