IBM 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

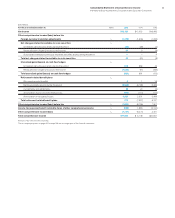

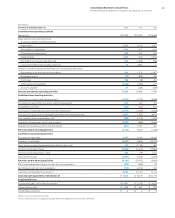

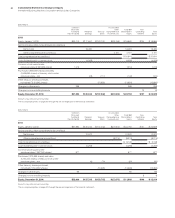

78 Consolidated Statement of Financial Position

International Business Machines Corporation and Subsidiary Companies

($ inmillions except per share amounts)

At December 31: Notes 2015 2014

Assets

Current assets

Cash and cash equivalents $ 7,686 $ 8,476

Marketable securities D508 0

Notes and accounts receivable—trade (net of allowances of $367 in 2015 and $336 in 2014) 8,333 9,090

Short-term fi nancing receivables (net of allowances of $490 in 2015 and $452 in 2014) F19,020 19,835

Other accounts receivable (net of allowances of $51 in 2015 and $40 in 2014) 1,201 2,906

Inventories E1,551 2,103

Prepaid expenses and other current assets 4,205 4,967

Total current assets 42,504 47,377*

Property, plant and equipment G29,342 39,034

Less: Accumulated depreciation G18,615 28,263

Property, plant and equipment—net G10,727 10,771

Long-term fi nancing receivables (net of allowances of $118 in 2015 and $126 in 2014) F10,013 11,109

Prepaid pension assets S1,734 2,160

Deferred taxes N4,822 6,675*

Goodwill I32,021 30,556

Intangible assets—net I3,487 3,104

Investments and sundry assets H5,187 5,520**

Total assets $ 110,495 $ 117,271 * **

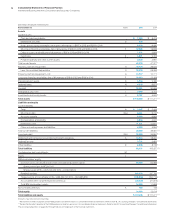

Liabilities and equity

Current liabilities

Taxes N$ 2,847 $ 5,084

Short-term debt D&J 6,461 5,731**

Accounts payable 6,028 6,864

Compensation and benefi ts 3,560 4,031

Deferred income 11,021 11,877

Other accrued expenses and liabilities 4,353 5,994*

Total current liabilities 34,269 39,581* **

Long-term debt D&J 33,428 34,991**

Retirement and nonpension postretirement benefi t obligations S 16,504 18,261

Deferred income 3,771 3,691

Other liabilities K8,099 8,733*

Total liabilities 96,071 105,257* **

Contingencies and commitments M

Equity L

IBM stockholders’ equity

Common stock, par value $.20 per share, and additional paid-in capital 53,262 52,666

Shares authorized: 4,687,500,000

Shares issued (2015—2,221,223,449; 2014—2,215,209,574)

Retained earnings 146,124 137,793

Treasury stock, at cost (shares: 2015—1,255,494,724; 2014—1,224,685,815) (155,518) (150,715)

Accumulated other comprehensive income/(loss) (29,607) (27,875)

Total IBM stockholders’ equity 14,262 11,868

Noncontrolling interests A162 146

Total equity 14,424 12,014

Total liabilities and equity $ 110,495 $ 117,271 * **

Amounts may not add due to rounding.

* Reclassified to reflect adoption of the FASB guidance on deferred taxes in consolidated financial statements. Refer to noteB, “Accounting Changes,” for additional information.

** Reclassified to reflect adoption of the FASB guidance on debt issuance costs in consolidated financial statements. Refer to noteB, “Accounting Changes,” for additional information.

The accompanying notes on pages 82 through 146 are an integral part of the financial statements.