IBM 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

Management Discussion

International Business Machines Corporation and Subsidiary Companies

On an annual basis, approximately 70percent of the company’s

software business is annuity-like, including Software-as-a-Service

and subscription and support. Renewal rates are steady, the SaaS

business is growing, and overall annuity revenue grew for the full

year. Transactional revenue declined year to year as large clients

with multi-year contracts continued to utilize the flexibility the com-

pany has provided in deployment of their software. Outside the

company’s top 250 clients, software revenue increased low single

digits adjusted for currency on a year-to-year basis.

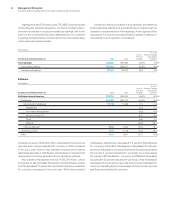

($ inmillions)

For the year ended December 31: 2015 2014

Yr.-to-Yr.

Percent/

Margin

Change

Software

External gross profi t $20,013 $22,533 (11.2)%

External gross profi t margin 87.3% 88.6% (1.3) pts.

Pre-tax income $ 9,066 $10,699 (15.3)%

Pre-tax margin 34.6% 37.0% (2.4) pts.

Software gross profit margin decreased 1.3points to 87.3percent.

Software pre-tax income of $9,066 million decreased 15.3percent,

with a pre-tax margin of 34.6percent, a decrease of 2.4points.

Profit performance for the year reflected the overall revenue trajec-

tory, a higher level of investments in areas such as Watson, Watson

Health, Watson IoT and Bluemix, and an impact from currency.

The company continues to transform and invest in the Software

business. Middleware serves the purpose of integrating different

environments, such as on premise and cloud. Key capabilities

have now been delivered on SoftLayer or as part of the Bluemix

platform to enable hybrid environments. The company’s middle-

ware remains the number one integration platform in the world and

now integrates across cloud environments. This allows clients’

existing applications to access the cloud, and new “born to the

cloud” applications to access clients’ existing assets.

The company is also adding substantial new capabilities to its

software and solutions portfolio, including The Weather Company

acquisition, which closed in January2016. This acquisition will

bring with it a high-volume platform that can ingest sensor data

at scale. The power of this platform is its ability to use Watson

cognitive capabilities to gather new insights by connecting data

at scale from multiple industry domains.

Systems Hardware

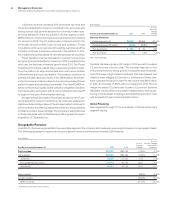

($ inmillions)

For the year ended December 31: 2015 2014

Yr.-to-Yr.

Percent

Change

Yr.-to-Yr.

Percent Change

Adjusted for

Currency

Systems Hardware external revenue $7,581 $9,996 (24.2)% 7.6%*

zSystems 28.1% 34.7%

Power Systems (0.4) 4.5

Storage (11.9) (7.0)

* Adjusted for the System x divestiture and currency.

Systems Hardware revenue of $7,581 million decreased 24.2per-

cent as reported, but grew 8percent year to year adjusted for

the divestiture of the Systemx business (28points) and currency

(4points) driven by zSystems and Power Systems. Systems

Hardware had a successful mainframe product cycle in 2015

and Power Systems grew as it was repositioned to address a

broader opportunity. The company continued to deliver innova-

tion to its systems to enable them to run the most contemporary

workloads. Approximately half of the Systems Hardware revenue

in 2015 was for solutions that address analytics workloads, or

hybrid and private clouds.