IBM 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

Management Discussion

International Business Machines Corporation and Subsidiary Companies

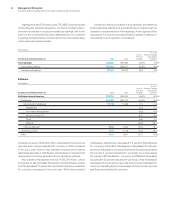

($ inmillions)

For the year ended December 31: 2015 2014*

Yr.-to-Yr.

Percent/

Margin

Change

Global Services

Global Technology Services

External gross profi t $11,981 $13,808 (13.2)%

External gross profi t margin 37.4% 39.0% (1.5) pts.

Pre-tax income $ 5,002 $ 5,931 (15.7)%

Pre-tax margin 15.2% 16.3% (1.1) pts.

Global Business Services

External gross profi t $ 4,837 $ 5,923 (18.3)%

External gross profi t margin 28.2% 30.4% (2.2) pts.

Pre-tax income $ 2,634 $ 3,408 (22.7)%

Pre-tax margin 14.9% 17.0% (2.1) pts.

* Reclassified to conform with 2015 presentation.

The GTS gross profit margin decreased 1.5points to 37.4per-

cent in 2015 compared to prior year. Pre-tax income decreased

15.7percent to $5,002 million. The GTS pre-tax margin declined

1.1points to 15.2percent compared to the prior year, primarily due

to investments being made in this business. The company con-

tinues to invest to deliver the most contemporary offerings that

are built with cloud, analytics, mobile, security and cognitive tech-

nologies enabling it to transform clients’ enterprises. In addition,

currency had a large year-to-year impact on profit given the strong

dollar currency environment.

The GBS gross profit margin decreased 2.2points to 28.2per-

cent in 2015 compared to the prior year. Pre-tax income decreased

22.7percent to $2,634 million and pre-tax margin declined

2.1points to 14.9percent compared to the prior year. This year-to-

year profit decline reflects the market shifts in the GBS business.

In parts of the portfolio where the market is declining, there is

price and profit pressure and action is being taken to optimize the

cost structure in these areas. The company continues to shift and

add significant resources to the high-growth analytics, cloud and

mobility practices, which impacts productivity and margin in the

near term.

Global Services Backlog

The estimated Global Services backlog at December31, 2015 was

$121billion, a decrease of 6.0percent as reported, but an increase

of 1percent adjusted for currency, compared to the December31,

2014 balance. The estimated transactional backlog at Decem-

ber31, 2015 decreased 6.5percent as reported, but was flat year

to year adjusted for currency. The estimated outsourcing backlog

decreased 5.4percent as reported, but grew 2percent adjusted

for currency compared to the prior year.

Clients are looking to transform their most critical systems into

hybrid cloud environments, and the complexity of these partner-

ships in many cases results in larger engagements. For the full year

of 2015, over 70 services deals greater than $100million were

signed, which was 40percent more than in 2014. About 70percent

of those transactions feature hybrid cloud content, which reflects

both the value IBM’s clients see in hybrid and the reality that not

all their workloads are optimized for the cloud.

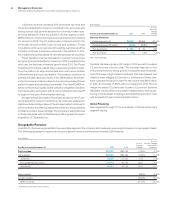

($ inbillions)

At December 31: 2015 2014

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Backlog

Total backl og $120.7 $128.4 (6.0)% 0.8%

Outsourcing backlog 76.4 80.8 (5.4) 1.7

Total Global Services backlog includes GTS Outsourcing, ITS,

GBS Outsourcing, Consulting and Systems Integration and Main-

tenance. Outsourcing backlog includes GTS Outsourcing and GBS

Outsourcing. Transactional backlog includes ITS and Consulting

and Systems Integration. Total backlog is intended to be a state-

ment of overall work under contract and therefore does include

Maintenance. Backlog estimates are subject to change and are

affected by several factors, including terminations, changes in the

scope of contracts, periodic revalidations, adjustments for revenue

not materialized and adjustments for currency.

Global Services signings are management’s initial estimate

of the value of a client’s commitment under a Global Services

contract. There are no third-party standards or requirements

governing the calculation of signings. The calculation used by

management involves estimates and judgments to gauge the

extent of a client’s commitment, including the type and duration of

the agreement, and the presence of termination charges or wind-

down costs.