IBM 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 Management Discussion

International Business Machines Corporation and Subsidiary Companies

• A decrease in other accrued expenses and liabilities of $1,641

million ($1,281 million adjusted for currency) driven by net

activity associated with the Microelectronics divestiture and

workforce rebalancing payments; and

• A decrease in deferred income of $856million ($226million

adjusted for currency); and a decline of $837million ($568

million adjusted for currency) in accounts payable reflecting

the wind down of the divested Systemx business payables

and decreases in counterparty collateral postings; partially

offset by

• An increase in short-term debt of $731million ($872million

adjusted for currency).

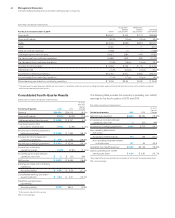

Cash Flow

The company’s cash flows from operating, investing and financ-

ing activities, as reflected in the Consolidated Statement of Cash

Flows on page79 are summarized in the table below. These

amounts include the cash flows associated with the Global Financ-

ing business.

($ inmillions)

For the year ended December 31: 2015 2014

Net cash provided by/(used in)

continuing operations

Operating activities $17,008 $ 16,868

Investing activities (8,159) (3,001)

Financing activities (9,166) (15,452)

Effect of exchange rate changes on

cash and cash equivalents (473) (655)

Net change in cash and cash equivalents $ (790) $ (2,240)

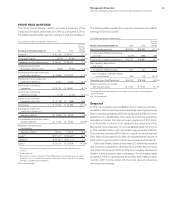

Net cash provided by operating activities increased by $139million

in 2015 driven by the following key factors:

• A decline in cash income tax payments ($3,092 million); and

• An improvement in sales cycle working capital of $1,192million;

partially offset by

• Performance-related declines within net income; and

• An increase in performance-related compensation payments

of $470million.

Net cash used in investing activities increased $5,158 million

driven by:

• A decrease in cash provided by divestitures of $2,758

million; and

• An increase in cash used related to acquisitions of

$2,693 million.

Net cash used in financing activities decreased $6,286 million as

compared to the prior year driven by the following factors:

• A decrease of $9,070 million of cash used for gross share

repurchases; partially offset by

• A decrease in net cash sourced from debt transactions of

$1,764 million driven by a lower level of issuances in the current

year; and

• An increase in dividend payments of $632million.

Noncurrent Assets and Liabilities

($ inmillions)

At December 31: 2015 2014

Noncurrent assets $67,991 $69,894* **

Long-term debt $33,428 $34,991**

Noncurrent liabilities (excluding debt) $28,374 $30,686*

* Reclassified to reflect adoption of the FASB guidance on deferred taxes in

consolidated financial statements. Refer to noteB, “Accounting Changes,” for

additional information.

** Reclassified to reflect adoption of the FASB guidance on debt issuance costs in

consolidated financial statements. Refer to noteB, “Accounting Changes,” for

additional information.

The decrease in noncurrent assets of $1,903 million (an increase

of $1,735 million adjusted for currency) was driven by:

• A decrease of $1,853 million ($1,417 million adjusted for

currency) in deferred taxes driven by the utilization of the tax

benefit associated with the Microelectronics divestiture; and

• A decrease of $1,096 million ($186million adjusted for cur-

rency) in long-term financing receivables; partially offset by

• An increase in goodwill of $1,466 million ($2,561 adjusted for

currency) resulting from acquisitions during the year.

Long-term debt decreased $1,563 million ($862million adjusted

for currency) driven by:

• Reclassification of $5,549 million to short-term debt to reflect

upcoming maturities; partially offset by

• Debt issuances of $4,647 million.

Other noncurrent liabilities, excluding debt, decreased $2,312 million

($387million adjusted for currency) primarily driven by:

• A decrease in retirement and nonpension postretirement

liabilities of $1,757 million driven by a currency impact of

$1,295million; and

• A decline of $635million ($207million adjusted for currency)

in other liabilities associated with a reclass to short-term

payables of a portion of the consideration payment associ-

ated with the Microelectronics divestiture.