IBM 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 Management Discussion

International Business Machines Corporation and Subsidiary Companies

The company announced the divestiture of its Microelectronics

business with future chip supply coming from an at-scale provider,

and has committed $3billion of investment over five years in the

next era of chip technology as it strengthens its semiconductor

research and development and systems innovation. The company

also divested the Systemx business, and announced the z13, the

new generation of the mainframe. With its portfolio repositioned

and the introduction of the new mainframe, this business segment

should now see profit leverage going forward.

Global Financing

See pages 69 through 73 for an analysis of Global Financing’s

segment results.

Geographic Revenue

In addition to the revenue presentation by reportable segment, the

company also measures revenue performance on a geographic

basis. The following geographic, regional and country-specific

revenue performance excludes OEM revenue.

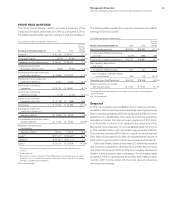

($ inmillions)

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency*

Total revenue $92,793 $98,367 (5.7)% (1.5)%

Geographies $92,326 $97,800 (5.6)% (1.5)%

Americas 41,410 43,249 (4.3) (0.8)

Europe/Middle East/Africa 30,700 31,628 (2.9) (0.6)

Asia Pacifi c 20,216 22,923 (11.8) (4.1)

Major markets (4.3)% (1.0)%

Growth markets (9.9)% (3.2)%

BRIC countries (10.7)% (4.5)%

* Adjusted for divestitures and currency.

Total geographic revenue of $92,326 million decreased 5.6per-

cent as reported and 1percent adjusted for divestitures (2points)

and currency (2points) in 2014 compared to 2013. In total, major

market countries decreased 4.3percent as reported and 1percent

adjusted for divestitures (2points) and currency (1point). Growth

market countries decreased 9.9percent as reported and 3per-

cent adjusted for divestitures (3points) and currency (4points)

compared to 2013. The year-to-year decline in growth markets rev-

enue adjusted for currency and the divestitures reflected growth in

the Latin American and Europe growth markets, more than offset

by decreased revenue in the Asia Pacific growth markets.

Americas revenue of $41,410 million decreased 4.3percent as

reported and 1percent adjusted for divestitures (2points) and cur-

rency (1point) compared to 2013. On an adjusted basis, there was

increased revenue in the growth markets offset by year-to-year

declines in the major market countries. Within the North Ameri-

can major markets, the U.S. declined 4.0percent as reported and

2percent adjusted for divestitures (2points). Canada was down

9.8percent as reported and 2percent adjusted for divestitures

(1point) and currency (7points).

EMEA revenue of $30,700 million decreased 2.9percent as

reported and 1percent adjusted for divestitures (3points) and

offset by currency (1point). On an adjusted basis, growth in Ger-

many, Italy and Spain was more than offset by declines in the UK

and France, compared to 2013.

Asia Pacific revenue of $20,216 million decreased 11.8percent

as reported and 4percent adjusted for the divested businesses

(3points) and currency (5points). Japan was down 7.6percent as

reported, but increased 3percent adjusted for currency (8points)

and divestitures (3points). On this basis, Japan reflected year-to-

year growth in every quarter of 2014. However, this growth was

more than offset by declines in the Asia Pacific growth markets.

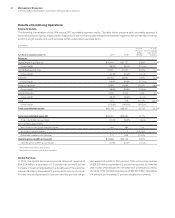

Total Expense and Other (Income)

($ inmillions)

For the year ended December 31: 2014 2013

Yr.-to-Yr.

Percent/

Margin

Change

Total consolidated expense

and other (income) $26,421 $28,440 (7.1)%

Non-operating adjustments

Amortization of acquired

intangible assets (374) (370) 1.2

Acquisition-related charges (12) (40) (70.0)

Non-operating retirement-related

(costs)/income (180) (433) (58.4)

Operating (non-GAAP)

expense and other (income) $25,855 $27,597 (6.3)%

Total co nso lid ated

expense-to-revenue ratio 28.5% 28.9% (0.4) pts.

Operating (non-GAAP)

expense-to-revenue ratio 27.9% 28.1% (0.2) pts.