IBM 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

95

The acquisitions were accounted for as business combinations

using the acquisition method, and accordingly, the identifiable

assets acquired, the liabilities assumed, and any noncontrolling

interest in the acquired entity were recorded at their estimated fair

values at the date of acquisition. The primary items that generated

the goodwill are the value of the synergies between the acquired

businesses and IBM and the acquired assembled workforce, nei-

ther of which qualify as an amortizable intangible asset.

For the “Other Acquisitions,” the overall weighted-average life of

the identified intangible assets acquired is 6.4years. These iden-

tified intangible assets will be amortized on a straight-line basis

over their useful lives. Goodwill of $717million was assigned to the

Software segment, $104million was assigned to the GTS segment,

and $74million was assigned to the GBS segment. It is expected

that 7percent of the goodwill will be deductible for tax purposes.

On December17, 2015, the company announced that it had

entered into a definitive agreement with AT&T to acquire their appli-

cation and hosting services business. The acquisition is expected

to strengthen IBM’s outsourcing portfolio and will align with IBM’s

cloud strategy.

On January21, 2016, the company announced that it had

acquired Ustream, Inc. (Ustream), a privately held company based

in San Francisco, California. Ustream provides cloud-based video

streaming to enterprises and broadcasters.

On January 29, 2016, the company announced that it had

acquired The Weather Company’s B2B, mobile and cloud-based

web-properties, weather.com, Weather Underground, The Weather

Company brand and WSI, its global business-to-business brand

for cash consideration of approximately $2billion. The cable tele-

vision segment was not acquired by IBM, but will license weather

forecast data and analytics from IBM under a long-term contract.

On February 2, 2016, the company announced its intent to

acquire Aperto, a digital agency with headquarters in Berlin,

Germany. Aperto will join the IBM Interactive Experience (IBM iX)

team. IBM iX provides clients a unique fusion of services span-

ning strategy, analytics and systems integration for scalable digital,

commerce, mobile and wearable platforms. The transaction is

expected to close in the first quarter of 2016.

On February 3, 2016, the company announced its intent to

acquire ecx.io, a digital agency headquartered in Dusseldorf,

Germany. The proposed acquisition of ecx.io will enhance IBM iX

with new digital marketing, commerce and platform skills to accel-

erate clients’ digital transformations. The transaction is expected

to close in the first quarter of 2016.

On February 18, 2016, the company announced that it had

acquired Resource/Ammirati, a leading U.S. based digital mar-

keting and creative agency, addressing the rising demand from

businesses seeking to reinvent themselves for the digital economy.

On February 18, 2016, the company announced its intent to

acquire Truven Health Analytics (Truven), a leading provider of

healthcare analytics solutions, for estimated cash consideration

of $2.6 billion. Truven has developed proprietary analytic meth-

ods and assembled analytic content assets, creating extensive

national healthcare utilization, performance, quality, and cost data.

The transaction is expected to close in the first quarter of 2016.

At the date of issuance of the financial statements, the initial

purchase accounting for the Ustream, The Weather Company and

Resource/Ammirati transactions was not complete.

2014

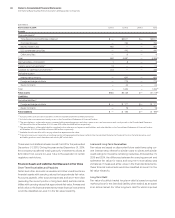

In 2014, the company completed six acquisitions at an aggregate

cost of $608million.

The Software segment completed acquisitions of five privately

held companies: in the first quarter, Aspera, Inc. (Aspera) and Clou-

dant, Inc. (Cloudant); in the second quarter, Silverpop Systems, Inc.

(Silverpop) and Cognea Group Pty LTD (Cognea); and in the third

quarter, CrossIdeas Srl (CrossIdeas). Global Technology Services

completed one acquisition in the third quarter, Lighthouse Security

Group, LLC (Lighthouse), a privately held company.

Aspera’s technology helps make cloud computing faster, more

predictable and more cost effective for big data transfers such

as enterprise storage, sharing virtual images or accessing the

cloud for increased computing capacity. Cloudant extends the

company’s mobile and cloud platform by enabling developers to

easily and quickly create next-generation mobile and web-based

applications. Silverpop is a provider of cloud-based capabilities

that deliver personalized customer engagements in highly scalable

environments. Cognea offers personalized artificial intelligence

capabilities designed to serve as an intuitive interface between

human users and data-driven information. CrossIdeas delivers

next generation identity and access governance capabilities to

help mitigate access risks and segregation of duty violations.

Lighthouse is a provider of cloud-enabled managed identity and

access management solutions.

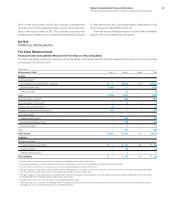

The following table reflects the purchase price related to these

acquisitions and the resulting purchase price allocations as of

December31, 2014.

2014 Acquisitions

($ inmillions)

Amortization

Life (in Years)

Tota l

Acquisitions

Current assets $ 56

Fixed assets/noncurrent assets 39

Intangible assets

Goodwill N/A 442

Completed technology 5–7 68

Client relationships 777

Patents/trademarks 1–7 18

Total assets acquired 701

Current liabilities (26)

Noncurrent liabilities (67)

Total liabilities assumed (93)

Total purchase price $608

N/A—Not applicable