IBM 2015 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

139

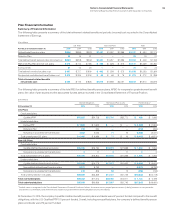

Valuation Techniques

The following is a description of the valuation techniques used

to measure plan assets at fair value. There were no changes in

valuation techniques during 2015 and 2014.

Equity securities are valued at the closing price reported on

the stock exchange on which the individual securities are traded.

IBM common stock is valued at the closing price reported on the

New York Stock Exchange. Equity commingled/mutual funds are

typically valued using the net asset value (NAV) provided by the

administrator of the fund and reviewed by the company. The NAV

is based on the value of the underlying assets owned by the fund,

minus liabilities and divided by the number of shares or units out-

standing. These assets are classified as Level1, Level2 or Level3

depending on availability of quoted market prices.

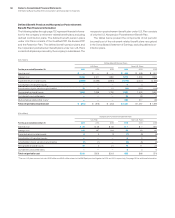

The fair value of fixed-income securities is typically estimated

using pricing models, quoted prices of securities with similar char-

acteristics or discounted cash flows and are generally classified

as Level2. If available, they are valued using the closing price

reported on the major market on which the individual securities

are traded.

Cash includes money market accounts that are valued at their

cost plus interest on a daily basis, which approximates fair value.

Short-term investments represent securities with original matur-

ities of one year or less. These assets are classified as Level1 or

Level2.

Private equity and private real estate partnership valuations

require significant judgment due to the absence of quoted market

prices, the inherent lack of liquidity and the long-term nature of

such assets. These assets are initially valued at cost and are

reviewed periodically utilizing available and relevant market data to

determine if the carrying value of these assets should be adjusted.

These investments are classified as Level3. The valuation meth-

odology is applied consistently from period to period.

Exchange traded derivatives are valued at the closing price

reported on the exchange on which the individual securities are

traded, while forward contracts are valued using a mid-close

price. Over-the-counter derivatives are typically valued using

pricing models. The models require a variety of inputs, including,

for example, yield curves, credit curves, measures of volatility and

foreign exchange rates. These assets are classified as Level1 or

Level2 depending on availability of quoted market prices.

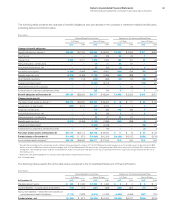

Expected Contributions

Defined Benefit Pension Plans

It is the company’s general practice to fund amounts for pensions

sufficient to meet the minimum requirements set forth in applicable

employee benefits laws and local tax laws. From time to time, the

company contributes additional amounts as it deems appropriate.

The company contributed $474million in cash to non-U.S.

defined benefit pension plans and $40million in cash to multi-em-

ployer plans for the year ended December31, 2015. For the year

ended December31, 2014, the company contributed $465million

in cash to non-U.S. defined benefit pension plans and $54mil-

lion in cash to multi-employer plans. The cash contributions to

multi-employer plans represent the annual cost included in net

periodic (income)/cost recognized in the Consolidated Statement

of Earnings. The company’s participation in multi-employer plans

has no material impact on the company’s financial statements.

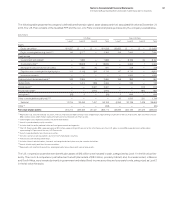

In 2016, the company is not legally required to make any con-

tributions to the U.S. defined benefit pension plans. However,

depending on market conditions, or other factors, the company

may elect to make discretionary contributions to the Qualified PPP

during the year.

The Pension Protection Act of 2006 (the Act), enacted into law

in 2006, is a comprehensive reform package that, among other

provisions, increases pension funding requirements for certain U.S.

defined benefit plans, provides guidelines for measuring pension

plan assets and pension obligations for funding purposes and

raises tax deduction limits for contributions to retirement-related

benefit plans. The additional funding requirements by the Act apply

to plan years beginning after December31, 2007. The Act was

updated by the Worker, Retiree and Employer Recovery Act of

2008, which revised the funding requirements in the Act by clar-

ifying that pension plans may smooth the value of pension plans

over 24 months. At December31, 2015, no mandatory contribution

was required for 2016.

In 2016, the company estimates contributions to its non-U.S.

defined benefit and multi-employer plans to be approximately

$500million, the largest of which will be contributed to defined

benefit pension plans in the UK, Japan and Spain. This amount

represents the legally mandated minimum contributions. Financial

market performance in 2016 could increase the legally mandated

minimum contribution in certain countries which require monthly

or daily remeasurement of the funded status. The company could

also elect to contribute more than the legally mandated amount

based on market conditions or other factors.