IBM 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

Management Discussion

International Business Machines Corporation and Subsidiary Companies

first quarter of 2016 as it was in the fourth quarter of 2015. The

company also expects acquisitions to drive improvement in the

software revenue trajectory in 2016.

Free cash flow realization, defined as free cash flow to income

from continuing operations (GAAP), was 98percent as reported

in 2015 and is expected to remain in the 90’s percent level in 2016.

At the profit level associated with the earnings per share expec-

tations, this translates to a free cash flow range of $11billion to

$12billion in 2016.

The company expects, in the normal course of business, that

its operating (non-GAAP) tax rate will be 18percent, plus or minus

a couple of percentage points, for 2016. The GAAP tax rate is

expected to be approximately 1 point lower. The rate will change

year to year based on nonrecurring events, such as the settlement

of income tax audits and changes in tax laws, as well as recurring

factors including the geographic mix of income before taxes, the

timing and amount of foreign dividend repatriation, state and local

taxes and the effects of various global income tax strategies.

The company expects 2016 pre-tax retirement-related plan

cost to be approximately $2.0billion, a decrease of approximately

$600million compared to 2015. This estimate reflects current

pension plan assumptions at December31, 2015. Within total

retirement-related plan cost, operating retirement-related plan

cost is expected to be approximately $1.4billion, a decrease of

approximately $100million versus 2015. Non-operating retirement-

related plan cost is expected to be approximately $500million,

a decrease of approximately $500million compared to 2015,

driven by decreased recognized actuarial losses and the Spanish

pension litigation impacts in 2015. Contributions for all retire-

ment-related plans are expected to be approximately $2.6billion

in 2016, approximately flat compared to 2015.

For a discussion of new accounting standards that the com-

pany will adopt in future periods, please see noteB, “Accounting

Changes,” beginning on page92.

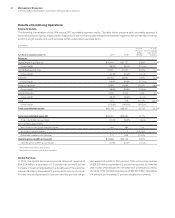

Liquidity and Capital Resources

The company has consistently generated strong cash flow

from operations, providing a source of funds ranging between

$16.9billion and $19.8billion per year over the past five years. The

company provides for additional liquidity through several sources:

maintaining an adequate cash balance, access to global funding

sources, a committed global credit facility and other committed

and uncommitted lines of credit worldwide. The following table

provides a summary of the major sources of liquidity for the years

ended December31, 2011 through 2015.

Cash Flow and Liquidity Trends

($ inbillions)

2015 2014 2013 2012 2011

Net cash from

operating activities $17.0 $16.9 $17.5 $19.6 $19.8

Cash and short-term

marketable securities $ 8.2 $ 8.5 $11.1 $11.1 $11.9

Committed global

credit facility $10.0 $10.0 $10.0 $10.0 $10.0

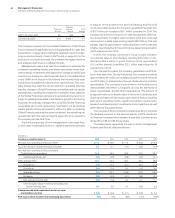

The major rating agencies’ ratings on the company’s debt securi-

ties at December31, 2015 appear in the following table and remain

unchanged from December31, 2014. The company’s indenture

governing its debt securities and its various credit facilities each

contain significant covenants which obligate the company to

promptly pay principal and interest, limit the aggregate amount

of secured indebtedness and sale and leaseback transactions to

10percent of the company’s consolidated net tangible assets,

and restrict the company’s ability to merge or consolidate unless

certain conditions are met. The credit facilities also include a cov-

enant on the company’s consolidated net interest expense ratio,

which cannot be less than 2.20 to 1.0, as well as a cross default

provision with respect to other defaulted indebtedness of at least

$500million.

The company is in compliance with all of its significant debt

covenants and provides periodic certification to its lenders. The

failure to comply with its debt covenants could constitute an event

of default with respect to the debt to which such provisions apply.

If certain events of default were to occur, the principal and interest

on the debt to which such event of default applied would become

immediately due and payable.

The company does not have “ratings trigger” provisions in its

debt covenants or documentation, which would allow the holders

to declare an event of default and seek to accelerate payments

thereunder in the event of a change in credit rating. The com-

pany’s contractual agreements governing derivative instruments

contain standard market clauses which can trigger the termination

of the agreement if the company’s credit rating were to fall below

investment grade. At December31, 2015, the fair value of those

instruments that were in a liability position was $186million, before

any applicable netting, and this position is subject to fluctuations

in fair value period to period based on the level of the company’s

outstanding instruments and market conditions. The company has

no other contractual arrangements that, in the event of a change in

credit rating, would result in a material adverse effect on its finan-

cial position or liquidity.