IBM 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

Management Discussion

International Business Machines Corporation and Subsidiary Companies

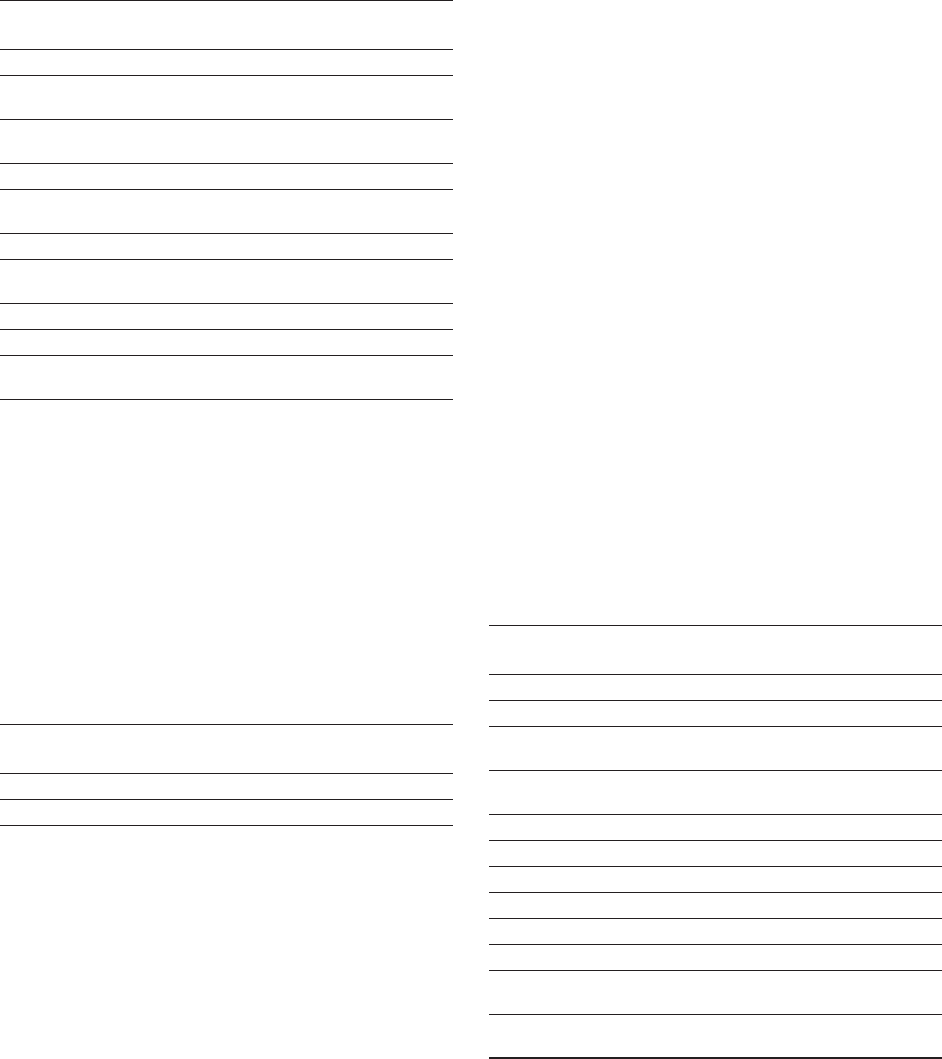

Other (Income) and Expense

($ inmillions)

For the year ended December 31: 2015 2014

Yr.-to-Yr.

Percent

Change

Other (income) and expense

Foreign currency transaction

losses/(gains) $ 414 $ (599) NM

(Gains)/losses on derivative

instruments (853) 654 NM

Interest income (72) (90) (19.8)%

Net (gains)/losses from securities

and investment assets 47 (26) NM

Other (260) (1,878) (86.1)%

Total consolidated other

(income) and expense $(724) $(1,938) (62.6)%

Non-operating adjustment

Acquisition-related charges (5) (1) NM

Operating (non-GAAP)

other (income) and expense $(729) $(1,939) (62.4)%

NM—Not meaningful

The decrease in income of $1,214 million year over year was pri-

marily driven by:

• Lower gains on divestitures ($1,623 million) primarily associ-

ated with the divestitures of the Systemx and customer care

businesses in 2014; and

• Higher foreign currency transaction losses ($1,013 million);

partially offset by

• Increased gains on derivative instruments ($1,507 million).

Interest Expense

($ inmillions)

For the year ended December 31: 2015 2014

Yr.-to-Yr.

Percent

Change

Interest expense

Total $468 $484 (3.2)%

The decrease in interest expense in 2015 versus 2014 was primar-

ily driven by lower average debt levels, partially offset by higher

average interest rates. Interest expense is presented in cost of

financing in the Consolidated Statement of Earnings only if the

related external borrowings are to support the Global Financing

external business. Overall interest expense (excluding capital-

ized interest) in 2015 was $1,009 million, a decrease of $16million

year to year.

Stock-Based Compensation

Pre-tax stock-based compensation cost of $468million decreased

$44million compared to 2014. This was due primarily to decreases

related to performance share units ($32million), the conversion

of stock-based awards previously issued by acquired entities

($6million) and restricted stock units ($6million). Stock-based

compensation cost, and the year-to-year change, was reflected

in the following categories: Cost: $100million, down $21million;

SG&A expense: $322million, down $28million; RD&E expense:

$51million, down $3million and Other (income) and expense:

($6million), down $8million. The amount of stock-based com-

pensation cost included in the loss from discontinued operations,

net of tax, was immaterial in 2015 and 2014.

Retirement-Related Plans

The following table provides the total pre-tax cost for all retire -

ment-related plans. These amounts are included in the Consoli-

dated Statement of Earnings within the caption (e.g., Cost, SG&A,

RD&E) relating to the job function of the plan participants.

($ inmillions)

For the year ended December 31: 2015 2014

Yr.-to-Yr.

Percent

Change

Retirement-related plans—cost

Service cost $ 484 $ 482 0.5%

Amortization of prior service

costs/(credits) (100) (114) (12.0)

Cost of defi ned contribution

plans 1,138 1,253 (9.2)

Total operating costs/(income) $ 1,522 $ 1,621 (6.1)%

Interest cost 3,316 3,994 (17.0)

Expected return on plan assets (5,879) (6,351) (7.4)

Recognized actuarial losses 3,283 2,467 33.1

Curtailments/settlements 36 25 41.2

Multi-employer plan/other costs 293 218 34.8

Total non-operating costs/

(income) $ 1,050 $ 353 197.2%

Total retirement-related

plans—cost $ 2,572 $ 1,974 30.3%