IBM 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

120

defendants. Plaintiffs allege that defendants violated Sections 20(a)

and 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5

thereunder. In May 2015, a related putative class action was also

commenced in the United States District Court for the Southern

District of New York based on the same underlying facts, alleging

violations of the Employee Retirement Income Security Act. The

company, management’s Retirement Plans Committee, and three

current or former IBM executives are named as defendants.

In August 2015, IBM learned that the SEC is conducting an

investigation relating to revenue recognition with respect to the

accounting treatment of certain transactions in the U.S., UK and

Ireland. The company is cooperating with the SEC in this matter.

The company is a defendant in numerous actions filed after

January1, 2008 in the Supreme Court for the State of New York,

county of Broome, on behalf of hundreds of plaintiffs. The com-

plaints allege numerous and different causes of action, including

for negligence and recklessness, private nuisance and trespass.

Plaintiffs in these cases seek medical monitoring and claim dam-

ages in unspecified amounts for a variety of personal injuries

and property damages allegedly arising out of the presence of

groundwater contamination and vapor intrusion of groundwater

contaminants into certain structures in which plaintiffs reside

or resided, or conducted business, allegedly resulting from the

release of chemicals into the environment by the company at its

former manufacturing and development facility in Endicott. These

complaints also seek punitive damages in an unspecified amount.

The parties have settled substantially all of these cases.

The company is party to, or otherwise involved in, proceed-

ings brought by U.S. federal or state environmental agencies under

the Comprehensive Environmental Response, Compensation and

Liability Act (CERCLA), known as “Superfund,” or laws similar to

CERCLA. Such statutes require potentially responsible parties

to participate in remediation activities regardless of fault or own-

ership of sites. The company is also conducting environmental

investigations, assessments or remediations at or in the vicinity

of several current or former operating sites globally pursuant to

permits, administrative orders or agreements with country, state

or local environmental agencies, and is involved in lawsuits and

claims concerning certain current or former operating sites.

The company is also subject to ongoing tax examinations and

governmental assessments in various jurisdictions. Along with

many other U.S. companies doing business in Brazil, the com-

pany is involved in various challenges with Brazilian tax authorities

regarding non-income tax assessments and non-income tax liti-

gation matters. The total potential amount related to these matters

for all applicable years is approximately $460million. The company

believes it will prevail on these matters and that this amount is not

a meaningful indicator of liability.

Commitments

The company’s extended lines of credit to third-party entities

include unused amounts of $5,477 million and $5,365 million at

December31, 2015 and 2014, respectively. A portion of these

amounts was available to the company’s business partners to

support their working capital needs. In addition, the company has

committed to provide future financing to its clients in connection

with client purchase agreements for $2,097 million and $1,816 mil-

lion at December31, 2015 and 2014, respectively.

The company has applied the guidance requiring a guarantor

to disclose certain types of guarantees, even if the likelihood of

requiring the guarantor’s performance is remote. The following is a

description of arrangements in which the company is the guarantor.

The company is a party to a variety of agreements pursuant

to which it may be obligated to indemnify the other party with

respect to certain matters. Typically, these obligations arise in the

context of contracts entered into by the company, under which

the company customarily agrees to hold the other party harmless

against losses arising from a breach of representations and cov-

enants related to such matters as title to assets sold, certain IP

rights, specified environmental matters, third-party performance

of nonfinancial contractual obligations and certain income taxes.

In each of these circumstances, payment by the company is

conditioned on the other party making a claim pursuant to the

procedures specified in the particular contract, the procedures of

which typically allow the company to challenge the other party’s

claims. While typically indemnification provisions do not include a

contractual maximum on the company’s payment, the company’s

obligations under these agreements may be limited in terms of time

and/or nature of claim, and in some instances, the company may

have recourse against third parties for certain payments made by

the company.

It is not possible to predict the maximum potential amount of

future payments under these or similar agreements due to the

conditional nature of the company’s obligations and the unique

facts and circumstances involved in each particular agreement.

Historically, payments made by the company under these agree-

ments have not had a material effect on the company’s business,

financial condition or results of operations.

In addition, the company guarantees certain loans and financial

commitments. The maximum potential future payment under these

financial guarantees was $34million and $46million at Decem-

ber31, 2015 and 2014, respectively. The fair value of the guarantees

recognized in the Consolidated Statement of Financial Position

was immaterial.

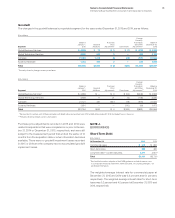

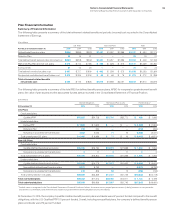

NOTEN.

TA XES

($ inmillions)

For the year ended December 31: 2015 2014 2013

Income from continuing operations

before income taxes

U.S. operations $ 5,915 $ 7,509 $ 7,577

Non-U.S. operations 10,030 12,477 12,667

Total income from

continuing operations

before income taxes $15,945 $19,986 $20,244